42

issue bonds must meet the following conditions:

there is a need to mobilize capital in several

batches in line with the purpose of issuing bonds

already approved by competent authorities, the

bond issuance plans with the number of issuance

drives, expected volumes, issuance time and

plan on capital use of each issuance drive must

be clarified, enterprises must also ensure that the

issuance time of each batch shall not be extended

over 90 days in accordance with the law on

securities; the disclosure of information must

be in accordance with regulations. When satisfy

conditions mentioned above, issuing enterprise

may issue bonds in multiple installments but not

exceeding 12 months.

Furthermore, in order to clarify regulations

on bond issuance dossiers and create favorable

conditions for enterprises to issue bonds, the

draft decree stipulates that enterprises’ annual

financial statements must be audited and is a

full approval. When the audit opinion is an

exception, the exception must not affect the

offering conditions and the firm must explain the

exclusion and impact of the exclusion factor on

the financial result and ability of the repayment

of principal and interest of corporate bonds. At

the same time, the draft decree specifies the use of

audited financial statements of parent companies,

subsidiaries, and companies formed after the

merger or consolidation process in the bonds.

Regarding the authority to approve bond

issuance plans, in order to be consistent with the

provisions of the Law on Management and Use

of State Capital for Investment in Production and

Business inEnterprises and the current regulations

of the Government Regarding capital mobilization

In addition, it is necessary to supplement

regulations in the direction of unifying the basis

of determination of interest of corporate bonds

in accordance with international practice, similar

to the regulations of bond interest calculation

method of the government, facilitating investors in

trading and valuing corporate bonds. At the same

time, in order to create more favorable conditions

for good companies to issue bonds, relevant

authorities should consider the conditions of

issuance. It is necessary to clarify the provisions

of the due debt without payment within three

years; give specific guidance on the regime and

contents of information reports which enterprises

issue bonds must meet.

In order to remove the difficulties and support

the positive development of the market, in the

coming time, the drafting agency has made many

progressive and positive solutions. Accordingly,

in relation to the conditions for issuance of bonds,

receiving opinions of ministries and branches in

the process of collecting opinions on the proposal

for development of the Decree, the draft decree

basically upholds the regulations on conditions

of distribution to issue bonds in Decree No.

90/2011/ND-CP. At the same time, on the basis

of reviewing the current regulations on capital

mobilization conditions of enterprises, the draft

decree supplemented and amended a number of

provisions on conditions for issuance of bonds.

