REVIEW

of

FINANCE -

Apr. 2018

25

been some securities issuance transactions with

mortgaged-backed properties started from 2007,

which treated as similar method to securitization,

such as DATC (Vietnam Debt Sale and Purchase

Company Limited) and VAMC (Vietnam asset

management company), which mainly focus

on dealing with non-performing loans in the

financial market. There are still many difficulties

in the development process at present. In

general, applying securitization in Vietnam in the

current context is difficult, but to create a good

environment for securitization development is

one of the necessary and feasible tasks.

Litterature reviews

Under the OECD definition of 1995, the

“securitization process” is: The issue of securities

which is not only guaranteed by the issuer’s

solvency, but also by the expected revenues from

these assets. The issuer is no longer a decisive

factor in the quality of the issued securities, but

rather assets’ profitability used as collateral to

determine the income and the risk of the securities.

As such, “securitization products” are assets

that separated from their own management and

are profitable (generating cash flow), and not

dependent on other assets, such as mortgages

(including property owned by individuals or

organizations used for mortgage such as houses,

land, production workshops, machinery...),

mortgage loans, commercial loans, portfolio of

credit card loans, non performing loans portfolio,

subprime loan portfolio, high-yield bonds, or

commercial real estate loans and receivables

(including receivables from consumer loans to

purchase vehicles, credit cards, copyright etc.),

receivables from loans for businesses, financial

leasing assets, investments in projects including

infrastructure development, income from

investment projects and other loans.

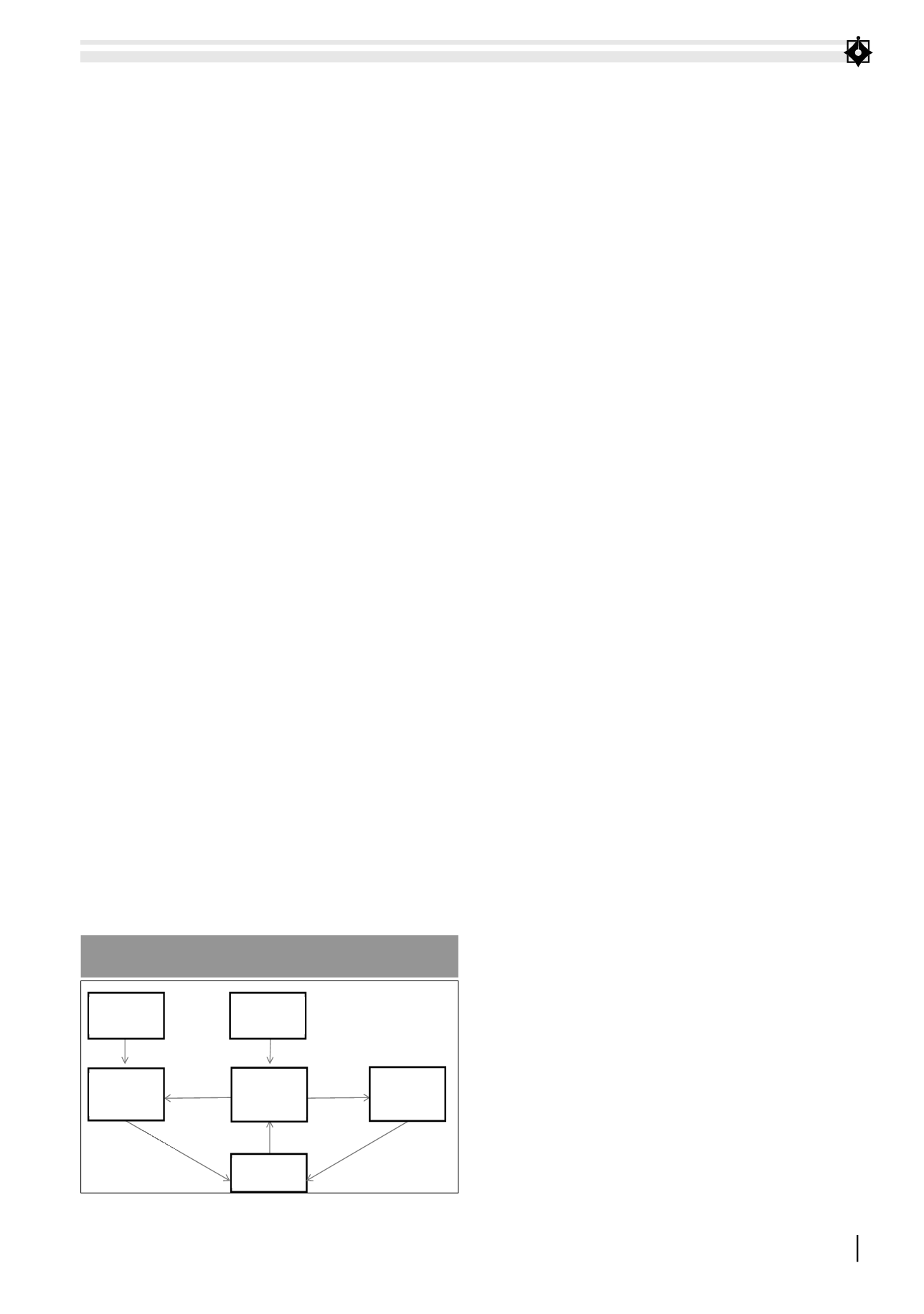

According to Jobst (2002), during the

securitization process, the loan owner will sell

the loan to a specialized financial institution

(SPV), which is often called a trust organization,

specialized in managing bankruptcy assets.

The SPV will buy back the loans by issuing

securities (bonds, bills, bills, commercial papers,

etc.). In addition, financial institutions (typically

investment banks) will often be involved in the

restructuring and marketing of these securities to

increase the demand of investors. It also provides

investors with a better understanding of these

securities through credit rating services.

Historically, the issue of securitization based

on the need of securing the wealth of assets that

had existed in the Middle Ages when the Genoa

Government of Northern Italy gathered some

wealthy people in the region to fund the trip to

exploit new lands. Modern securitization has

appeared more than 30 years ago, first from the

United States in 1970 and later expanded widely,

and then appeared strongly in other countries.

In particular, the “securitization” industry was

officially established in 1970with the first stockpile

of securities issued by the National Association of

Mortgages (GNMA, or “GinnieMae” ). In 1985, the

first ABS signed by Sperry Univac Corporation,

although the first mortgage agreement made

by the Bank of America in 1977. Since 1986, the

tax law of the United States for MBS and ABS

trading activities started to have effective. Then,

ABS began to dominate the US market in the

early years, and since 1987 it has been associated

with other credit card-related securities. The

securitization industry in the United States has

expanded to the Atlantic (England, 1985) and later

expanded to other European countries such as

Spain, Belgium, New Zealand, and Ha lan...).

In general, the term “securitization” derives

from the fact that securitization is a structured

financing process (issuing debt securities

for financing) on the basis of socialization of

investment. Securitization is the process of putting

collateral assets into the secondary market where

they exchanged. It also could turn poor assets into

Income from securization

produtcs

Investor

Deliver securization produtcs

Issuing securities

Payment of principal and

interest after deducting

expenses

Transfering asset

Sale loans, assets

Credit enhancing

Assurance

Trustee

SPV

Originator

Credit

Enhancer

Transfer profit to investors

FIGURE 1. SECURIZATION PROCESS

Source: Jobst (2002)