REVIEW

of

FINANCE -

November, 2018

3

14 times compared to 2017); Paying Taxes

ranked 86 out of 190 nations (increased 81 times

compared to 2017), ranked the fourth in ASEAN

countries (WB, 2018). Although there have been

many improvements over the past few years, tax

evasion, and even corruption in tax management

is widespread.

The process of tax refrom

The tax reform process can be divided into

three periods as followings:

Before 1990

Tax policies were promulgated by the ordinance

or decree. It was not in line with constitution on

tax. In the first period during 1990-1995 period,

therefore, the requirement to reform the tax system

in this period was to be developed and issued in a

system of tax laws, applied uniformly throughout

the country. There were many tax laws such as

law on special consumption tax, law on profit tax,

law on export tax, law on agricultural land use

tax...

The period from 1996 to 2004

The rapid economic growth is the premise

for Vietnam’s reform of tax system. The goal

of this step is to consolidate revenue collection

by strengthening management and preventing

revenue losses; Build a budget based on internal

resources; Prepare for regional economic

integration. To achieve this goal, it is necessary

to develop taxes that are compatible with the

international community. At the same time, it

needs to adjust and supplement the existing taxes

to suit economic development-they issued value

added tax to replace sales tax law and corporate

profit tax law to replace income tax law. These are

two very important laws. The scope of these two

taxes is quite wide, affecting many socio-economic

aspects. This can be as considered the most

important break through of tax reform in this step.

The period from 2005 to 2010

This phase of tax reform is being implemented

in the context of the emerging world information

technology era, the gap between countries

is getting closer in an open market, which

inevitably has many implications to tax policy of

each country. On December 6

th

, 2004, the Prime

Minister of Vietnam issued a decision approving

the reform of tax system until 2010. The objective

of the tax reform at this stage was “to synchronize

the system of tax policies with a reasonable

structure suitable to the socialist-oriented market

economy and with the associated modernization

of tax administration…” (Government, 2004).

They issued tax management law and revised

other taxes: VAT, Corporate income tax, Personal

income tax, Export - import tax, Excise tax, and

Natural resource tax.

Outstanding achievements in tax reform

After five years of implementation of the tax

system reform, basically tax incentives have been

amended, supplemented and completed in a

comprehensive manner. Basically, it is to ensure

the balance between revenues and expenditures

towards socio-economic development of the

country.

Compared with the period 2006-2010, the scale

of state budget revenue collection and tax revenue,

the 5-year fees for 2011-2015 increased about 2

times. The average state budget mobilization

rate reached 23.4% of GDP (targeted at 23-24%

of GDP), of which the mobilization from taxes

and fees reached 21.6% of GDP (target 22-23%).

