64

system. For example, CPTPP will put an end

to subsidies, discrimination, preferential loans,

and special access rights to public procurement

entitled to state-owned enterprises. This, in turn,

will force businesses to compete fairly and equally.

Therefore, state-owned retailing businesses must

work more proactively to survive and thrive.

It also acts as a driving force for businesses to

improve their capacity.

In addition to the abovementioned positive

impacts, Vietnamese retail market will also

face some challenges under the context of

implementing new generation FTAs as follows:

First,

according to commitments specified in

CPTPP and EVFTA, Vietnam must remove ENT

requirement for foreign retailers from member

countries after 5 years of the effective date.

This will possibly result in the penetration and

expansion under larger scale of foreign retailers

in Vietnam market, hence leading to the risk of

market dominance of foreign retailers.

Second,

with respect to sources of goods,

domestic goods will face the risk of being

replaced by imported goods. In the condition

that Vietnam has not developed adequate

and effective use of trade barriers, namely

TBT, SPS, or temporary trade remedies, to

protect the domestic market to a certain extent,

the participation in FTAs, particularly new

generationFTAs,willnegatively

impact the national growth as

well as the competitiveness of

Vietnamese products.

In short, the analysis of

commitments specified in

new generation FTAs has

revealed both positive and

negative impacts on Vietnam’s

market. It is noticeable that

the competitive pressure from

retailers of member countries

in new generation FTAs will

be significantly fiercer than

those from conventional FTAs.

However, the implementation

of these new generation FTAs

will offer Vietnam retail market

an opportunity to diverse the

supply sources, participate in

the global supply chain, and

develop a more competitive retail system; thereby

improvingtheallocationof resources, andboosting

social welfare. Especially those in relation with

the opening up of e-commerce market will have

positive influence on the supply of goods, which

will be more appealing and efficient for the retail

market. This once again gives a hope for a more

dynamic retail market when these FTAs come

into full force.

References:

1. Bui Truong Giang (2010), Vietnam economic policy and strategy for

approaching the Free Trade Agreement, Social Science Publisher, Ha Noi,

2010;

2. Bela A. Balassa (1961), The Theory of Economic Integration,

Homewood, Ill., R.D. Irwin, 1961;

3. Viner, J. (1950), The Customs Union Issues, New York: Carnegie

Endowment for International Peace;

4. WTO (2011), World trade Report 2011: The WTO and preferential trade

agreements: From co-existence to coherence;

6. The World Bank (2016), “How do “new generation” trade agreements

such as the TPP differ from traditional free trade agreements?”, Global

Weekly;

7. WTO Center, VCCI, AVR (2016), “Risks to Vietnam’s retail industry

in the context of TPP and FTA integration, status quo and policy

recommendations”, Policy Research, Ha Noi, December 2016;

8. Websites: blogs.worldbank.org, tinnhanhchungkhoan.vn,

thesaigontimes.vn, tapchibanle.org.

