REVIEW

of

FINANCE -

Feb. 2018

43

time, thedraftdecree regulates theestablishment of

specialized information pages on the stock market

at the Stock Exchange, thereby contributing to

increasing transparency of the market, protecting

investors, enabling state management agencies to

effectively supervise and monitor the market, and

support the liquidity of the secondary market of

bonds.

Apart from the regulations on the direction

of enterprises to issue bonds in depository

organizations, the draft decree prescribes the

responsibilities of the depository organizations

in reporting and supplying information on

bond owners, ensuring the scope of issuance of

individual bonds and providing information on

the repayment of principals and interests of bonds

to the Stock Exchange and management agencies.

In addition to the above amendments and

supplements, experts also proposed to disclose

information at the highest level, especially

information on corporate health, the release to

meet the need to meet each other. The drafting

agency should detail the mechanism for sharing

information from the Stock Exchange with

investors when they have the demand.

References:

1. Parliment Enterprise Law;

2. Parliment Law on management and use of state capital invested in

production and business at enterprises;

3. Parliment Securities Law;

4. The Ministry of Finance (2012) Circular No. 211/2012/TT-BTC guiding

the implementation of a number of articles of the Government’s Decree

No. 90/2011 / ND-CP on the issuance of corporate bonds.

of enterprises which are not guaranteed by the

Government on the international market, the

draft decree regulates that the issuance of bonds

in the domestic market, apart from the approval

authority as for ordinary enterprises, the issuance

of bonds must be approved by the representative

office of the owner in accordance with the law on

themobilization of capital of state enterprises (Law

on Management and Use of State capital invested

in production and business in enterprises and

guidelines). For bond issuance in the international

market, the bond issuance plan must be approved

by the General Assembly of Shareholders or the

Board of Directors in accordance with the Charter

of the company. For the plan of issuance of

convertible bonds, the plan to issue bonds with

the warrant must be approved by the General

Assembly of Shareholders. For state-owned

enterprises, in addition to the approval authority

as for ordinary enterprises, the bond issuance

plan must be approved by the representative

office of the owner in accordance with the law on

the mobilization of capital of state enterprises.