The structure of state budget revenue has been

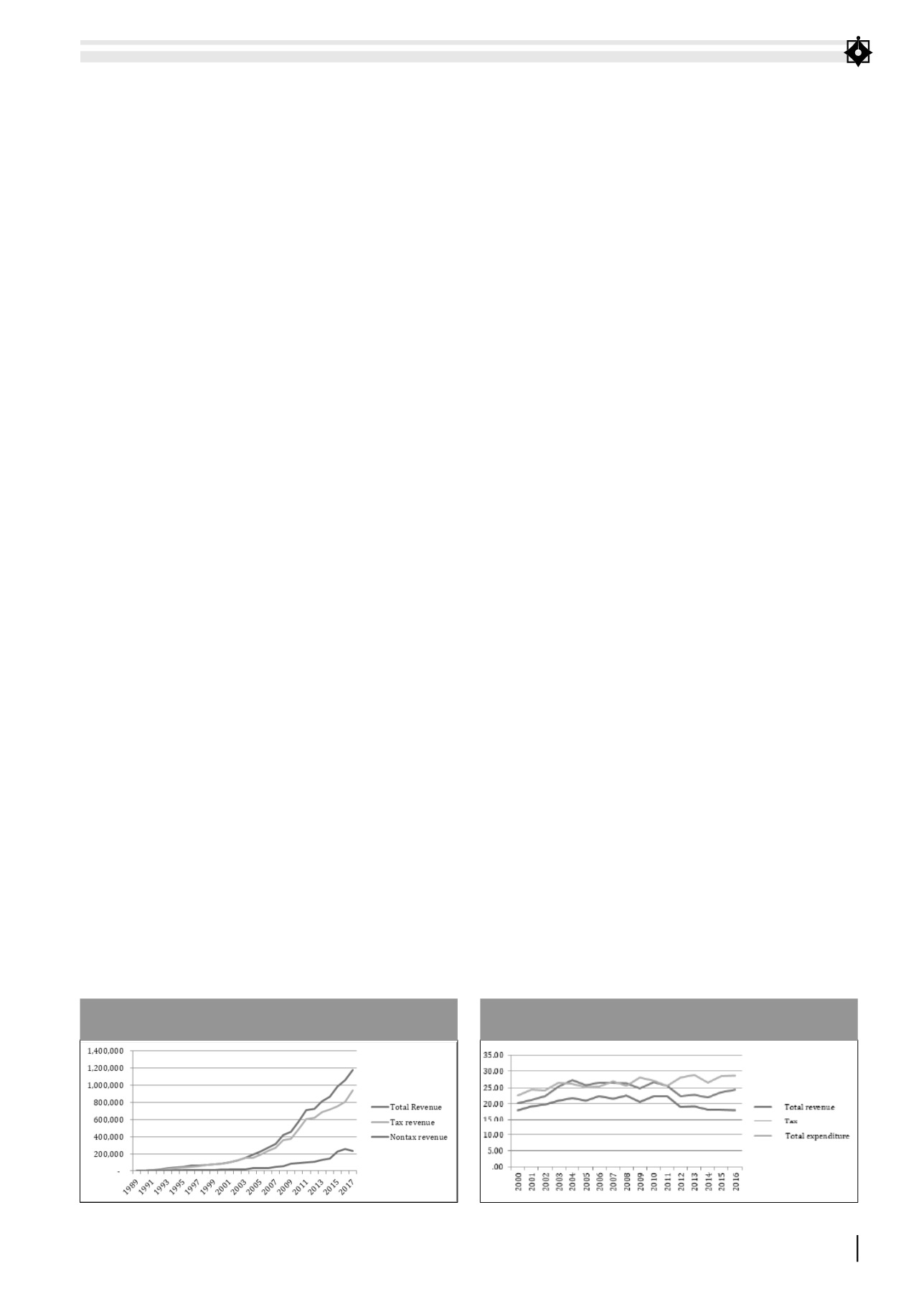

FIGURE 1. THE REVENUE IN VIETNAM 1989-2017

(BILLION VND)

Source: IMF in Vietnam

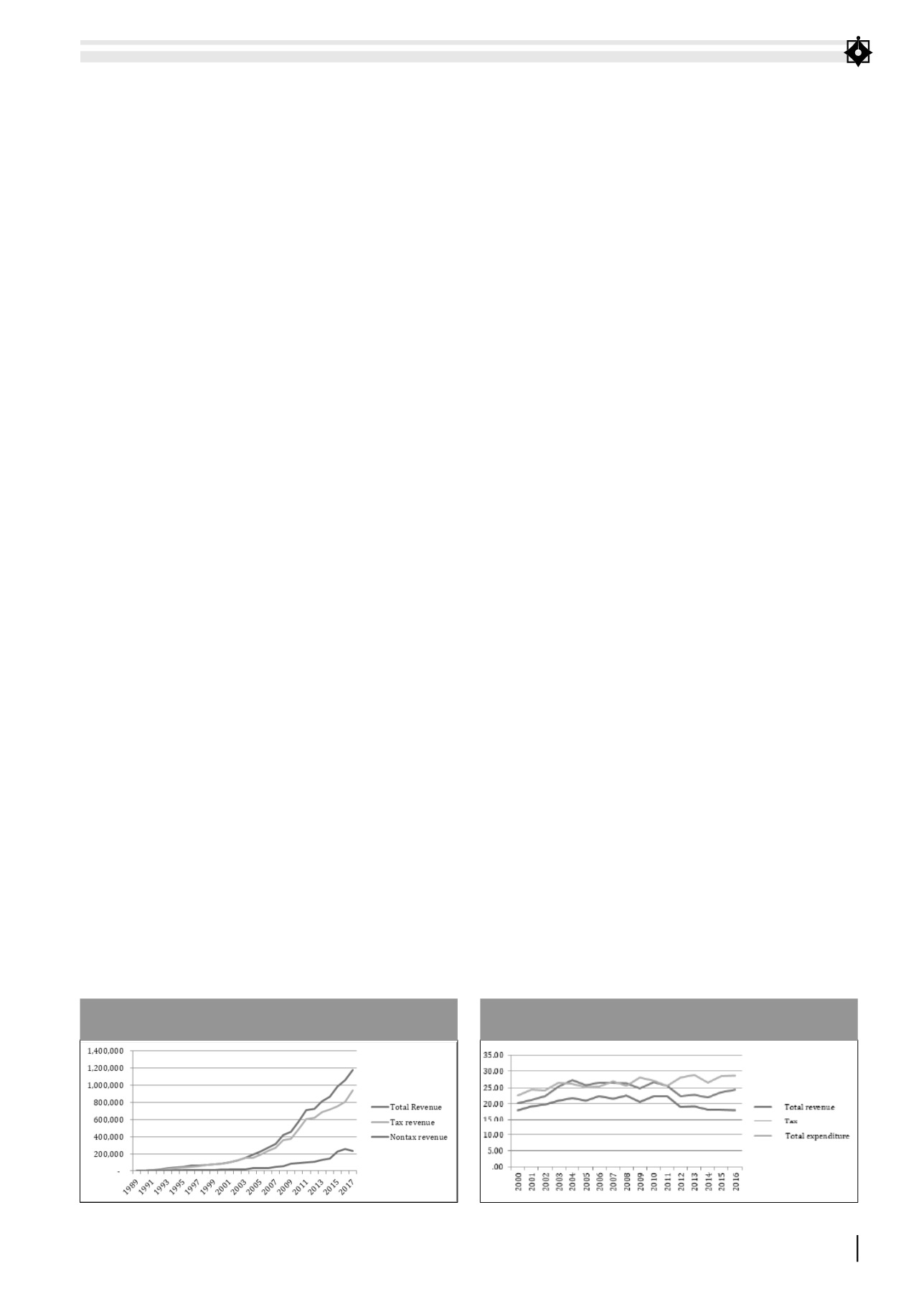

FIGURE 2. THE EVOLUTION OF TAX REVENUE IN VIETNAM

2000-2016 (% OF GDP)

Source: ADB in Vietnam