REVIEW

of

FINANCE -

Apr. 2018

51

(currently at 49% for joint stock companies and

30% for commercial banks) and allowing FDI

to be disbursed in VND only through VND

accounts at authorized credit institutions. To

some extent, these two measures have limited

the massive increase (beyond the control in some

cases) of indirect capital inflows into Vietnam.

In the coming time, the Government may apply

additional measures such as taxing on foreign

exchange transactions.

Secondly

, synchronizing fiscal and monetary

policies. In order to enhance the effectiveness of

the implementation of monetary and fiscal policy,

it is necessary to have a smooth and synchronous

combination of the two policies to enhance the

effectiveness of each policy.

State budget revenues and expenditures must

be closely linked to the principle of keeping the

monetary stability of the SBV. The government

should speed up the process of reforming the tax

system by amending and supplementing existing

tax laws towards expanding taxpayers, lowering

tax rates and drafting new tax laws to contribute

to the increase of state budget revenues and the

reduction of expenditures, thereby reducing the

state budget deficit.

In parallel with the increase in state budget

revenues, fiscal policy should reduce public

expenditures towards continuing to reduce

recurrent expenditures, and the ratio of

infrastructure expenditures to state budget should

be cut through years towards “the State and

investors do together” by calling for investment or

land conversion projects for foreign corporations

to get infrastructure to reduce the burden of

public debt. At the same time, it is necessary to

establish a regular and continuous relationship

in the planning and implementation of monetary

and fiscal policy between the Ministry of Finance

and the SBV.

Thirdly,

improving the basic conditions for

directing the monetary policy towards inflation

targeting. Historically, Vietnam has implemented

a multi-objective monetary policy. However,

in recent times, this policy has also revealed its

limitations. First of all, it has made Vietnam’s

inflation not market-oriented but subject to a lot

of subjective factors. In addition, multi-purpose

monetary policy has limited the SBV’s ability to

respond to market movements, especially price

volatility. The decision-making on the volatility

of inflation without compromising or weakening

other objectives has put the SBV ahead of more

complex options.

Compared to the basic criteria for the success of

the inflation targeting policy, it is not feasible for

Vietnam to immediately apply inflation targeting

at present. However, the present situation requires

a need to improve the basic conditions, the premise

for the process of applying this policy in the future.

In order to improve the premise conditions for the

roadmap to apply the inflation targeting policy,

the following measures should be implemented:

- In the transition period to the inflation

targeting policy, Vietnam should promote the

reliable calculation of basic inflation. This will be

an important basis for the SBV to supplement the

monetary policy since the basic inflation reflects

the trend of price fluctuation.

Core inflation not increasing is the basis for the

SBV to consider the possibility of not tightening

monetary policy. In contrast, when core inflation

rises, the SBV should consider having a monetary

policy response to control inflation.

In addition, basic inflation is likely to predict

CPI inflation in the future. This is one of the bases

for making a monetary policy decision because

the monetary policy is often delayed.

- Step by step building the independence of the

SBV, especially its functional independence. This is

a prerequisite for the success of the future inflation

targeting policy (to ensure the implementation

of a single objective monetary policy and the

transparency in all activities). Then, the SBV

should be more active in regulating the amount

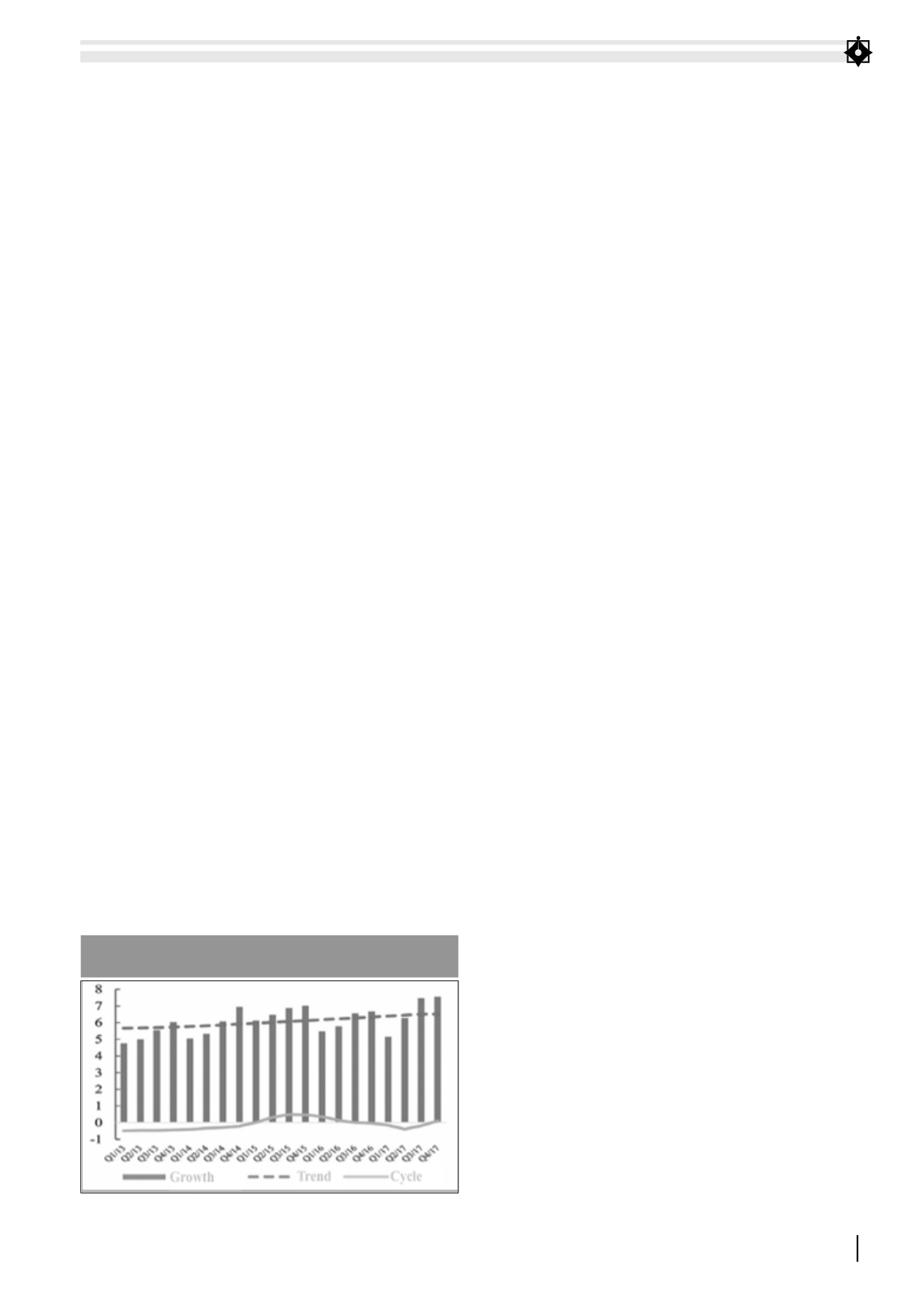

FUGURE 1. INTEREST RATE VOLATILITIES FROM 2013 TILL NOW

Source: Calculated by NFSC