REVIEW

of

FINANCE -

November, 2018

15

companies.

With the strong development in the right

direction, the stock market has become the driving

force for the establishment and development

of a more active and effective private sector,

contributing to the promotion of equitization of

SOEs and restructuring of the economy both in

terms of sectors, fields and participants.

Since 2005, more than 750 SOEs have

successfully auctioned their shares on the two

exchanges. Scale, performance, governance

quality of listed equitized SOEs have been

improved: Total equity increases by 16% per

year on average; Turnover grows by 4% per year,

profits rises by about 9%/year.

Among the 100 listed enterprises with the

largest market capitalization (about VND 3.1

million billion), on average in the period from

2012 to 2016, return on equity (ROE) of each

enterprise increased from 12.16% to 16.65%; Total

assets increased from VND 35,130 billion to VND

60,089 billion and equity increased from VND

4,964 billion to VND 9,054 billion. In this group,

there are 46 private companies with capitalization

level of 40%. In the 2012-2016 period, the total

assets of listed companies increased by 80%,

equity increased 2.2 times and the total profit

increased by 2.5 times.

The stock market has narrowed the gap

between private equity and listed equitized

companies, whereby the average equity size

of listed equitized SOEs compared to private

listed companies fell from 1.6 times in 2012 to

1.3 times in 2016. Many private companies have

developed strongly after listing on the stock

market. Typically, in the case of Vingroup, the

capital contribution of shares and equity at the

initial listing was VND 800 billion and VND 1.842

billion respectively in 2007 and as of now has

increased to VND 26,377 billion and VND 45,266

billion; At the same time, it has helped expand the

company’s core businesses such as agriculture,

industry, healthcare, education and retail.

Regarding equitization, divestment has

helped diversify ownerships as well as enhanced

transparency and efficiency. Of the 54 listed SOEs

among the 100 listed companies with the largest

market capitalization, the average ratio for state

ownership is about 47%, of which 29 enterprises

have 50% of capital owned by the Government.

The listing of SOEs after equitization helps

promote the process of public capital divestment,

ensuring transparency and efficiency in selling

prices according to the market mechanism and

at the same time improving the performance of

post-equitized enterprises.

A number of post-equitized SOEs have had

outstanding performance such as Vietnam Dairy

Products Joint Stock Company, Cotecons Joint

Stock Company, etc. Comparing to the period

of 2012-2016, the return on equity of VNM are 2

to 3 times higher than the average profit rate of

listed companies and 4-5 times higher than the

mobilization interest rate of commercial banks;

The size of equity and assets of VNM has also

increases 1.5 times.

