16

Exchange. Additionally, the derivatives market

has been put into operation, creating favorable

conditions for both companies and investors and

showing positive changes from the authorities.

- The insurance market:

The size of the insurance

market is growing rapidly and reaching about

2% of GDP. In the period of 2012-2016, premium

income has more than doubled from VND 41,246

billion in 2012 to VND 86,049 billion in 2016,

while the premium income in 2017 reached

VND 105,611 billion. The total assets of the

entire insurance market by the end of 2017 was

estimated at VND 302,935 billion (increasing

by 23.44% compared to that in 2016), the total

investment in the economy was estimated at

VND 247,801 billion, (increasing by 26.74%

compared to that in 2016), the total premium

of the insurance market was estimated at VND

105,611 billion, (increasing by 21.20% compared

to that in 2016), the insurance reimbursement was

estimated at VND 29,423 billion. In addition, the

number of insurance companies also increased

rapidly meanwhile there was the improvement in

the size and quality of companies. By the end of

2017, the entire insurance market had 63 insurers

(including 29 non-life insurance companies, 18

life insurance companies, 14 insurance brokers

and 2 reinsurers) and 1 foreign owned non-life

insurance branch.

Thirdly,

the supply of goods has been expanded:

In the credit - banking market, along with the

process of innovation and integration, under

the competitive pressure from the appearance of

foreign banks, domestic commercial banks has

been forced to improve, diversify its products

and develop new banking services that enhance

customer convenience (such as increasing features

of personal accounts, developing card services,

developing services modern banking such as

phone banking, internet banking ...). On the stock

market, the number of listed companies increased

from 2 companies (in 2000, when Vietnam stock

market began) to nearly 700 companies. In

addition to the traditional securities products

such as stocks and bonds, the legal framework

for derivatives has been established since 2015

and this derivative market has officially come into

operation since August 10

th

, 2017, with the first

basic product is futures contract.

In the insurance market, voluntary retirement

insurance products were established and

developed in 2013. Up to now, there have been

six life insurance companies offering retirement

insurance products namely Manulife, AIA, Dai-

ichi, Sun Life, Bao Viet Life and Prudential. The

results in 2016 were estimated at 6,948 contracts

(accounting for 0.4% of new contracts).

Fourthly,

the regulatory framework for

inspection and supervision has been increasingly

improved and in line with international practice:

banking supervision has shifted from on-site

monitoring to remote monitoring (via the project

Developing the information system to support

remote monitoring in 2010), remote monitoring

has come much together with direct inspection in

order to ensure continuous and regularmonitoring

over the credit institutions. The monitoring is not

to simply work on compliance monitoring but

has initially shifted to a risk-based monitoring

system for the operations of each bank as well as

the whole system (applying CAMELS standards,

Basel). In addition, the issuance and regular

updating of regulations on limits and safety ratios

in the operations of credit institutions has also

helped the banking sector to develop stably.

In the stock market, the monitoring

mechanism is being implemented at two levels,

with the assignment and coordination between

the supervisory level of the State Securities

Commission and the supervision levels of the

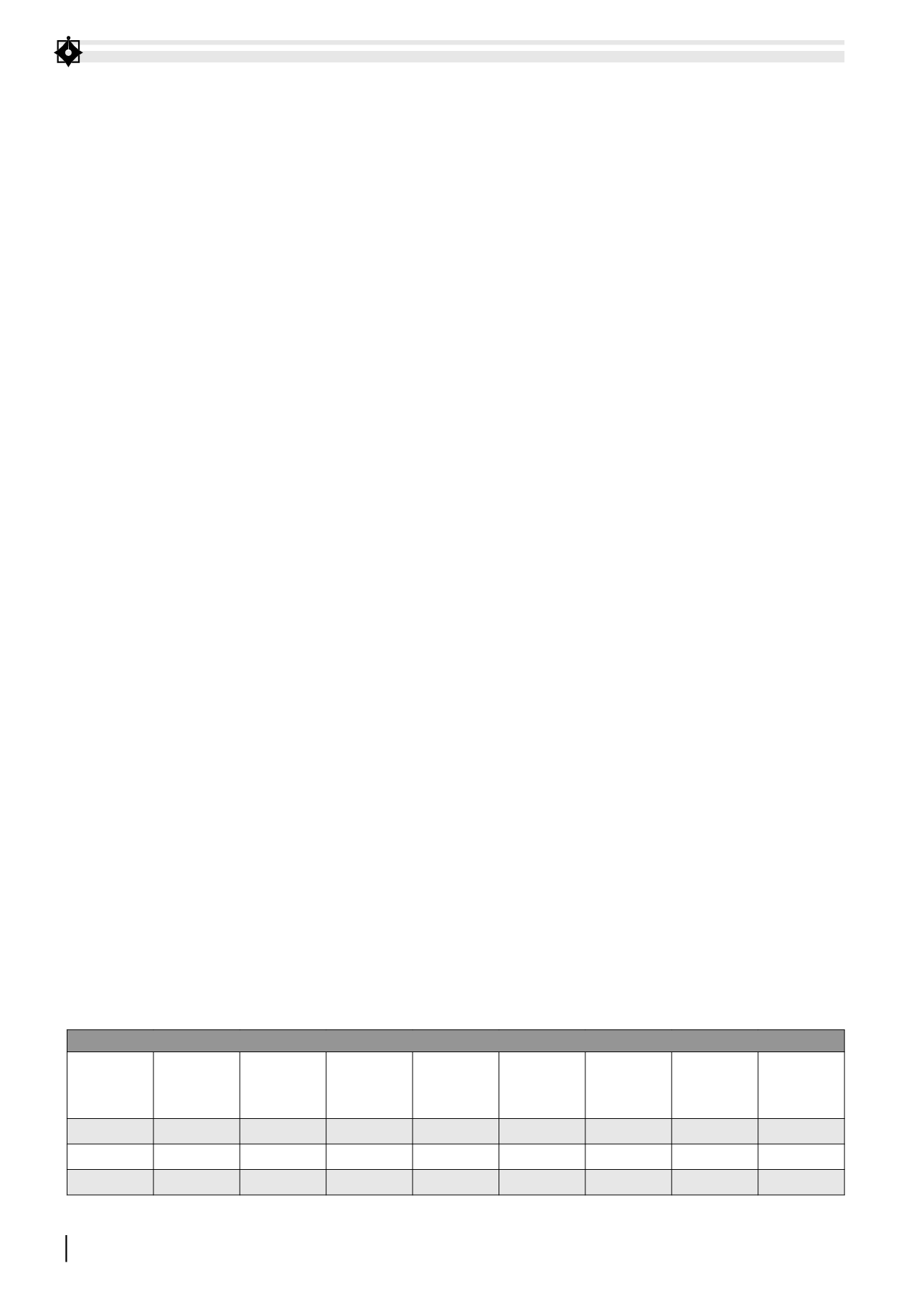

TABLE 1. VOLUME OF LISTED AND UNLISTED SECURITIES (AS OF 12/2017) (BILLIONS SECURITIES)

Time

Listed

Shares

Listed Gov’t

Bond

UPCoM ETF

Fund

Certificates

HoSE Bond

Total

Compared

to previous

period end

31/12/2015

53,08

7,53

5,06

0,038

0,086

65,8

31/12/2016

60,38

9,3

14,82

0,041

0,015

0,095

84,65

28,60%

29/12/2017

71,82

9,98

24,71

0,18

0,02

0,16

106,87

26,25%

Source: State Securieties Commition