16

been completed in accordance with international

practices and market reality. The expansion

and development of public companies, listed

companies with the participation of investors,

including small investors set the requirements

of shareholders and market for controlling and

monitoring enterprises to minimize conflicts of

interest, guarantee rights of shareholders and

obligations of major shareholders and internal

shareholder...

Over the past 18 years, the stock market

has achieved a fast, stable and synchronous

development in terms of structure, affirming

the important role of acttracting capital to the

economy, regulating and settling macroeconomic

development and promoting private sector

development and SOE restructuring.

In addition to these positive results, the reality

also shows that Vietnam stock market faces

many difficulties and challenges. Typically, the

world economy has many unpredictable changes

such as geopolitical issues, protectionism, trade

war, tax policy adjustment, gradually increasing

interest rates, which can influence the movement

of capital flows. At the same time, the domestic

economy has improved significantly, but the level

of sustainability is not high, labor productivity,

economic restructuring and renovation of growth

models are more challenging, coupled with high

budget deficit, bad debt settlement and banking

system restructuring.

Towards a sustainable market

For a more stable, transparent and sustainable

market, some solutions should be done as follows:

Firstly,

to complete the legal framework for

the securities market on the basis of building a

new Security Law on the principle of ensuring

the development of safe, transparent and efficient

security markets; Facilitate issuers to mobilize

capital with diversified commodities on a

transparent basis; Promote the development of

investment funds; Apply international practices

in line with practical conditions and ensure the

compatibility between the Security Law and other

relevant laws. Improve the quality of corporate

governance and information disclosure; Create

mechanisms to restructure security companies

operating inefficiently and promote security

organizations to develop; Build additional

mechanisms to protect investors; Diversify and

improve the quality of goods in the market by

raising public offering conditions, managing and

preventing spills through individual offerings.

Secondly, to

diversify and improve goods

quality on the stock market to be a key solution

in the development of the stock market in a

transparent and sustainable manner. Therefore,

it is necessary to promote equitization and state

capital withdrawal in enterprises associated

with the listing and registration of transactions

on the stock market; Strengthen regulations on

providing guidance for issuance and offering

by book-drawing method; Enhance inspection;

particularly supervise the process of raising

capital and using capital before registering and

listing; Monitor the transparency of financial

information in public companies, capital use,

disclosure and corporate governance; Encourag

listed companies to apply international standards

and practices on disclosure of information

and financial statements in accordance with

international financial reporting standards,

applying international accounting standards and

auditing standards.

Alongwiththediversificationandimprovement

of the quality of goods, it is necessary to actively

implement measures to complete the price and

tax mechanism applicable to transactions in the

derivative market relevant to each level of market

development; Studying and developing a guiding

document and allowing the transactions of other

products such as futures contracts on indices

other than VN30, index options, futures options...;

Putting security warrants, future contracts and

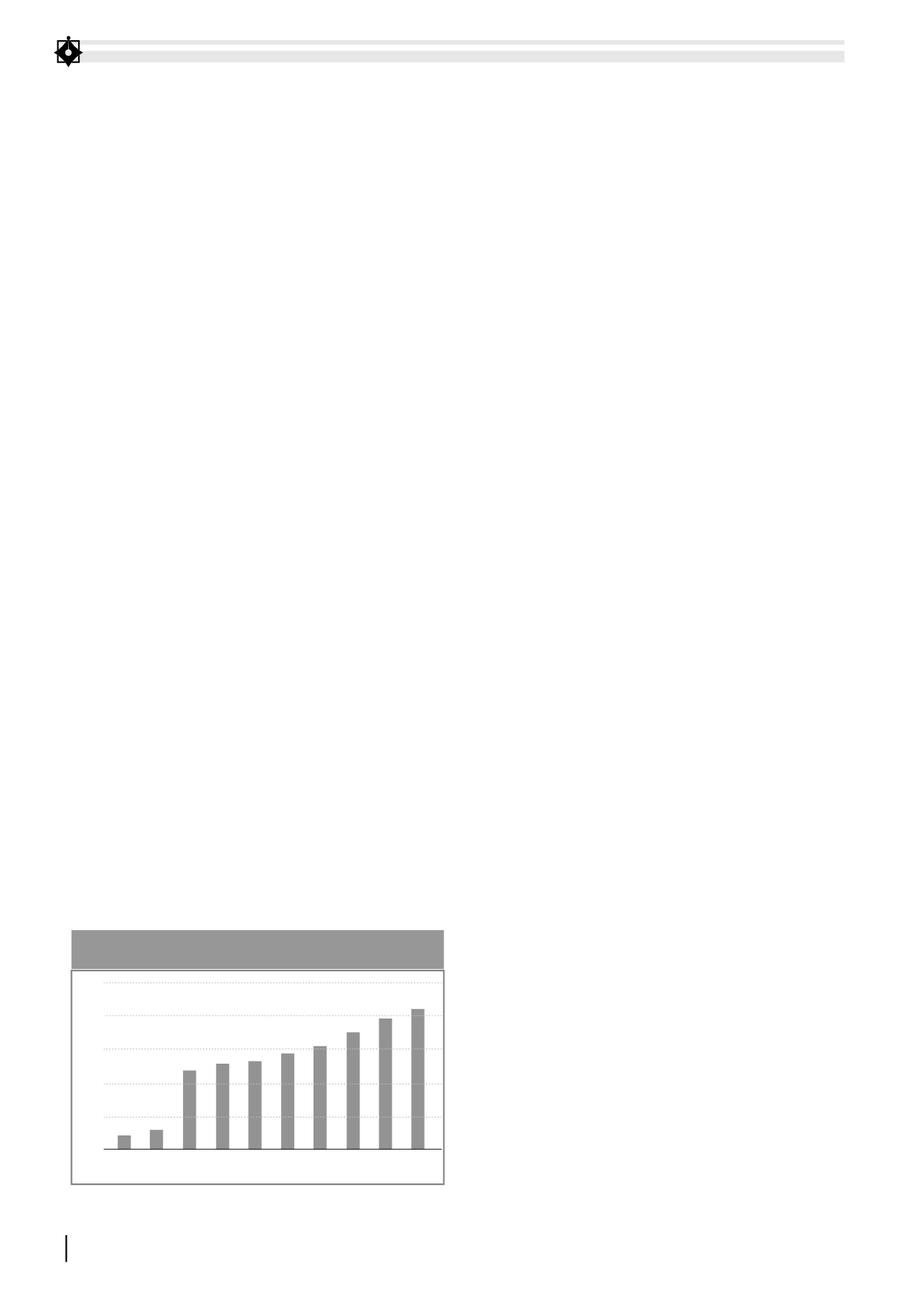

31/8/2018

2017

2016

2015

2014

2013

2012

2011

2005

2000

0

500.000

1.000.000

2.000.000

1.500.000

2.500.000

2.109.013

1.712.389

1.921.554

1.510.864

1.400.178

1.257.505

1.239.833

1.156.243

31.316

2.997

GRAPH 3: SCOPE OF FOREIGN INVESTOR ACCOUNTS

Source: State Securities Commission