REVIEW

of

FINANCE -

Feb. 2018

21

Vietnamese insurance market and companies

such as: the domestic reinsurance market in the

country still heavily depends on the support of

foreign reinsurance enterprises, Reinsurance

businesses will face stronger competition from

foreign reinsurers; the monitoring system is

still incomprehensible and no early warning

mechanism has been established.

-Thestockmarket:ThefactthatVietnamofficially

joined the WTO and the central resolution 4 (Xth

Legislature) came into being emphasized the need

for international economic integration in 2007. A

lot of bilateral and multilateral commitments have

contributed to the development of the Vietnamese

stock market in a positive way, mobilizing and

allocating medium and long-term capital for social

economic development. The market capitalization

of the stock market in 2017 has reached over 70%

of GDP which is the highest level since the market

started to operate.

The domestic stock market has benefited from

international experience and practices of prior

countries in the process of building and developing

markets. In addition, foreign capital inflows have

also increased the size and liquidity of the stock

market. The legal framework has been improved

in accordance with international standards and

practices in order to meet practical requirements

and attract foreign investors. Thereby, maximum

capital is raised for the state budget, for investment

development, production expansion and business

activities of various enterprises. However, in

addition to positive impacts, there are also certain

negative impacts on the domestic stock market

because fundamental factors are insufficient for

sustainable development.

investment incentives granted for the production

of exports issued prior to WTO accession.

- Charge and Fee Policy: Vietnam committed

to impose fees and charges on services related to

import and export activities in accordance with

WTO rules; however, there are some adjustments

related to customs fees. At the same time, some

members suggested that the cost of using basic

infrastructure in Vietnam was higher than that

of other countries in the region and thus fees had

been reduced before WTO accession (Decision No.

88/2004/QD-BTC dated 12/11/2004).

Impacts after 10 years of WTO accession

Impacts on financial markets

Being a member of the WTO has brought about

many opportunities and challenges for Vietnam’s

financial market as follows:

- Insurance market: Since WTO commitments

were implemented, Vietnamese insurance market

has been gradually improved and many positive

results have been achieved. From 2007 up to

now, the legal system on insurance business

has been reviewed and amended in order to

implement Vietnam’s international commitments

on insurance business (in the process of

participating in Free Trade Agreements in general

and WTO in particular). Insurance Business

Law was amended and supplemented in 2010

to meet the commitments in the US-Vietnam

Bilateral Trade Agreement, WTO commitments

and other relevant laws. The size of insurance

companies and the insurance market have

increased as well. However, WTO accession has

also poses a lot of difficulties and challenges for

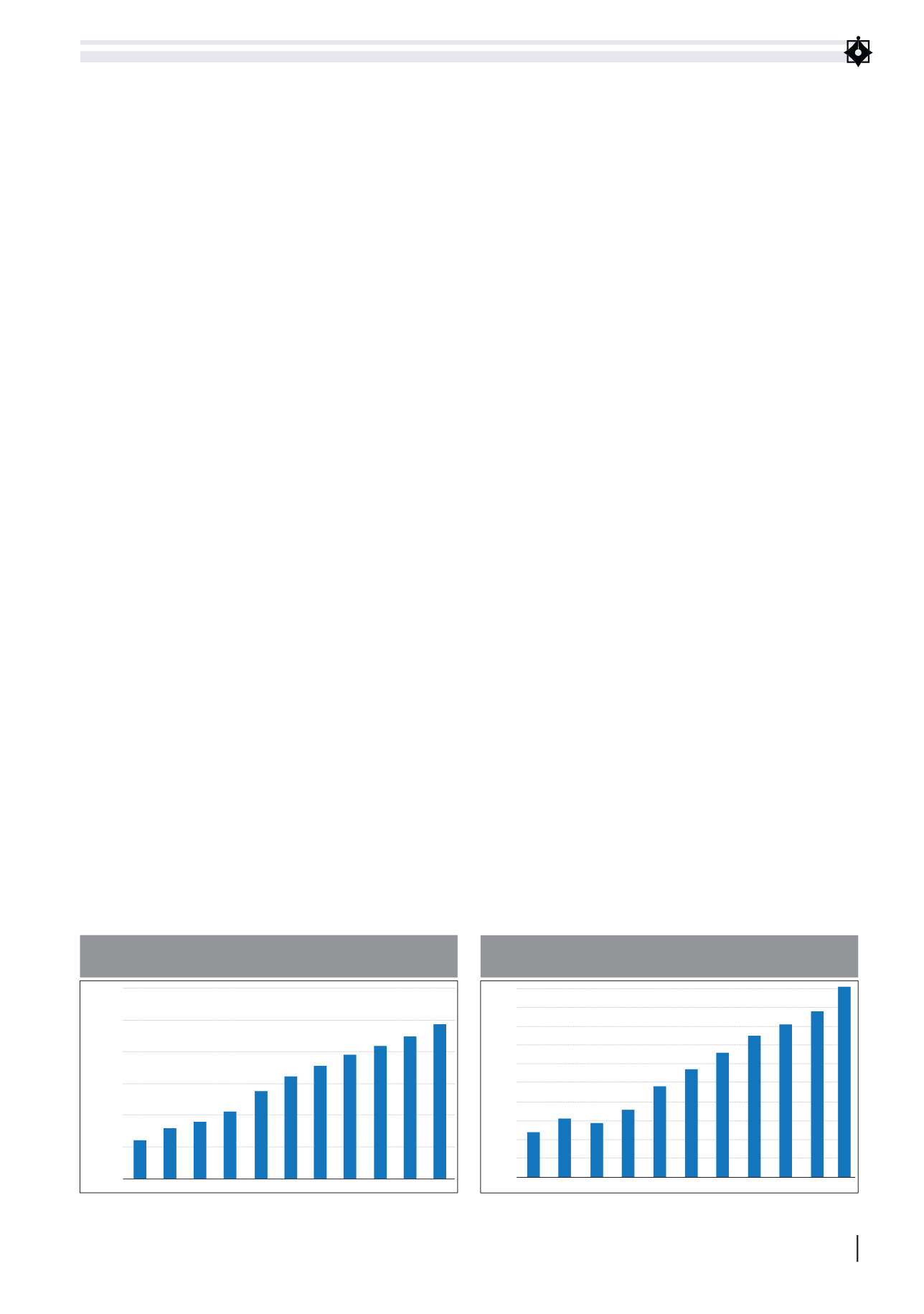

0

1.000.000

2.000.000

3.000.000

4.000.000

5.000.000

6.000.000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

FIGURE 1: VIETNAM’S ANNUAL GDP IN 2007 - 2017 AT

CURRENT VALUE (BILLION VND)

Source: General Statistic Office

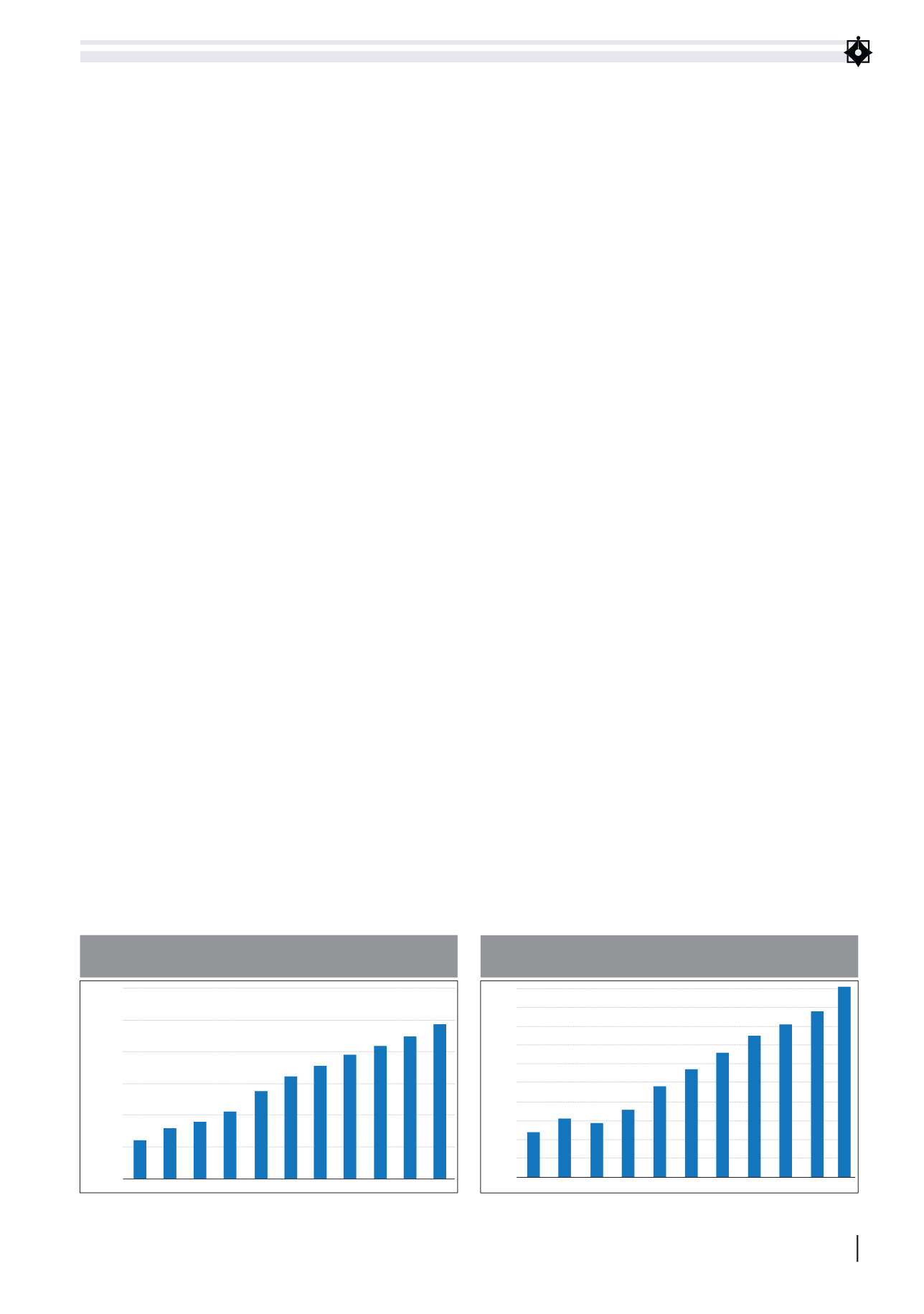

0

20.000

40.000

60.000

80.000

100.000

120.000

140.000

160.000

180.000

200.000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

FIGURE 2: VALUE OF VIETNAM’S EXPORTS IN THE 2007 - 2017

PERIOD (MILLION USD)

Source: General Statistic Office