REVIEW

of

FINANCE -

Apr. 2018

19

with protecting investors, expanding investor

base is an important issue that many countries

have to pay attention to and consider as a

solution on the demand side to attract domestic

and foreign investment capital sources. With

the integration process and implementation of

WTO commitments, it is necessary to loosen

the ownership ratio of foreign investors in the

Vietnamese stock market.

Fourthly,

to develop intermediary institutions

and market services; To further strengthen the

restructuring of securities trading organizations

such as securities companies, fund management

companies, securities investment companies,

etc., in order to improve their financial capacity

and ensure their operations to be healthy, liquid

and systematically secure; At the same time, to

restructure the banking system by thoroughly

resolving the problem of bad debts, cross-

ownership between enterprises and banks, banks

and securities companies.

Fifthly,

to complete the bond market structure.

Experiences in countries around the world show

that, to develop the bond market, it is firstly to

develop the stock market as the foundation,

thereby promoting the market of corporate bonds.

The outstanding debts of government bonds in

Vietnam account for a large proportion of total

outstanding debts but are still low in comparison

with that in other countries in the region (53.84%

in Thailand and 51.73% in Malaysia). Therefore,

in order to further develop the stock market

under the Roadmap for the development of

the bond market up to 2020, it is necessary to

develop a comprehensive market including the

legal framework, activities in the primary market,

secondary market, investor development as well

as associated services.

Sixthly,

to continue topromote the restructuring

of the stockmarket, infrastructure, and technology;

To continuously build a model and roadmap for

the process of merging two Stock Exchanges;

to complete the central counterbalancing

partnership model; To formulate and implement

a scheme on connection of the system of clearing

and settlement of securities with the inter-bank

payment system.

Seventhly,

to improve systematic security,

performance and competitiveness of insurance

companies; to encourage and support businesses

to develop and diversify insurance products;

besides, to diversify and professionalize insurance

distribution channels.

Eighthly,

to improve the legal framework,

efficiency and effectiveness of management and

supervision of the State; To complete the system

of unified and uniformed legal frameworks

meeting the requirements of management,

supervision and integration with regional and

international capital markets; To add serious civil

and criminal penalties to prevent and handle acts

of violation in the capital market and securities

market, strengthen the apparatus and enhance

the managerial and supervisory competencies of

the State for the capital market.

References:

1. Resolution No. 15/NQ-CP dated June 3

nd

, 2014 by the Government on

some Solutions to Promote Equitization, Divestment of State Capital in

Enterprises;

2. Decree No. 42/2015/NĐ-CP dated May 5

th

, 2015 on Derivative and

Derivative Securities Market;

3. Decree No. 60/2015/NĐ-CP Amending and supplementing a number

of articles in Decree No. 58/2012/NĐ-CP dated July 20

st

, 2012 by the

Government regulating and guiding the implementation of some

articles stated in the Law on Securities and the Law on Amendments

and Supplements to a Number of Articles of the Law on Securities;

4. Project “Restructuring the system of Credit Institutions in the period

of 2011-2015” and the project “ Restructuring the system of Credit

Institutions associated with bad debt resolutions in the period of 2016-

2020”;

