22

and the clearing members has been continuous,

smooth. The transmission of transaction result

data, the announcement of the position between

the HNX, the VSD and the clearing members,

the transmission of data of cash depositing/

withdrawing activities, payment of position

losses/profits have been implemented safely and

accurately in accordance with the regulation.

The VSD has cooperated with the HNX

to bring 8 future contracts into trading and 4

expired contracts into payment, cooperated

with VTB to pay daily position losses/profits

and settle expiration payment smoothly and

safely. The average trading value of the daily

market is quite large (approximately VND 715

billion). However, the VSD applies the method

of clearing the obligations between the trading

accounts of the investors for the clearing

members. Therefore, the daily loss/profit of the

VSD accounts opened at Vietinbank is quite

small (approximately 319 million VND/day),

equivalent to 0.04% of the trading value. This

has contributed to improving the efficiency of

clearing and settlement of derivative securities,

minimizing the risk of insolvency of the clearing

members and investors.

However, in addition to the achievements,

the risk management in the derivative securities

market maintains a weakness in the eyes of the

clearing member. This weakness also requires

to be closely monitored by the regulatory and

market regulators.

Directions to the future development

Promoting the 2017 achievements,, the VSD

and concerned parties continue to implement

some key tasks in 2018 as follows:

Firstly,

to launch new products for the market.

The base stockmarket andderivative securities

market have a correlation and close relationship

with each other. Throughout the process

from founding to operation of the derivative

securities market, the management agency has

a consistent guiding viewpoint which is the

careful development along the roadmap, taking

steps to minimize negative impacts on the base

stock market.

In the first phase of the market, only VN30

future contracts were put into trading. Then in

September 2017, in the Notice No. 680/TB-BTC,

the Ministry of Finance decided to set up the

roadmap for the following product launch of

a government bonds future contract. At the

same time, the Ministry of Finance requested

the HNX, the VSD to study and develop future

contracts based on other indexes which are

expected to be accurate based on scientific

calculations.

In this regard, the VSD has made the

necessary preparations, in particular the

systematic functions of the VSD are ready for

the clearing and settlement of government bond

futures contracts. In 2018, VSD will coordinate

with concerned parties including the HNX, the

clearing members and the VTB

to get the product into trading.

With the futures contracts

on the new indexes, the

impl ement a t i on of the

new indexes will require

coordination between the VSD,

the HNX as well as the unit

responsible for calculating and

operating the set of related

indexes in the construction,

monitoring and evaluation for

a minimum period of 1 year.

Thus, it would take about a year

to introduce derivative products

on the new index (if any).

Secondly,

to collect the

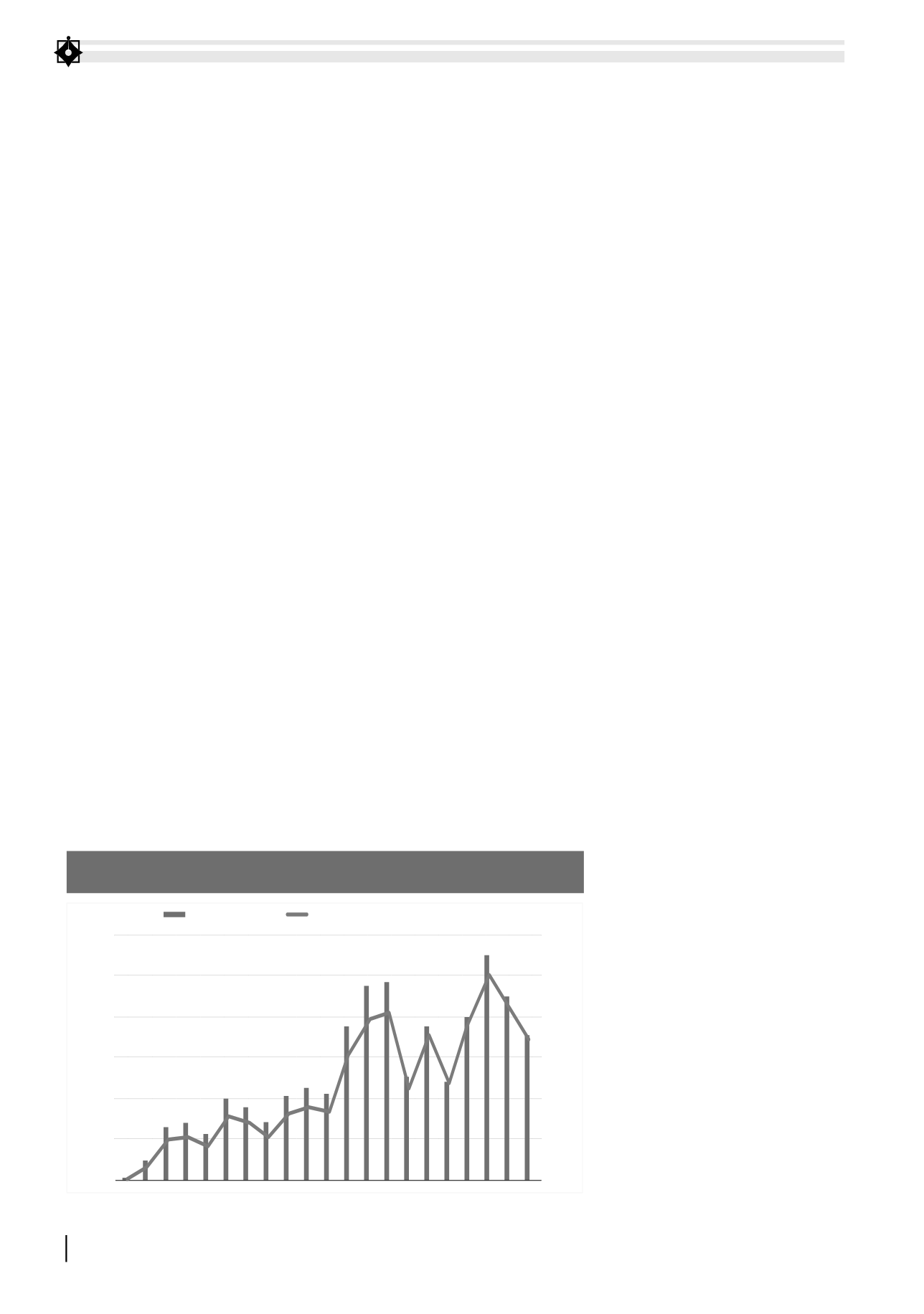

Trade volume

Trade value (billionVND)

0

2,000

4,000

6,000

8,000

10,000

12,000

0

20,000

40,000

60,000

80,000

100,000

120,000

(

billionVND

)

FIGURE 1. WEEKLY DERIVATIVE SECURITIES MARKET TRADE VOLUME AND VALUE

(AUGUST 10

TH

- DECEMBER 29

TH

, 2017)

Source: HNX