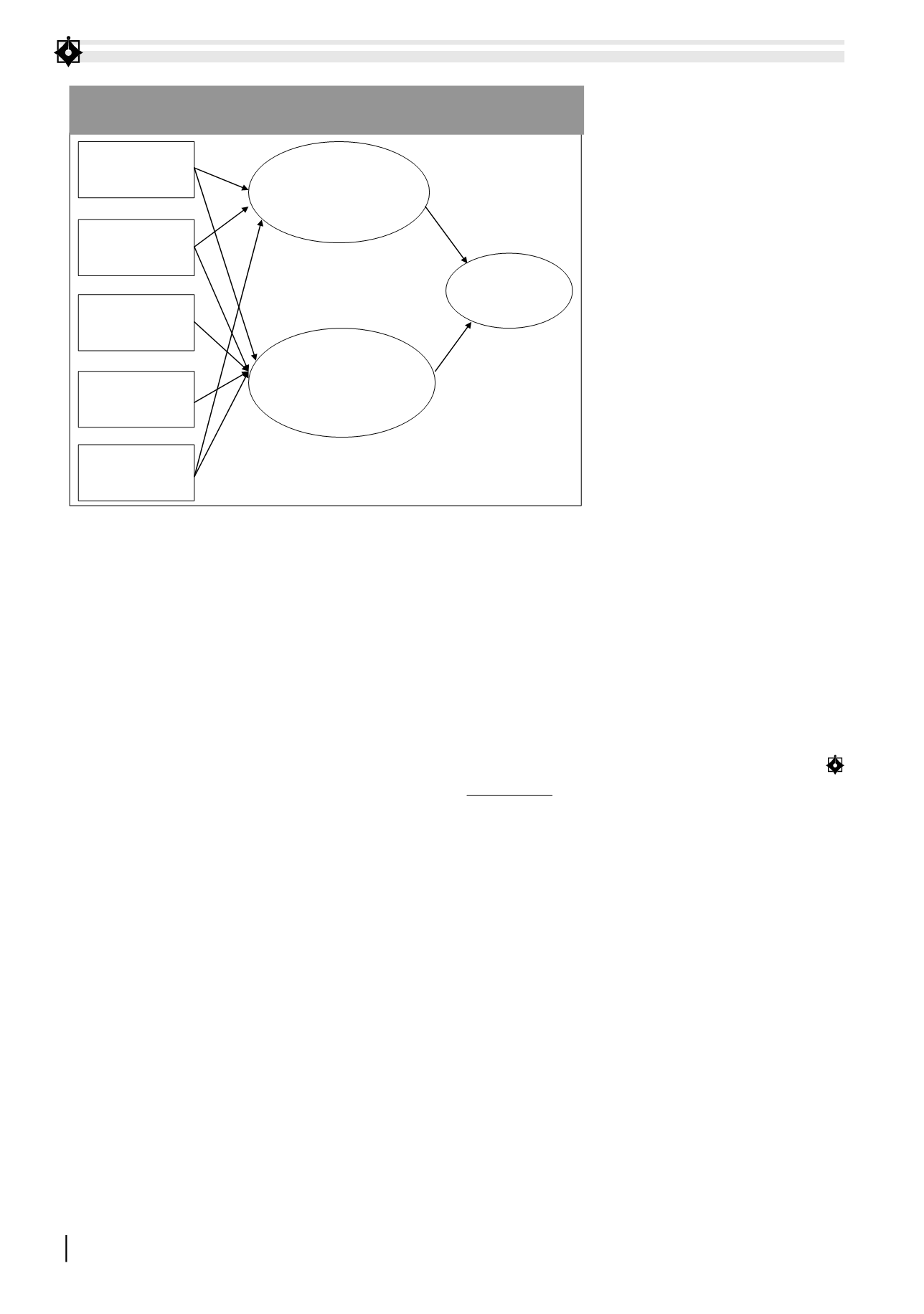

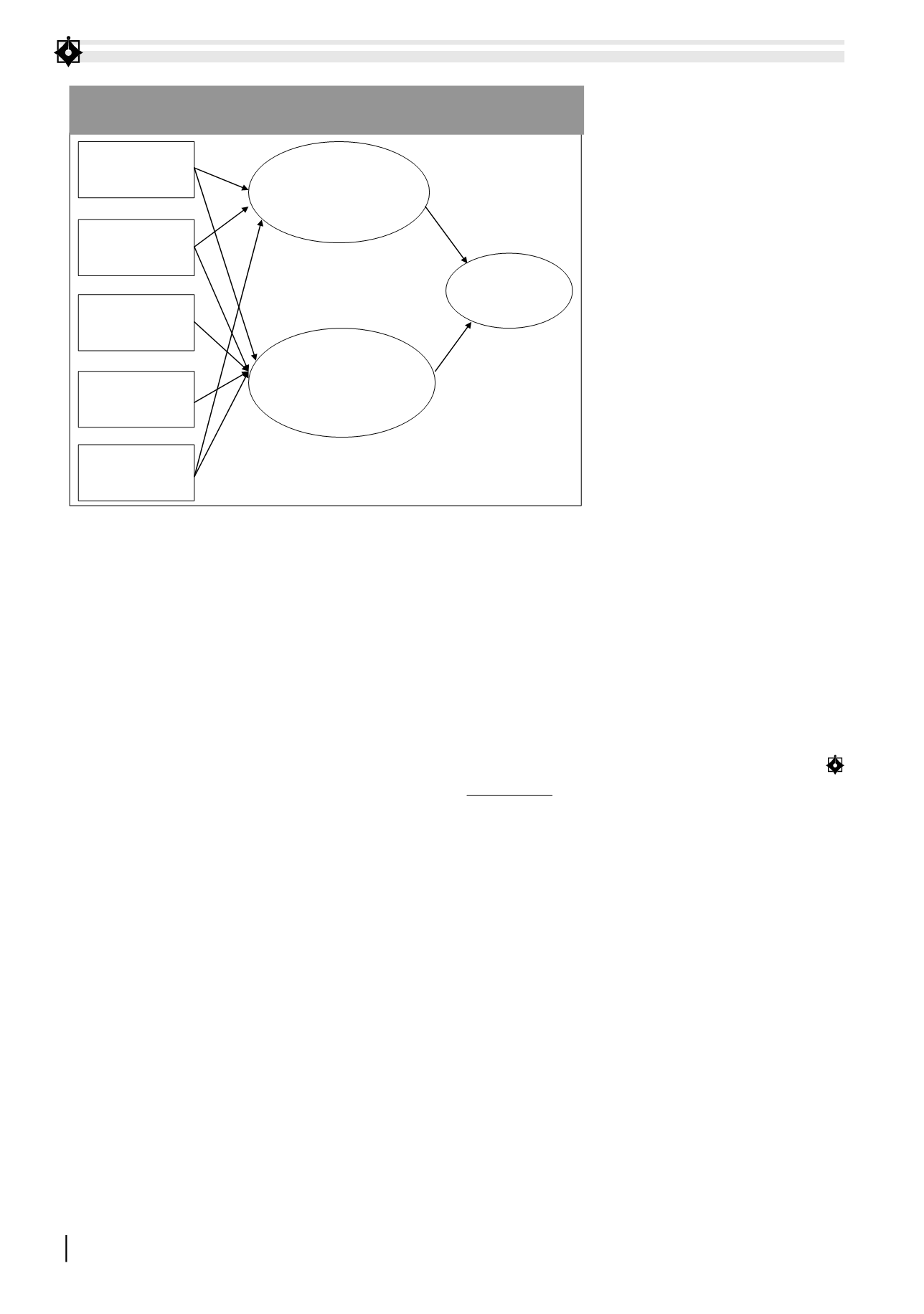

WTO

Vietnam – Korea

FTA

Vietnam – EACU

FTA

EVFTA

CPTPP

Commitments on

opening up of retail

market

Commitments on

opening up of market

for goods and issues

related to the circulation

of goods

Retail market

FIGURE 1: IMPACT CHANELS OF COMMITMENT GROUPS UNDER THE NEW

GENERATION FTAS AND AGREEMENTS TO THE VIETNAMESE RETAIL MARKET

Source: The authors