8

is possible that angel investors will help SMEs

address their problem of capital, learn advanced

management practices and achievements in

science and technology for their businesses.

Tax policies contribute to enhancing the

initiative and transparency in business accounting

of enterprises. The new, clear and transparent tax

policies force SMEs adjust their accounting and

invoicing regimes in order to benefit preferential

policies such as input VAT deduction. Especially,

according to the Law on VAT, enterprises that

want to deduct input tax must pay via banks

for goods and services purchased, except for

goods and services purchased each time valued

at less than VND20 million. This is important in

reducing the risk for businesses when dealing

with companies that have been dissolved, gone

bankrupt or just buy and sell invoices, thereby

contributing to control and ensure financial

status, prevent tax fraud and tax in SMEs.

Limitations in implementing tax policies towards

SMEs

In the past years, the Government has applied

variety of modifications, supplements to tax

policies towards SMEs in attempt to adjust to new

economic condition and to support the business

operation of SMEs. However, tax system and tax

policies still show limitations namely:

- Tax policies are changed frequently in short-

term, modification and supplement routine is

implemented slowly, reporting forms and sheets

are frequently changed causing loss of time and

costs of the SMEs. Measures taken mostly are tax

payment extension and tax payment deferment;

these measures only relieve the difficulties of

SMEs at a certain time but in the long-term, they

burden tax liabilities on the SMEs for the next

years. In addition, procedure for tax exempt, tax

reduction and appraisal are complicated causing

negative feelings of the tax exempted subjects.

- Typical regulations on tax also show

inadequacies. According to the Law on VAT,

there are three tax rates are applied: 0%, 5%, 10%

to different business lines. In the long run, the

imposition of these three tariffs is complicated

and inappropriate as more tax rates lead to non-

transparency and increased tax. For business

income tax, the tax rate (20%) for SMEs inVietnam

is still very high compared to other countries, so

it is not enough to stimulate the development

of these enterprises. Besides the incentive effect,

business income tax incentives can also “distort”

the investment environment, circumventing the

law for tax incentives. For example, an enterprise

can register to establish a new company instead

of the old one when the incentives expire. Or, an

enterprise can transfer profits from the parent

company without preference to its affiliates to

benefit incentives and reduce taxable income.

