REVIEW

of

FINANCE -

Feb. 2018

45

Specifically:

Opportunities

(i) Opportunities to expand and develop

overseas markets for Vietnamese banks:

International economic integration in general and

participation in joint-stock banks in particular has

opened up opportunities for Vietnamese banks

approaching the market overseas. Integration

creates favorable conditions for domestic credit

institutions to expand their activities to foreign

markets through the provision of services within

the framework of commitments, especially cross-

border trade and provision .

(ii) Opportunity to receive new training,

consultancy and training support from banks

and foreign financial institutions: International

integration creates opportunities for linking of

domestic banks with foreign banks. Linking with

foreign banks helps local banks to have good

conditions to enhance their ability to prevent

and handle risks through technical assistance

and technical assistance in applying banking

technology, management and development of

new products.

The scrutiny in business is also the opportunity

for domestic banks to lift to a new height. Opening

the banking market in line with bilateral and

multilateral commitmentswill be a good condition

to attract direct investment in the financial

sector, at the same time banking technologies

and advanced management skills is absorbed by

domestic banks through business cooperation.

The involvement of foreign investors in domestic

banks is an important factor in improving the

level of business management in domestic banks.

(iii) Vietnamese banks are engaged in a level

playing field with high professionalism. When

implementing integration commitments, the

intervention of the State intervenes in business

operations of banks will be reduced and the

protection will be limited. This context makes

it possible for Vietnamese banks to be more

active in their businesses, and at the same time,

banks have the opportunity to demonstrate

their capabilities and qualifications. Domestic

banks are forced to specialize more deeply in

their operations to rapidly access and develop

new banking services, improve the efficiency

enable participants to have full discretion in the

future.

Participating countries also set out principles

for the formal recognition of the importance of

legal procedures to encourage the provision

of insurance services by licensed suppliers and

processes to achieve this goal. In addition, the

CPTPP also mentions specific commitments on

portfolio management, electronic payment card

services and the transfer of information for data

processing purposes. However, the CPTPP also

mentions the exceptions in protecting the financial

autonomy of CPTPP participants, in which they

will be given the initiative to take measures

to reinforce the CPTPP financial stability and

consistency of its financial system. This includes,

but is not limited to, exceptional provisions

that Member States consider prudently and the

exceptions to non-discriminatory measures in

the process of establishing and implementing

monetary policy or other policy.

Opportunities and challenges

for the banking industry

Internationalexperienceshowsthatcompetitive

and open financial and banking systems are one

of the preconditions for effective development

and economic growth. This is also the reason

that the trend of international integration of the

banking industry has become more popular

and widespread. In addition to the undeniable

benefits of accessing capital, technology transfer,

professional experience, etc., the integration

trend posed no less a challenge to the banking

sector in the process of adjustment and reform

towards a stable and sustainable banking system.

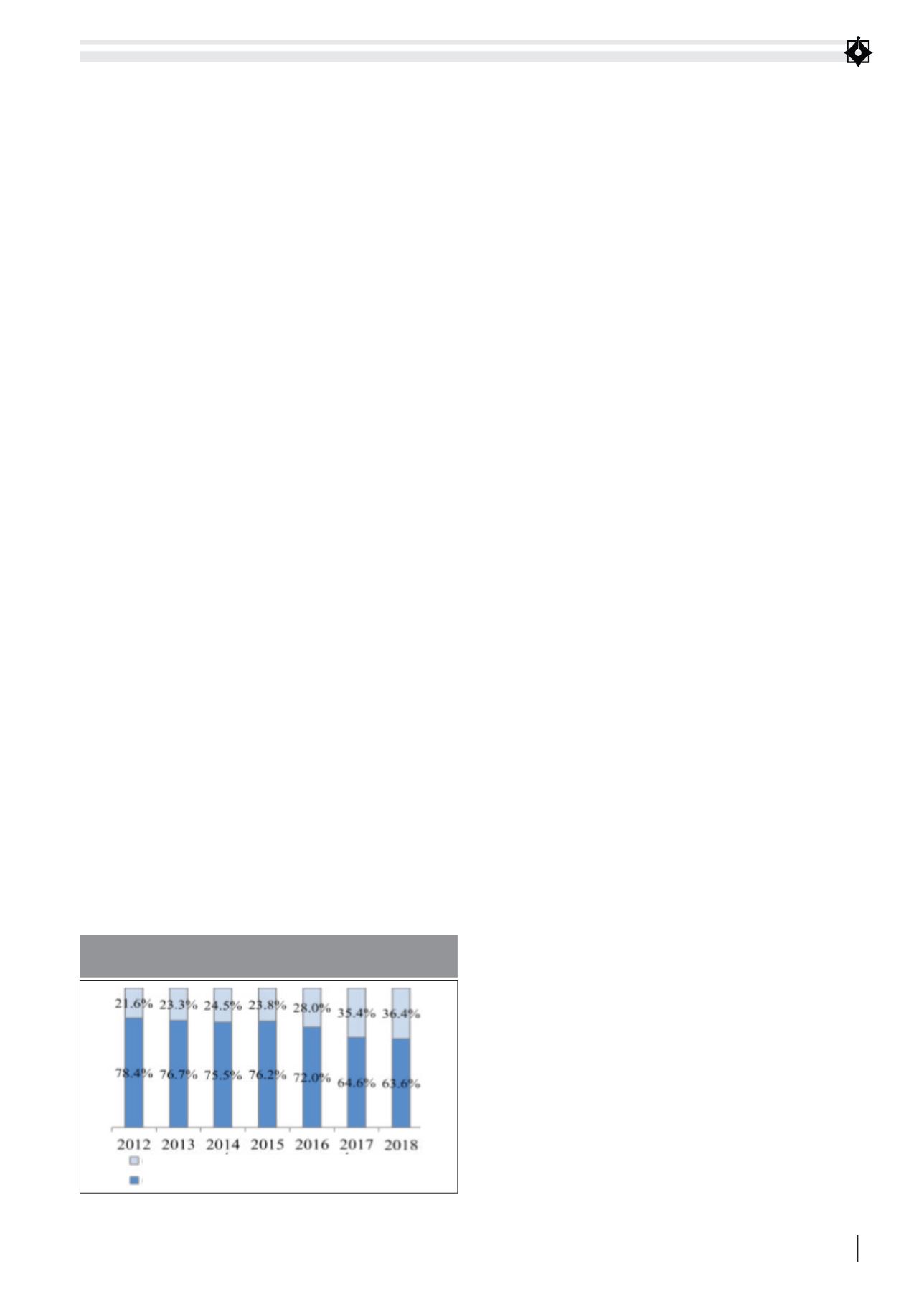

Capital supply from the capital market

Capital supply from the credit credit institutions

FIGURE 1: THE PROPORTION OF CAPITAL SUPPLY

TO THE ECONOMY 2012-2017

Source: General Statistic Office