Regarding the direction of overcoming the

inadequacies of regulations on information

disclosure and reporting, to enhance the openness

and transparency in the mobilization of bonds to

protect investors, to innovate mechanisms and

methods of information disclosure according

to international practice, the draft decree also

specifies the manner and contents of information

disclosure, including: pre-release information

disclosure, issuance results publicity, periodic

disclosure, extraordinary disclosure. At the same

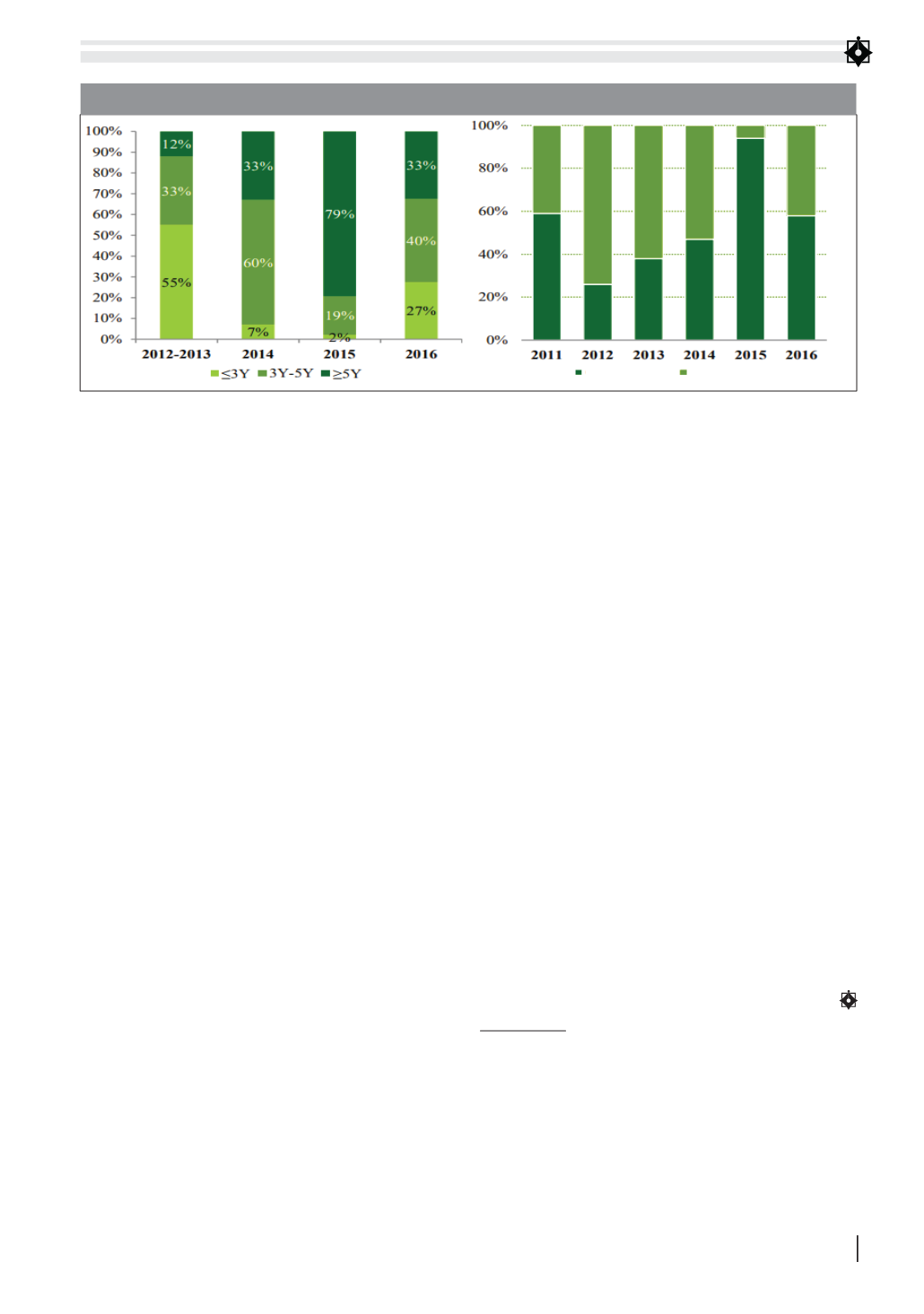

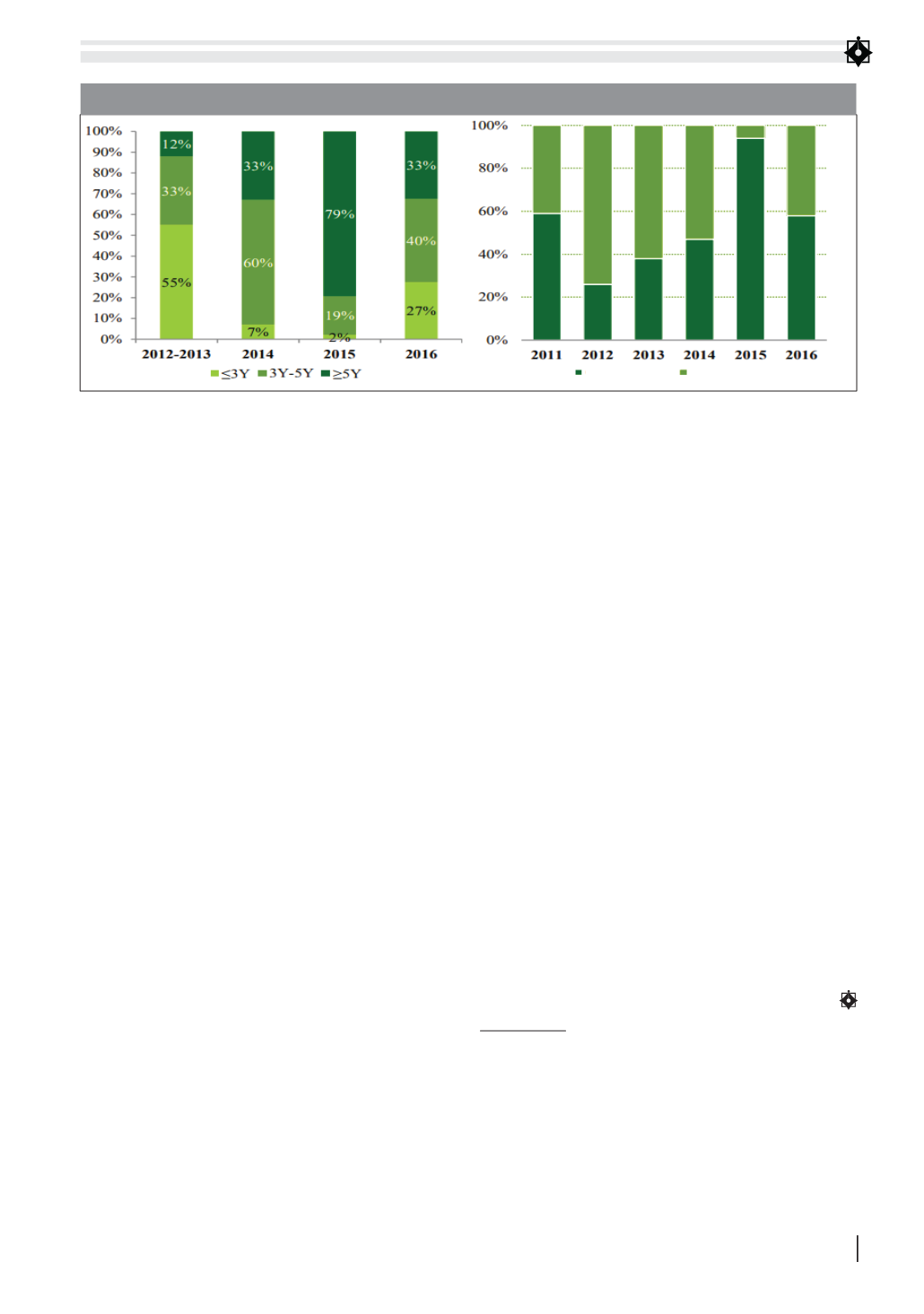

Public

Individual

FIGURE 3: CORPORATE BONDS BY TYPE OF ISSUANCE

Source: VCBS