REVIEW

of

FINANCE -

Feb. 2018

37

orientation of monetary policy management.

Beside, the SBV’s announce of the amount of

foreign exchange reserves with great growing

trend also showed a strong commitment of

management agencies throughout 2017 on the

direct intervention capacity in foreign exchange

market in order to stabilize exchange rate,

contributing to eliminate the waiting psychology

for sharp increase rate, reduce foreign currency

speculation. SBV also collaborated closely with

related units to strengthen the work of inspection,

examination and handling the violations of foreign

exchange business operations and ensure that

credit institutions and economic entities strictly

following the regulations of rate and exchange

rate transaction. These fundamental changes in

exchange rate and foreign market management

have created initially the great stability. It can be

affirmed that, 2017 was considered as a successful

year of SBV in managing exchange rate and

stabilizing foreign exchange market (bring the rate

in unofficial market closely to the one in official

market). As of 31, Dec. 2017, SBV announced the

central rate of VND to USD at 22.425VND/USD,

which increased 1.2% in comparison with the one

at the end of 2016. In Bloomberg’s assessment of

the level of stability of some Asia currencies, VND

belonged to the most stable group.

In the period from 2012 to now, the

communication and transparency of the

information of SBV’s operations in particular and

the whole banking sector in general were an old

point but had significantly change (both frequency

and content) in monetary policy management.

SBV improved the mechanism to provide

information, enhance the initiation, timeliness,

transparency and accountability on the SBV’s

management mechanism, policy and decisions

and the performance of credit institutions system

through different channels.

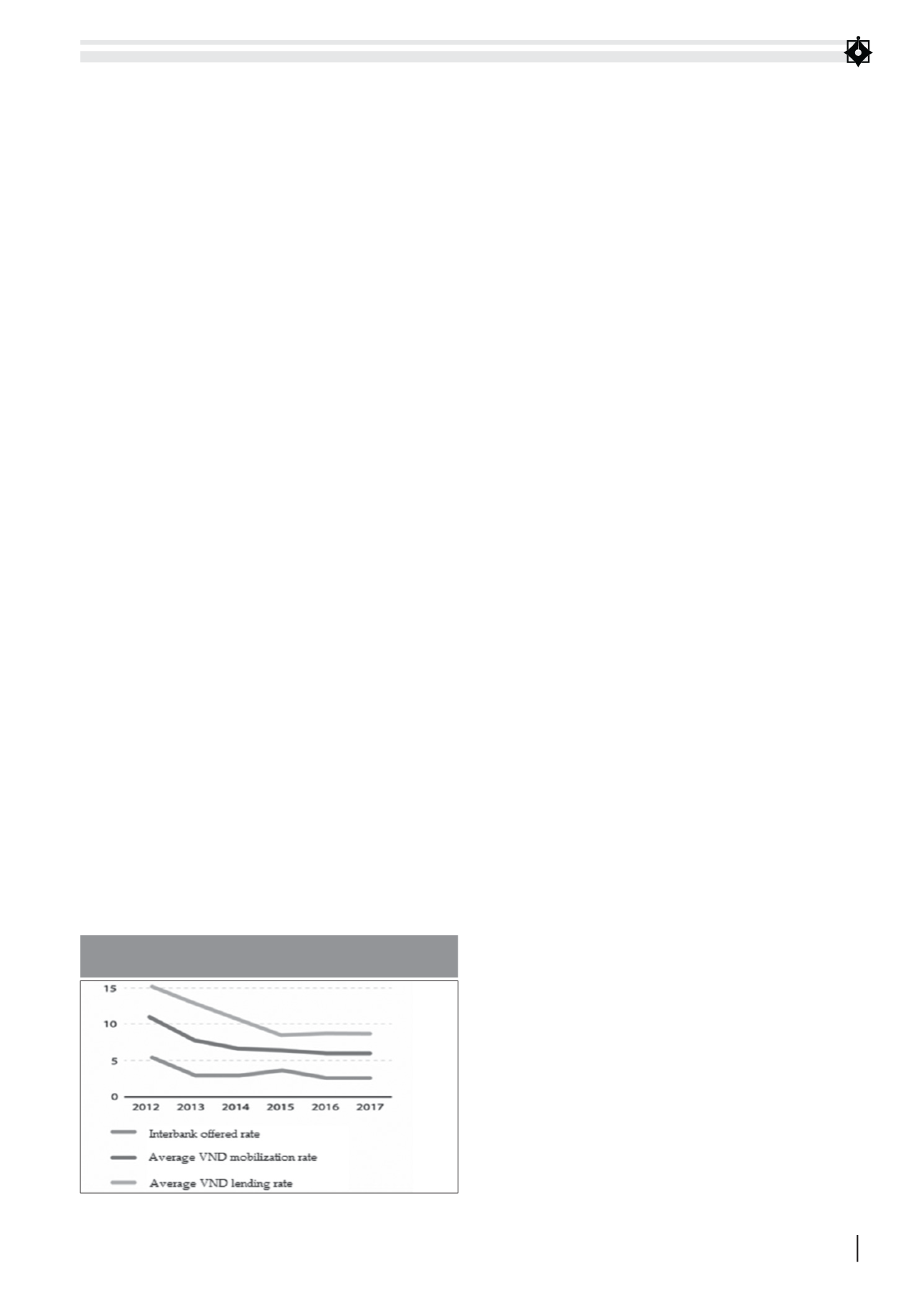

In general, the decrease of lending interest rate

ground, particularly for the priority sector along

with the direction of credit for the Government’s

priority sector showed the results of the efforts

created by monetary policy management in the

mission to support Government to restructure

the economy. Vietnam’s economic and inflation

rate growth happenings from 2001 switched

from the position of “relatively high growth, low

outstanding balance.

In the management of OMO and refinancing,

in 2017, SBV also managed flexibly OMO

and refinancing matching the capital supply

and demand in the market, which supported

producers, enterprises and credit institutions who

were relevant to bank credit for agriculture and

rural; coordinating effectively with intervention

in the foreign exchange and gold market. Beside,

when SBV supported the Ministry of Finance to

issue successfully government bonds with long

terms and low interest rate, it manage the amount

of money supply harmoniously with fiscal policy.

For the work of exchange rate executive

management,SBVcontinuedtomanageinitiatively

exchange rate policy and lead the market in

order to implement the aim of maintaining stable

exchange rate, creating public’s confident on the

value of the domestic money. On 31, Dec. 2015,

SBV issued Decision No. 2730/QD-NHNN about

the announce of the central rate of VND to USD,

the cross rate of VND to other foreign currencies.

The central rate was determined on the basis

of the reference of the weighted average rate in

interbank foreign currency market happenings,

exchange rate in international market of some of

the currency of some countries happenings who

had trade, loan, debt and greater investment

relationship with Vietnam, macro-economic,

money balances and in line with monetary policy

objectives. The new exchange rate management

way allowed the exchange rate to change daily

flexibly according to domestic foreign money

supply and demand happenings, the fluctuation

of international market but still ensured the

management role of SBV according to the

FIGURE 2: INTEREST RATE HAPPENING IN 2012 - 2017 PERIOD

(%)

Source: National Financial Supervision Comission