Specifically, with the issuance of bonds divided

into several issuance, to create conditions for

enterprises to mobilize capital into many waves,

in accordance with the progress of disbursement

and investment projects, the draft decree added

to the regulations that enterprises that wish to

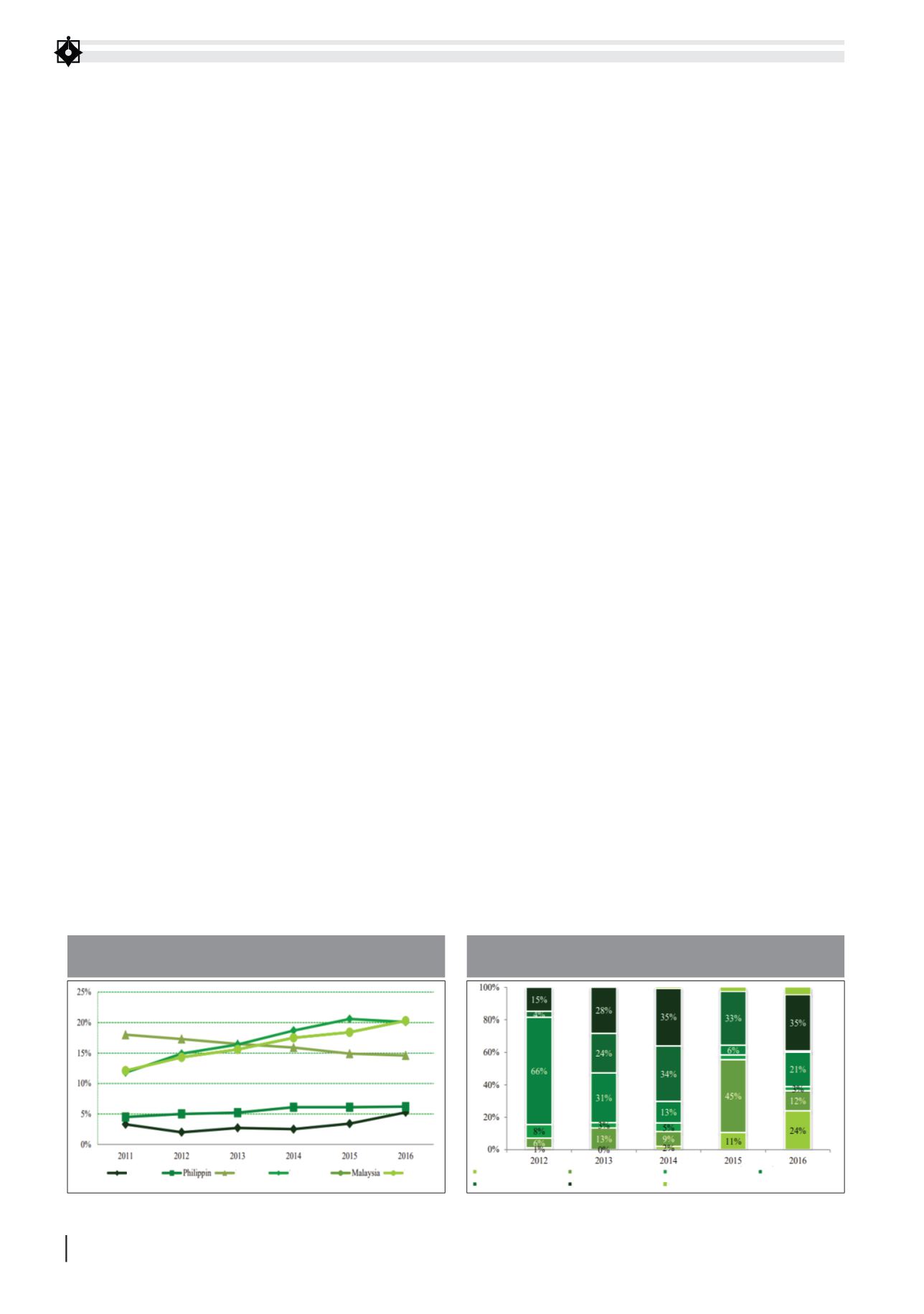

Corporate bonds issued by industry

Other

Mining

Production

Banking

Infrastructure

Stocks

Real estate

FIGURE 2: CORPORATE BONDS ISSUED

BY INDUSTRY

Source: VCBS

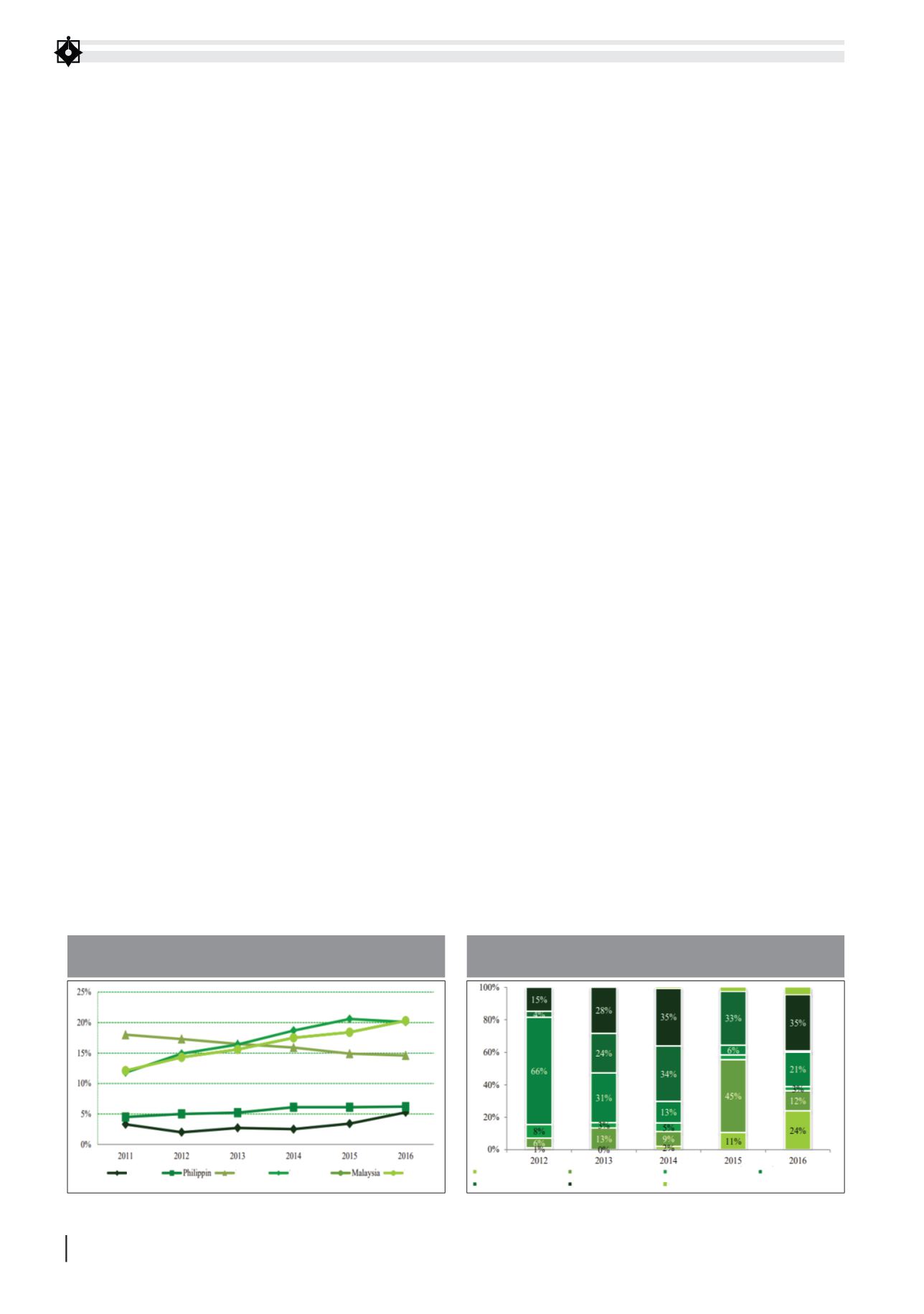

Vietnam

Japan

China

Thailand

FIGURE 1: THE RATIO OF CORPORATE BONDS TO THE

ECONOMIES OF SOME COUNTRIES IN THE REGION

Source: Bloomberg