Thus, tax incentives will make the enterprises

themselves split or transformed into smaller

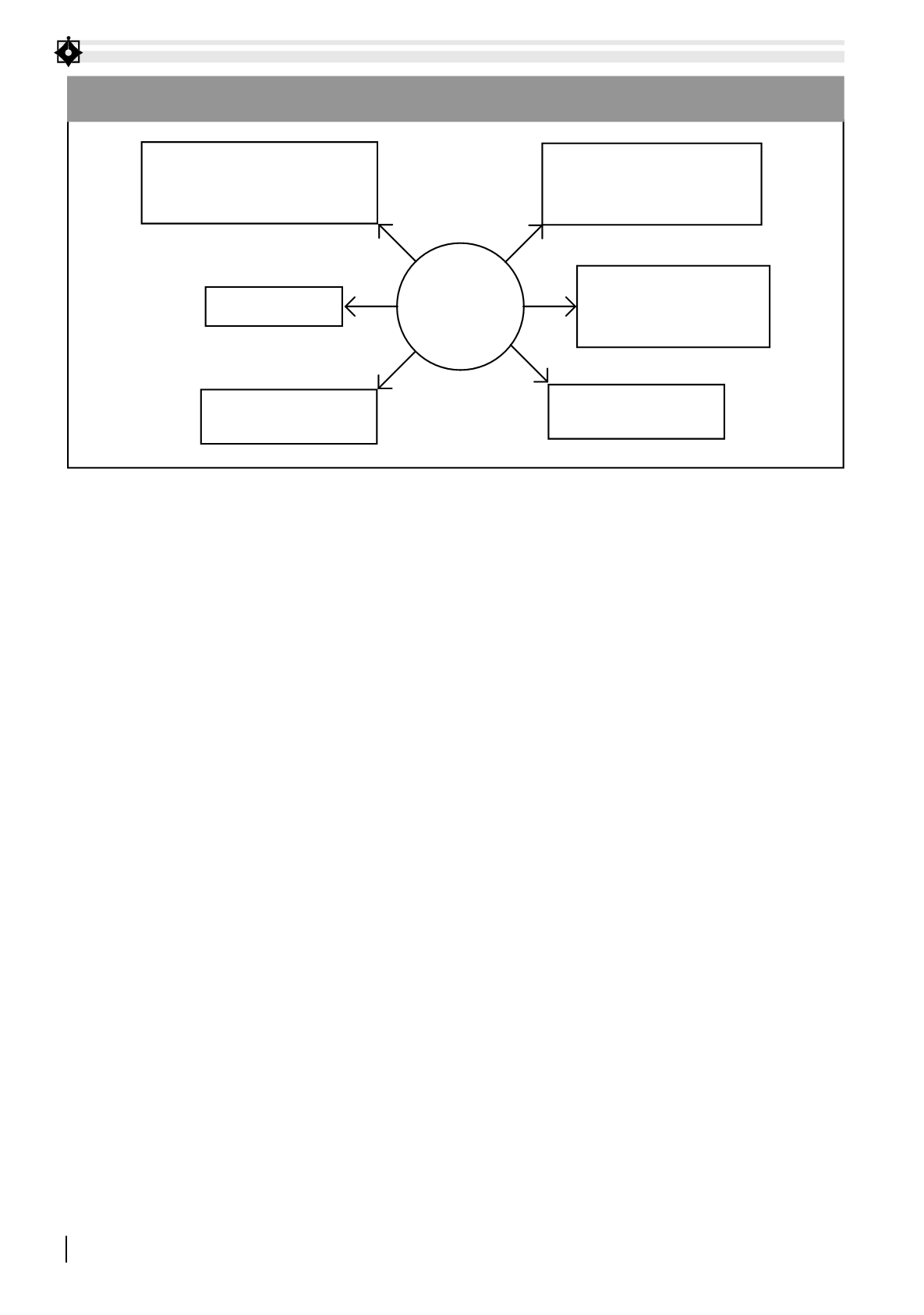

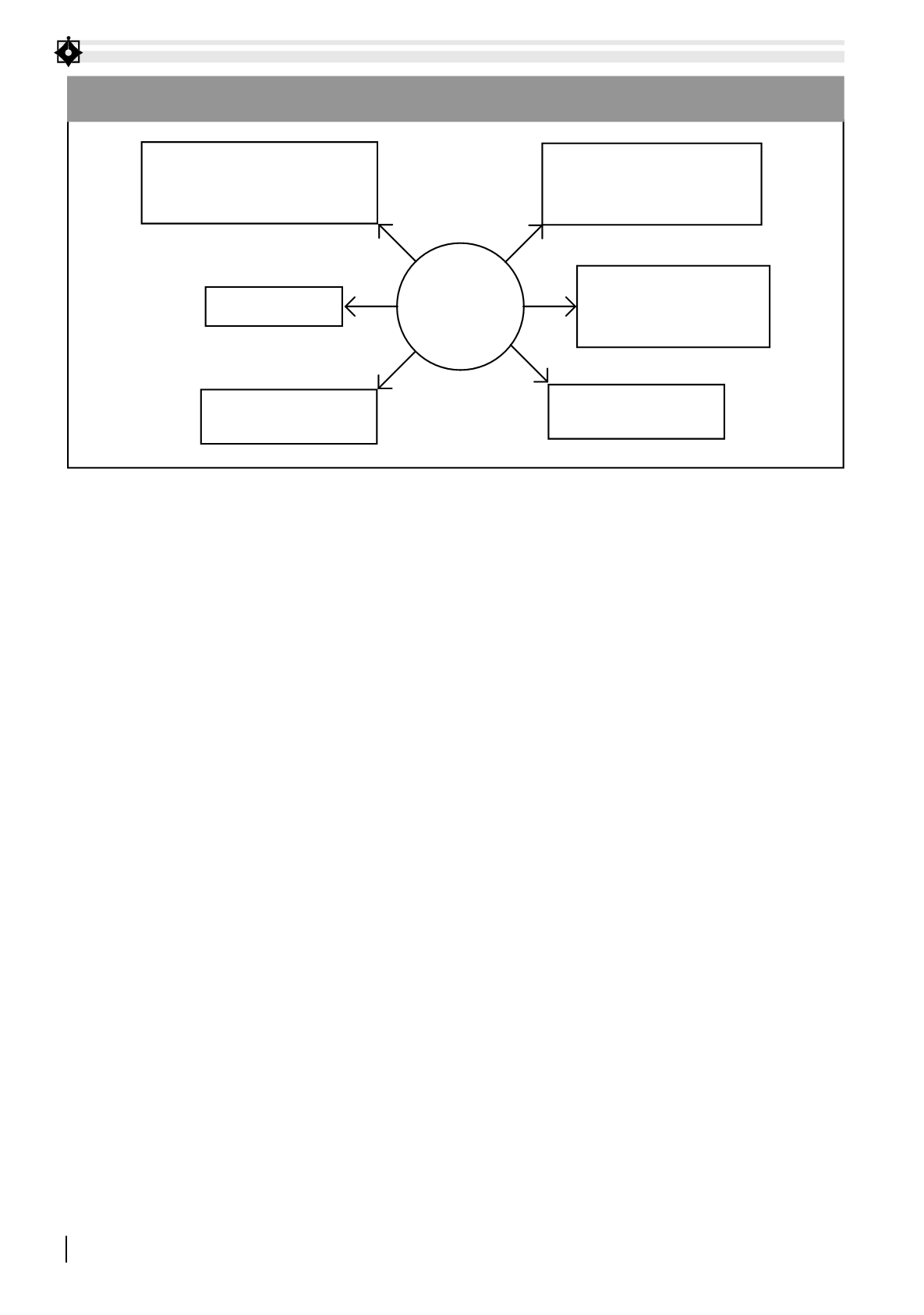

State budget (subsidy, guarantee,

insurance, preference, tax reduction...)

Foreign capital

Mobilized from the capital

market

Partner (deferred payment,

commercial credit...)

Credit capital,

guarantee, discount, nancial

leasing

Equity capital,

contributed capital

Capital

for SMEs

CAPITAL FOR SMALL AND MEDIUM SIZED ENTEPRISES

Source: The research of author