REVIEW

of

FINANCE -

Feb. 2018

13

39.8 thousand billion VND from accrued tax

liabilities in 2016. Customes agencies also carried

out more than 8.2 thousand inspection after customs

clearance to increase the State budget an additional

value of 2.2 thousand billion VND; settled and

recollected 589.7 billion VND from arisen accrued

tax liabilities before 31st December 2016.

Secondly,

State budget spendings ensured

resources to implement successfully socio-economic

development goals.

Industries, sectors and local authorities strictly

executed instructions of the Government, Prime

Minister and Ministry of Finance to ensure rational

and reasonable spendings; revised and arranged

to save normal expenditure; rational procurement;

securedfinance for salary andwages, socialwelfares

and development, etc.

In the condition of limited central budget,

Ministry of Finance consulted the Government to

actively proceed budgeting to execute important

contents such as: political responsibilities,

successfully hosting and organizing APEC Summit

2017, rearranging pension, social insurance benefits

and subsidies for contributive people to increase

by basic salary since 1st July 2017 and supported

supplementary salary to local authorities who

were in difficulty balancing their financial

sources. In addition, 4.2 thousand billion VND

had been disbursed from cental budget provision

to overcome the outcomes of storms, floods and

to recover production after natural calamities;

distributed more than 127.3 thousand tons of rice

from national reserve to support communities and

pupils of underdeveloped regions; timely covered

the losses and damages to marine environment

from the compensation of Formosa.

By December 31st 2017, the normal expenses

had been disbursed according to plan to fund the

functional activities of agencies and units using

state budget.

Thirdly,

capital mobilization and budget

balancing had been executed with security.

Due to positive results in State budget receiving

of local authorities and implementing tight policy

on spending, budget deficit of 2017 was within the

limit proposedby theCongress, it is estimated about

174.3 thousand billion VND equivalent to 3.48% of

implemented GDP. This was an encouraging signal

in implementing financial budget duties to ensure

market; diversifying long-term government

bonds to increase the State budget capacity and to

relieve the stress of short-term debts; minimizing

government guarantee for new loans, avoiding

loan-based lending and government bond-based

funding activities; periodically and adequately

assessing the impacts on government and local

authority debts and their solvency before making

new loans.

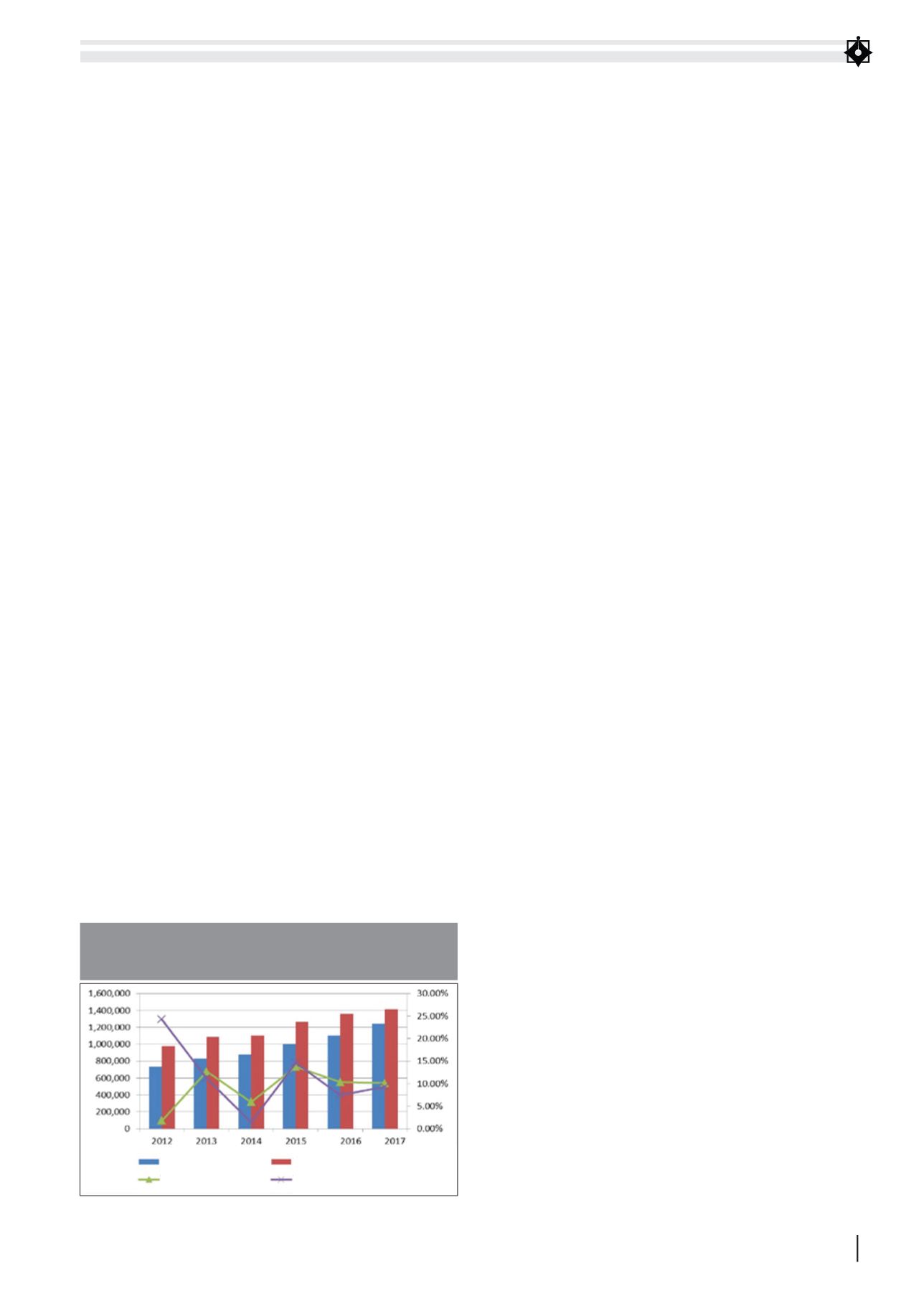

Financial budgetary duties in 2017 – The results

Firstly,

the State budget revenues had been

implemented positively and excessively in

compared to the budgetary schedule for 2017.

Although there were changes in socio-economic

situation impacting the process of State budget

receips, the budget plan still obtained positive

results due to reasonable and effective fiscal

policy. By 31st December 2017, the State budget

receipts account was 1,283.2 thousand billion

VND exceeding 71 thousand billion, equivalent

to 5.9% in comparison to the plan and exceeding

43.7 thousand billion VND in comparison to the

Parliament’s report equivalent to 25.6% in GDP,

in which taxes and charges accounted for 21% of

GDP. The local budgetary revenue also obtained

positive results in comparison with plan statement

which facilitated local budgeting.

Management of receipts, avoiding losses and

reducing accrued liabilities of tax had encouraging

results. In 2017, tax agencies conducted inspection

over 86.55 thousand enterprises and raised an

additional tax revenue of 16.3 thousand billion VND

that contributed to the State budget approximately

12 thousand billion VND; recollected approximately

Total state budget revenue

Budget revenue growth rate

Budget expenditure growth rate

Total state budget expenditure

FIGURE 1: STATE BUDGET REVENUES AND EXPENDITURES,

REVENUE AND EXPENDITURE GROWTH RATES DURING

2012-2017

Source: Ministry of Finance