14

Secondly,

the restructure of budget spending was

not really effective when the total value of budget

spending to GDP in 2017 was 28.2%, higher than

the targeted rate of 24-25% for the period of 2016-

2020; Simultaneously, the enhancement of public

resource efficiency in supplying public services was

limited while the implementation of autonomy for

the non income-generating agencies was low and

delayed resulted in less attractiveness to the outer

resources for public service supply.

Thirdly,

the assignment of investment capital

has been implemented slowly that affect negatively

to the distribution progress of state budget and

government bond in different ministries, industries

andauthorities. The assignment of capital using state

budget and government bond in 2017 was sluggish

and multifold. At the end of April, the Congress

passed the official list and limit of government bond

for the projects which was divided into three times

of capital distributions inApril, May and September

2017. By 31st December 2017, the allocationof capital

using state budget was 75.9%; government bond

was solely 23.5% of the plan.

Fourthly,

the difficulty in mobilizing long-term

capital. The cost of foreign capital mobilization

tends to increase, hence, the accessibility to ODA

packages of WB, ADB and other funds in the future

might be decreased, as a result, the reduction of

incentive for investors or preference for repayment

is forecast to raise the interest rates and, therefore,

the foreign liabilities. This will significantly affect

the sustainability of foreign liabilities.

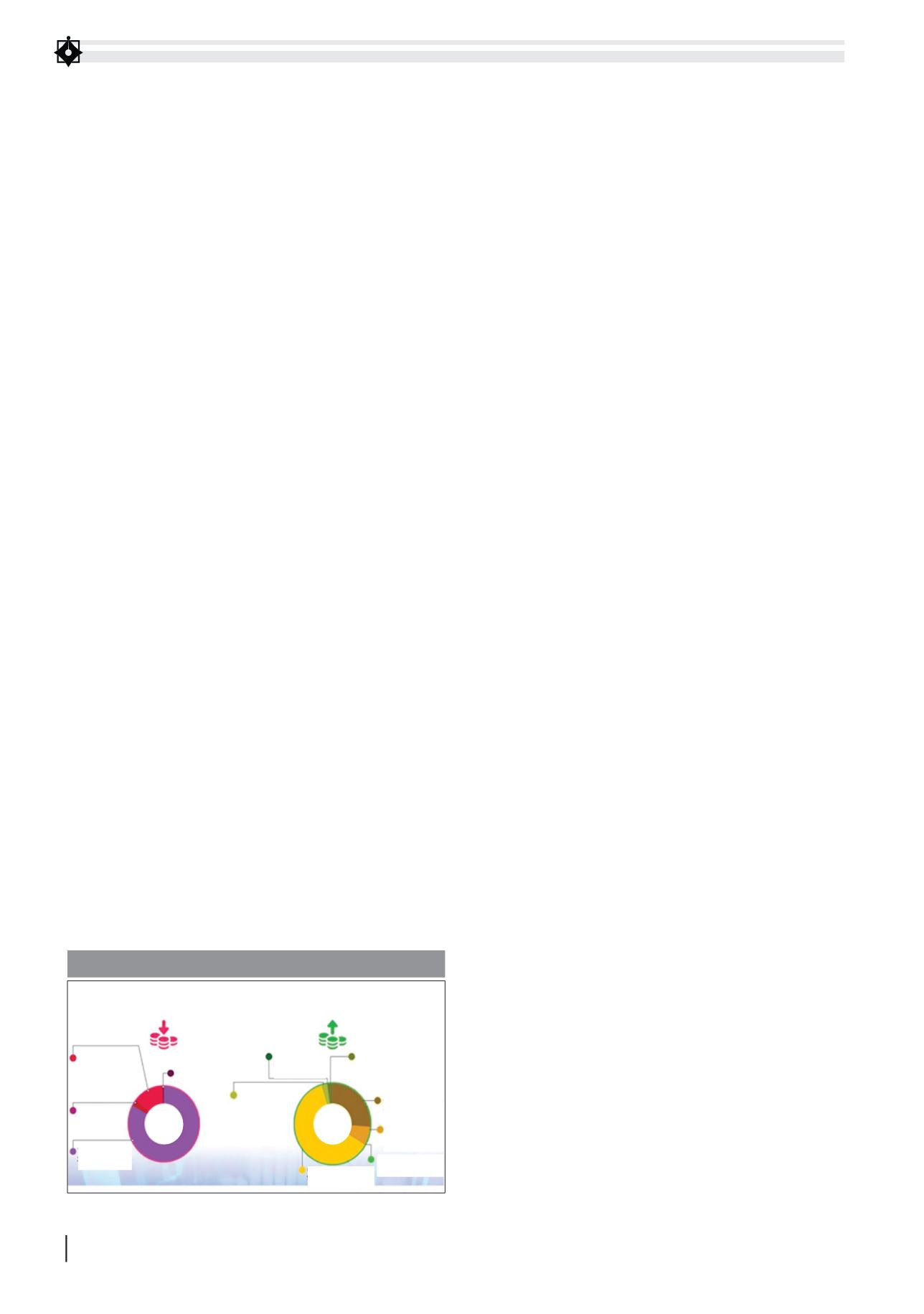

Orientation of finance and state budget for 2018

At the fourth session, the XIV Congress

asserted the implementation of Resolution of

Political Bureau on restructuring state budget and

public debt management, the fiscal policy of 2018

continues to actively implement the consolidation

and strictness of financial state budget disciplines

and regulations; anti-transfer pricing, avoiding

losses and accrued tax, enhancing control of budget

spendings to ensure economization and efficiency

of public debt ratios and to keep them within

acceptable limit. According to that, the financial

goal of 2018 state budgeting is: total state budget

receipt will be 1,319.2 thousand billion VND, total

spending will be 1,523.2 thousand billion VND,

