38

interest market control can lead to the distorted

development of financial market and instability

of the economy.

FromJune, 2002, the SBVapplied the negotiated

rate mechanism and eliminated the limit on

lending rate, allowing commercial bank and their

customer to negotiate lending rate. However, in

2007, SBV applied some administrative measures

in the monetary policy management and this

measures were effective, but they left great

consequence. Thus, the views on the interest

rate liberalization of Vietnam in the coming time

should focus on the following issues:

Firstly,

the time and speed of the interest

rate liberalization: Basically, the interest rate

liberalization should be implemented at the same

time with the restructure of financial system

and the economy. Vietnam is the country which

is experiencing macro and finance imbalances

and having incomplete legal framework and

financial market supervision, so that commercial

banks system which is in restructure process

so the quickly implementation of interest

rate liberalization will cause negative effects.

Moreover, the ineffective operation of SOE

system, the lack of competitiveness of commercial

bank system on products, service (mainly

compete on price through interest rate) and the

lack of transparency on customer’s information

who is lending make it hard to determine the

interest rate consistent with the capital supply

and demand of the market. The process of rapid

or slow interest rate liberalization depends on the

interest rate risk management capacity of banks

and borrowers.

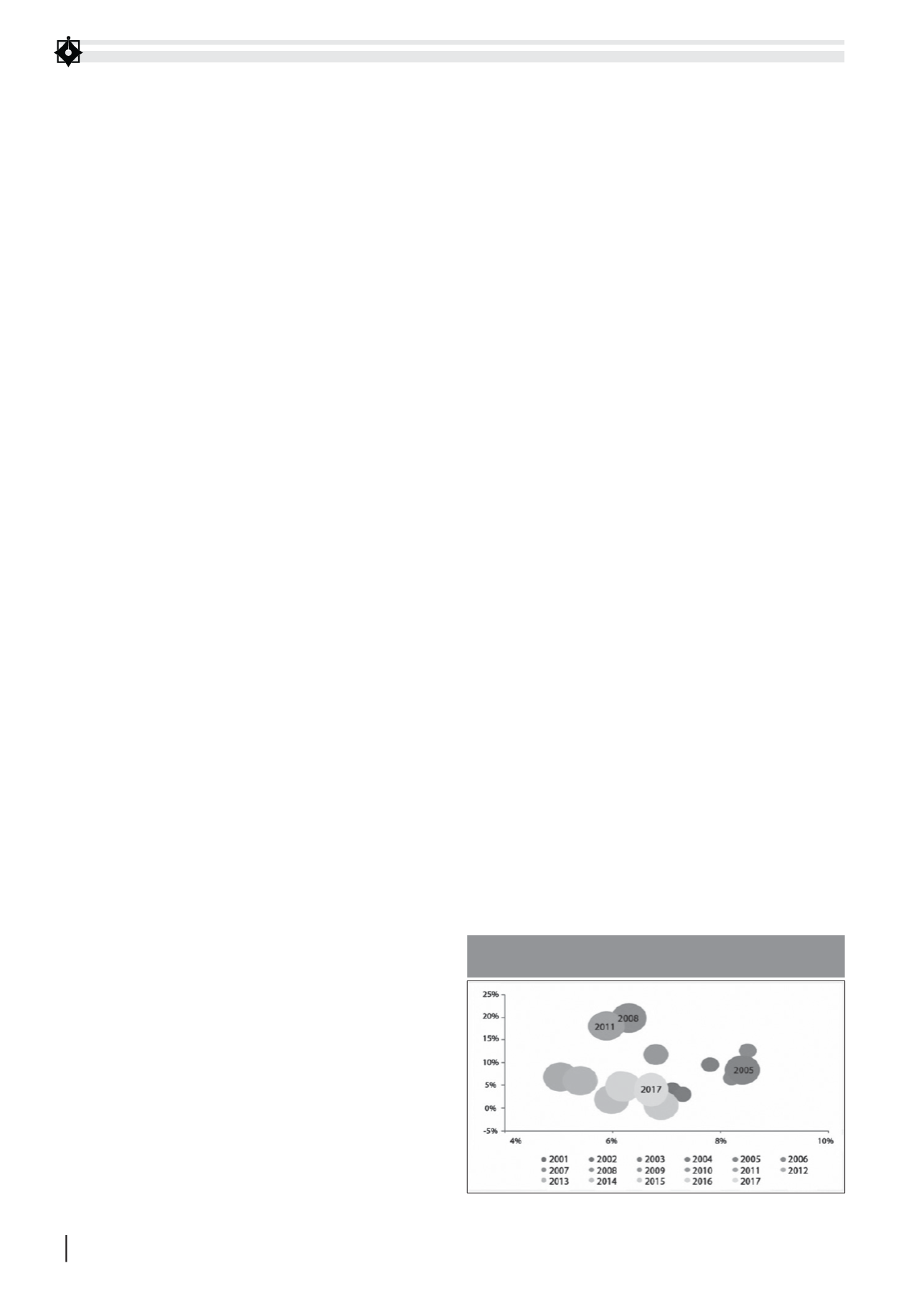

Interest rate liberalization will lead to increase

inflation” to “ high growth, moderate inflation” in

2004-2007 period, to “relatively high growth, high

inflation” in 2008-2011 period, “low growth, low

inflation” in 2012-2014 period and “stable growth

and inflation” in 2015-2015 period. The result

for 3 years (2015-2017) showed that the relative

stable of Vietnam’s economy was the condition

to accumulate the necessary factors for the future

high-growth period.

The central content of monetary policy

management in the coming time

Promoting the achieved results, in the coming

time, monetary policy management should focus

on the 3 following keys issues:

Firstly,

selecting and committing to implement

the priority objectives of monetary policy; The

implementation of a monetary policy having

priority objectives would help the work of

monetary policy management of the SBV

more consistent and also increase the market

orientation. Accordingly, the Government of

Vietnam should complete the legal documents

which clearly regulating and giving tasks for

SBV in order to concentrate on pursuing one

major objective. Maintaining stable price, which

was reflected by low inflation and supporting to

economic development objective should be the

ultimate objective of monetary policy. In addition,

instead of managing a monetary policy which

was closely near a fixed rate, SBV could build and

announce a targeting inflation regional as an basis

for monetary policy management and orient the

inflation expectation of public. If this measure is

implemented, it will create flexibility for the work

of SBV’s management. This is also a preparatory

step for the switch to manage monetary policy in

line with targeting inflation in the future when

having necessary conditions.

Secondly,

limiting administrative measure in

interest rate management, towards using indirect

tools. The application of the administrative

intervention mechanism to interest rate is only

effective in short-term if the level of financial

market development is low, indirect control

tools are not effective and SBV’s financial

market control capacity is limited. In long-term,

as interest rate is a variable which has great

influence to the operation of economy, the direct

FIGURE 3: VIETNAM’S ECONOMIC GROWTH AND INFLATION

RATE SPEED (%)

Source: General Statistic Office