Listed companies are leaders in corporate

governance, information disclosure and

application of modern accounting, auditing

and financial reporting standards. Corporate

governance standards applied to listed companies

andpubliccompaniesinVietnamstockmarkethave

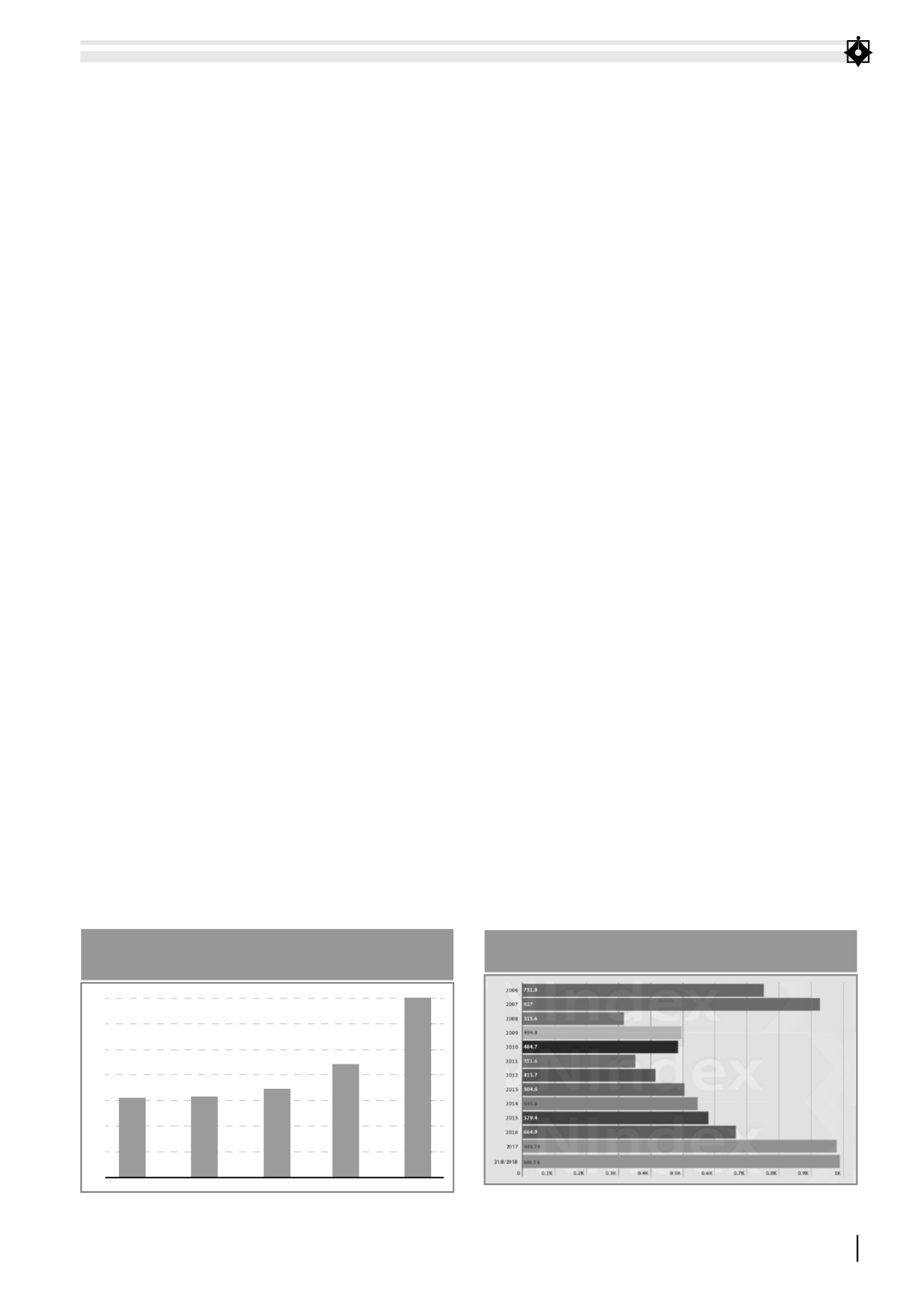

GRAPH 2: VN-INDEX OVER THE YEARS 2006-2018

Source: State Securities Commission

2013

31

31.5

34.5

44

74

0

10

20

30

40

50

60

70

2014

2015

2016

2017

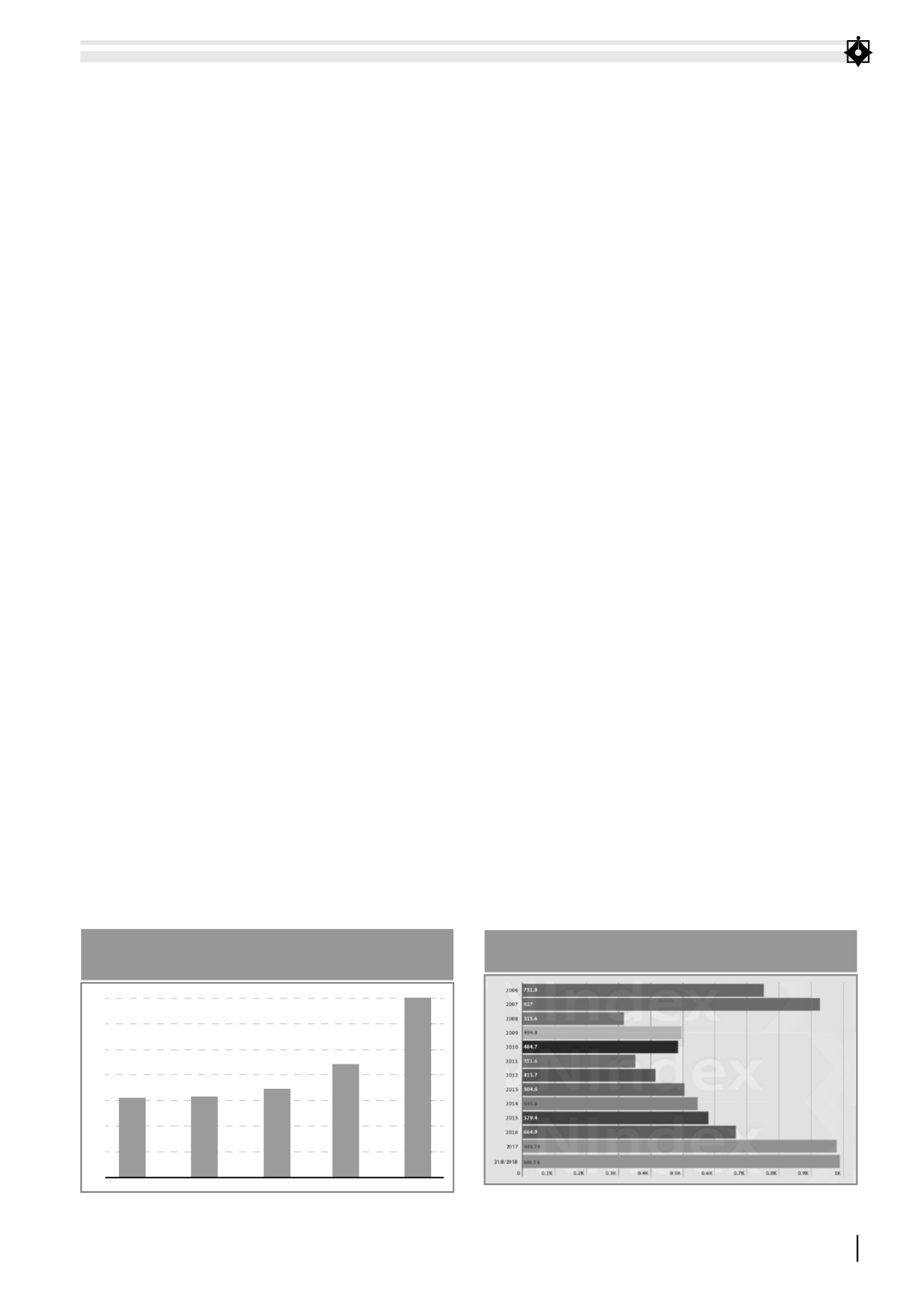

GRAPH 1: SIZE OF STOCK MARKET (%GDP)

IN THE PERIOD OF 2013-2016

Source: State Securities Commission