state budget deficit rate will be 204 thousand billion

resources for socio-economic development.

The capital mobilization of Government bond

from the market experienced positive changes, the

list of Government bonds were improved in both

maturity and rate, relief in short-term debts and

reduction in liquidity risk. In 2017, the State Treasury

mobilized 159.9 thousand billion VND on HASTC

including 100% government bonds with maturity of

5 years and longer; average maturity was 13.52 years

which was longer than in 2016 of 8.71 years. Average

rate was 6.07%/year which was lower than in 2016

with 6.49% and the costs of borrowing were also

reduced. Additionally, the issuance of government

bonds for Vietnam Social Insurance reached the

value of 63 thousand billion VND with maturity of

10 years and rate of 5.82%/year.

The challenges

Firstly,

there were receipts and taxes executed

with lower results compared to the estimation plan,

the structure of receipts was not sustainable when

large amounts of revenue in relation to business

operation such as revenues from state enterprises,

foreign enterprises and private sectors were lower

than planned estimation. Revenue from state

enterprises was at 87.9% of the plan, from foreign

enterprises was 85.1% and from private sector was

93.1%. The main reason was due to the changes and

volatilities in economic growth of the earliermonths

(quarter I was 5.15% and quarter II was 6.28%) that

affected business performance of enterprises. In

addition, the readjustment of import tax according

to FTA commitments also affected significantly the

operation of foreign enterprises. Furthermore, the

slow equitization process of the state enterprises

had negative impact on budget receipts.

Total state budget revenue

Total state budget expenditure

Importand

exportactivities

revenue:

179 trillionVND

Crudeoil

revenue:

35.9 trillionVND

Domestic

revenue:

1,099.3 trillionVND

Aid revenue:

5 trillionVND

1,319.2

trillionVND

1,523.2

trillionVND

Aidexpenditure:

1,300 trillionVND

Regularexpenditure:

940,748 trillionVND

Payroll reformand

reduction

expenditure:

35.767billionVND

Financial reserve

fundexpenditure:

100billionVND

Interestpayment

expenditure:

112,518billionVND

Statebudget reserve:

32,097billionVND

Development

investment

expenditure:

399.7 trillionVND

2018 STATE BUDGET ESTIMATION

Source: Decision 2610/QD-BTC