5. Some website: mof.gov.vn, ssc.gov.vn...

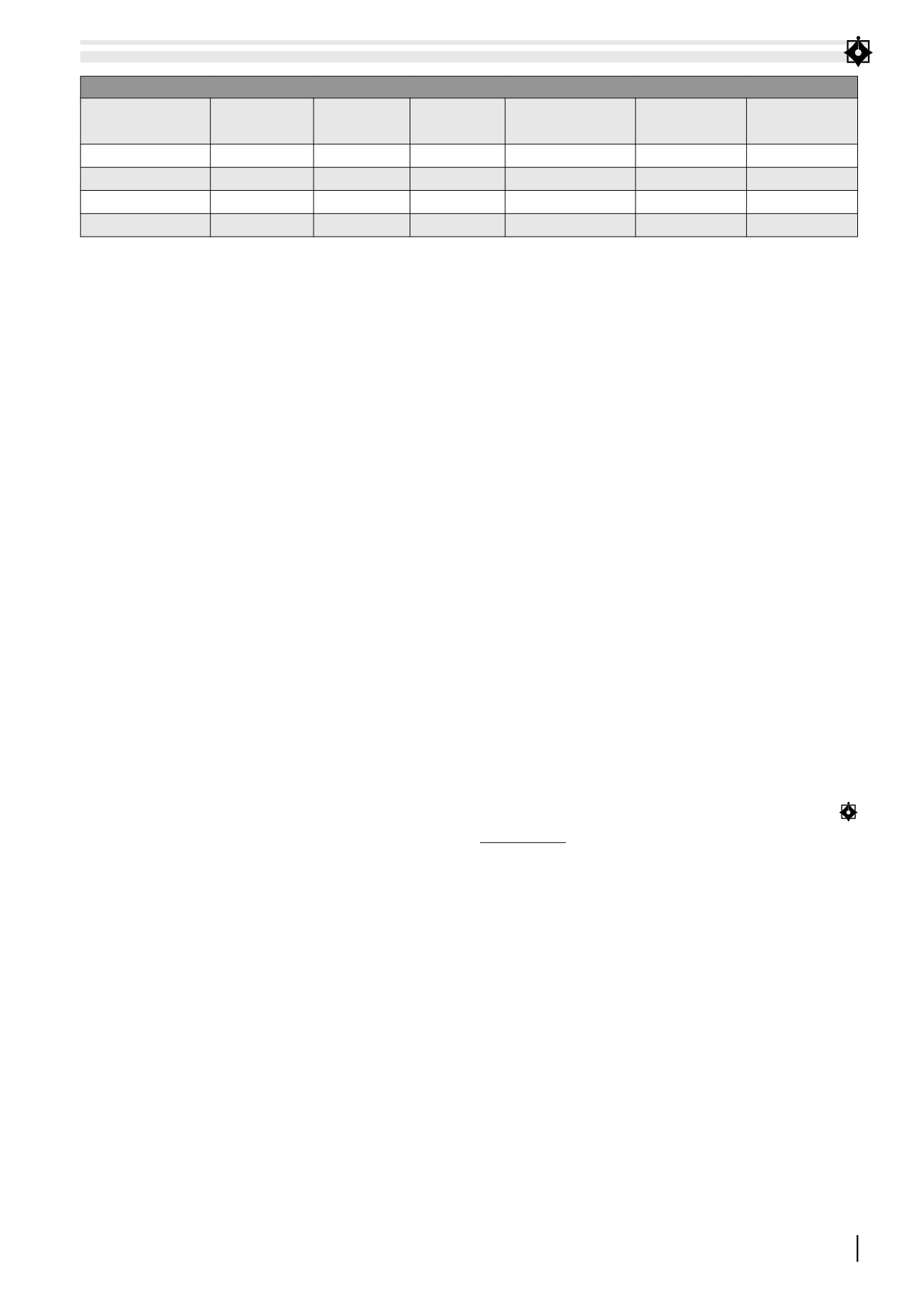

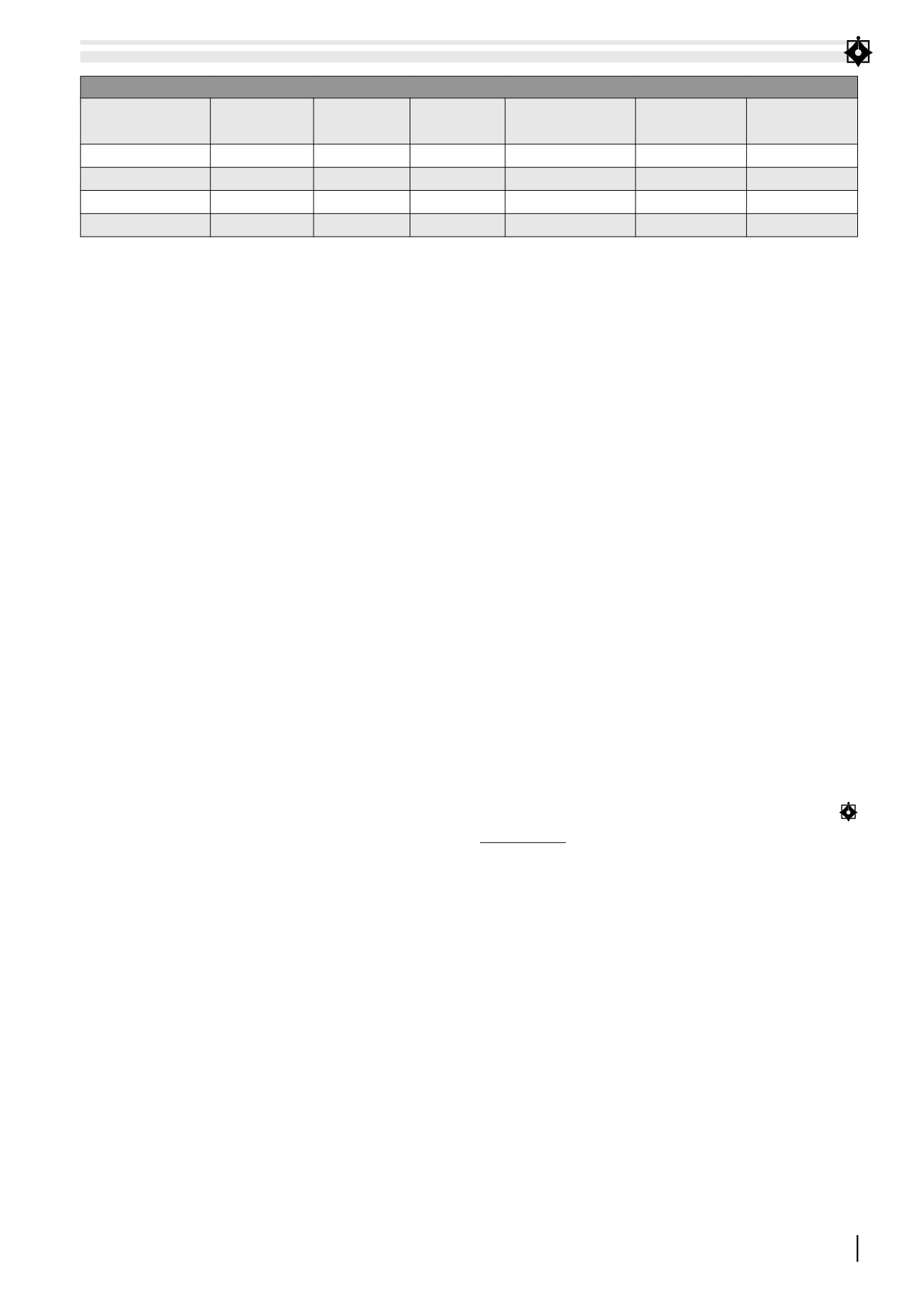

TABLE 2. THE CAPITALIZATION OF VIETNAM SECURITES MARKET AS OF FEBRUARY 2018 (VND BILLION)

Capitalization of

securites market

HOSE

HNX

UPCoM Government bond/

Corporate Bond

Total

%GDP

31/12/2016

1,491,778

150,521

306,629

931,340

2,880,268

68.7

29/12/2017

2,614,150

222,894

677,629

1,013,833

4,528,506

100.57%

31/01/2018

3,010,052

234,878

714,941

1,005,083

4,964,954

110.27%

28/02/2018

3,039,209

235,328

696,153

1,026,843

4,997,533

110.99%

Source: State Securities Commission