REVIEW

of

FINANCE -

Apr. 2018

21

securities market reached 1,106,353 contracts,

equivalent to the transaction value (by nominal

contract size) of over VND 96,297 billion.

On average, the transaction volume reached

10,954 contracts per session and the nominal

transaction value reached VND 953.44 billion per

session. In August, the average trading volume

was 3,653 contracts per session. In December,

the average trading volume was 4.7 times bigger

than that in August, reaching 17,029 contracts,

of which the trading day of December 12

th

, 2017

had the largest trading volume over the past 4

months, reaching 27,994 contracts, equivalent to

the trading value of VND 2,508.56 billion.

In the last months of the year, the positive

movement of the VN30 Index in the base

securities market made the future index in

most terms rise. Short term futures contracts

continued to trade at a lower rate than the

VN30 Index, liquidity was mainly on short-

term contracts in line with international

practices. The strong fluctuation of the VN30

Index made the trading activity of the futures

contract increase sharply, especially at the end

of October, beginning of November, 2017.

The above figures show that the derivative

securities market had a successful 4 months’

time, in which the first derivative product was

the futures contract of the VN30 Index. This

product had been given interest by the investors,

thus reflecting a great potential of the market

development.

Issues of market management and monitoring

In the payment model, the VSD is the only

institution that performs the clearing and

settlement function of derivative securities

under the central counterparty model. Since the

introduction of the guidelines of the Government

and the direction of the Ministry of Finance, the

State Securities Commission (SSC), the VSD has

cooperatedwith theHNXandmarket participants

to urgently prepare necessary conditions to put

the derivative securities market into operation

as planned.

The good point is that although the market is

new in the field, there has been a rapid growth in

all aspects in the market. In general, the clearing

memberscomplystrictlywithregulationsonclearing

and settlement of derivative securities of investors,

not allowing the case of insolvent investors. To

achieve this result, the VSD has implemented many

synchronized solutions such as:

- For monitoring the risk management rate,

there has been the application of the daily

monitoring mechanism in all activities of

the clearing members and investors, thereby

detecting violations immediately if any. After

more than 4 months of operation, there have

been some cases where investors’ accounts have

violated the ratio of using collateral assets. In

these cases, the VSD sent an immediate warning

to the HNX to suspend the trading session and

notify the Clearing Member of the settlement

immediately on the same day.

- For dealingwith offending clearingmembers,

all accounts of investors violating the ratio of

using collateral assets are treated right in the

day (either paying additional margin or closing

positions), which would not cause insolvency.

However, in order to make clearing members be

aware, identify the issue in time and tighten their

risk management, especially in the first stage of

market, according to the current Regulations

on Management of Clearing Members, the VSD

has issued a decision on reprimand for some

securities companies.

The coordination between the VSD and

concerned parties (HNX, VTB) has been

smoothly implemented. The connection between

the VSD system of clearing and settlement of

derivatives with the system of the HNX, the VTB

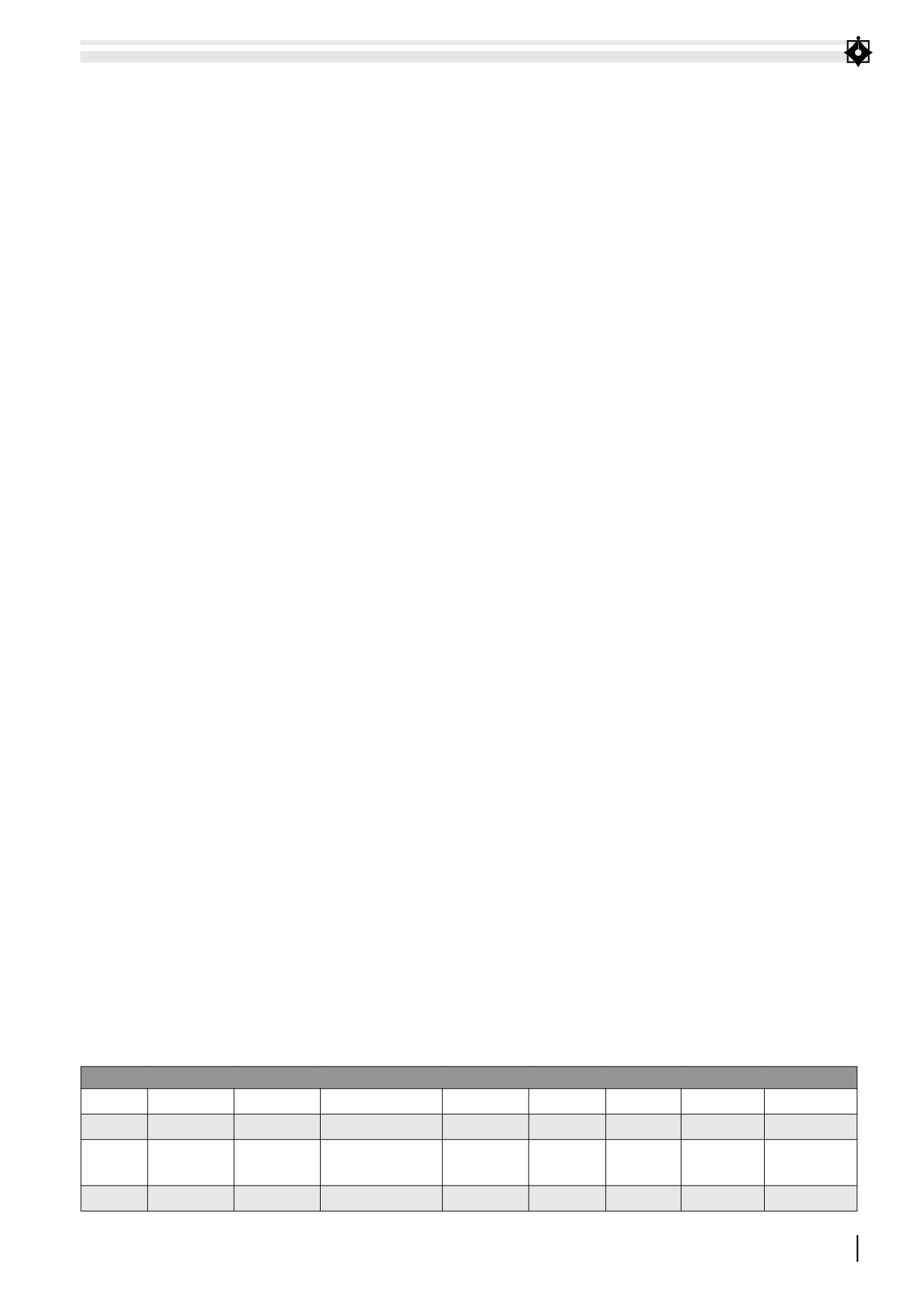

TABLE 1: CONSOLIDATION OF ENTIRE DERIVATIVE SECURITIES TRANSACTIONS (BILLION VND)

No

Indicator

Unit

Aug. (since 10/8)

Sept

Oct

Nov

Dec

Total

1

Trading vol.

Contract

58.444

131,903 238,330 320,064 357,612

1,106,353

2

Trading

value

Billion VND

4,362.59

10,299.36 19,370.08 28,484.13 33,781.57 96,297.75

3

Ending vol.

Contract

2,166

3,275

3,949

8,122

8,077

Source: HNX