18

share, with the dominant proportion of total

outstanding loans in the market.

- The restructuring of insurance companies have

been still slow while the competitiveness of domestic

insurance companies has not been high:

Insurance

services in Vietnam have not been diversified,

insurance coverage (especially coverage of non-

life insurance) is still low. Insurance segments

have been uneven. The exploitation network

and the level of management companies of

Vietnamese insurance companies has not been

stable and professional. while the business style

has not been professional. There have been many

insurance disputes in the Vietnamese market,

mainly due to the fact that insurance companies

did not perform their insurance obligations

or insurance companies did not explain the

details of insurances to insurance buyers,

leading to confusion about insurance coverage.

In addition, there have been still unhealthy

competition among insurance companies;

Insurance premiums have not been built on the

basis of statistics to ensure financial security and

performance of enterprises.

- The legal capital for insurance companies is

still low, which would not motivate companies to

increase chartered capital:

In accordance with

the commitments to integration, Vietnam will

liberalize its insurance only in the non-life

insurance sector. With the current legal capital of

non-life insurance companies of VND 300 billion

(less than USD 1.5 million), it would be very

difficult for Vietnamese insurance companies

to financially compete with foreign insurance

companies is extremely difficult.

Solutions on development

of Vietnam’s capital market on the future

In order to achieve the goals of sustainable

development of the capital market in the context

of modern and internationally integrated market

economy, a number of focused solutions should

be implemented as follows:

Firstly,

to increase the supply of quality

products in the market by improving regulations

on issuance, listing, development of new products

and the process of equitization, divestment

of state capital in enterprises. Specifically: (i)

Adopting policies to encourage large enterprises

and corporations to list securities on the

organized trading markets in order to improve

the quality of goods on the stock market through

strict regulations on capital and business

activities of enterprises when listing securities; (ii)

Developing a derivative market in order to create

liquidity for the market, as well as contributing to

attracting investors, especially foreign investors,

to participate in the market; (iii) Researching and

developing new products in the bond market such

as pre-sale bond, derivative bond, floating rate

bond, asset-basedsecuritization,mediumand long

term bonds...; (iv) Speeding up the equitisation of

State owned enterprises in accordance with the

methods outlined in Resolution No. 15/NQ-CP of

the Government dated March 6

th

, 2014 on some

measures to promote equitization, divestment

of State capital of enterprises, especially large

enterprises in telecommunications, aviation and

energy sectors.

Secondly,

to diversify the investor base to

increase the demand for the stock market,

attracting more capital for the capital market;

To develop the system of investors, especially

institutional investors with long-term capital

such as insurance companies, compulsory

retirement funds, supplementary pension

funds, domestic and foreign invested funds via

investment incentives and the establishment

of an investment fund, such as imposing the

certain rate of investment allocation or forced

investment of a part of assets in securities, tax

incentives, etc.

Thirdly,

to increase the participation of

financial institutions and foreign investors. Along

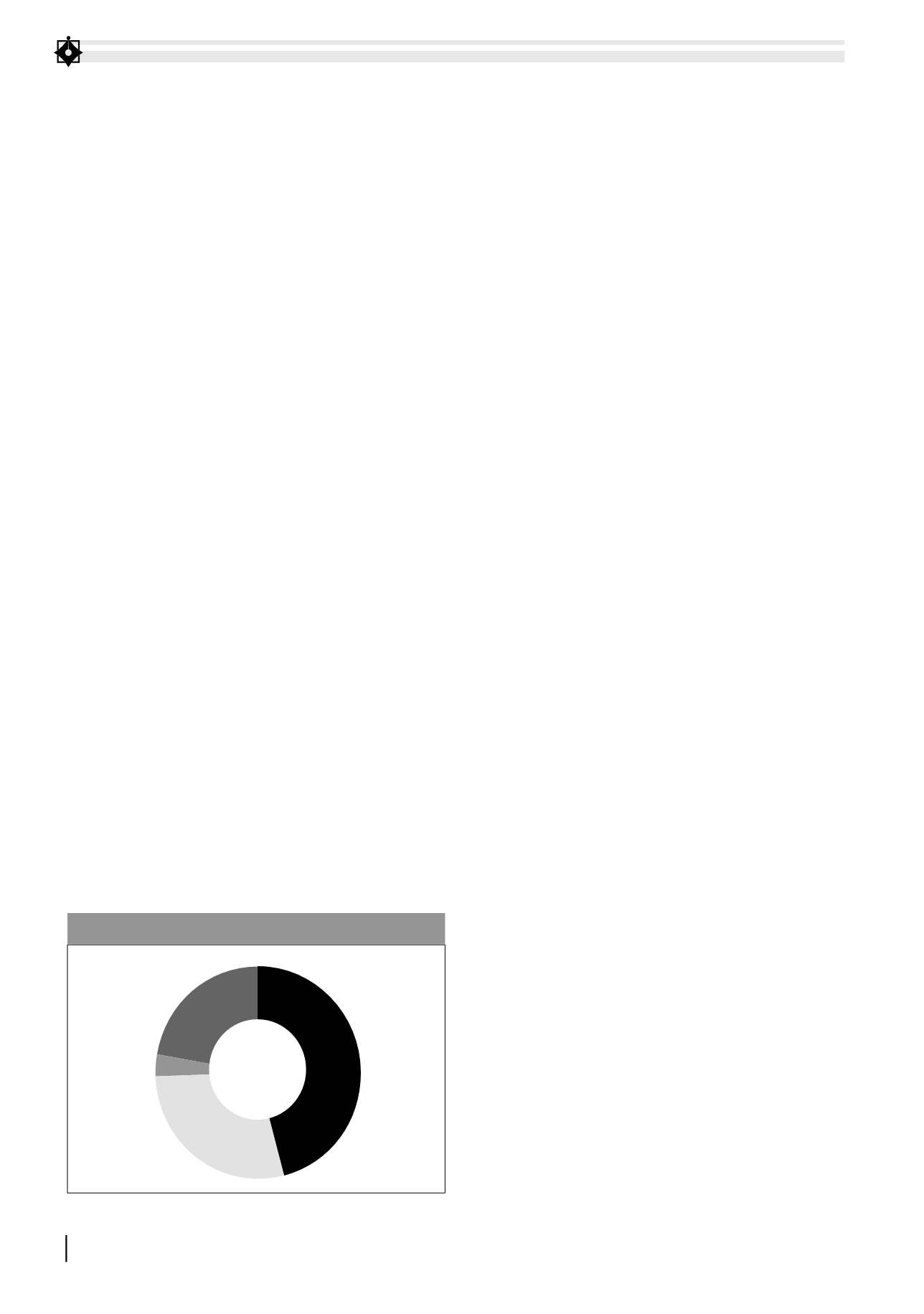

29

non-life

insurance

companies

63

insurance

companies

18

life insurance

companies

2

reinsurance

companies

14

insurance brockers

FIGURE 1. NUMBEROF INSURANCE COMPANY BYTHE ENDOF 2017

Source: Insurance Supervisory Authority