REVIEW

of

FINANCE -

Feb. 2018

41

The assessment shows that although the

initial results are achieved, the size of the market

of small capitals is still small compared to the

potential of the economy, the market size of

other countries in the region and the demand for

capital mobilization of businesses. By the end of

2016, the outstanding debt of the bond market

was equal to 5.27% of GDP, while the size of the

bank credit channel was equal to 116% of GDP.

Outstanding debt in Vietnam’s securities market

is much lower than the average of about 22% of

GDP of other countries in the region, of which

99% of the volume has been issued in individual

form. The size of the market is small, due to

macroeconomic instability; the financial system

and capital mobilization channel are mainly bank

credit channel; the awareness of bond capital

mobilization is limited; investor base is weak;

the legal framework for issuing corporate bond

issuance is limited.

The direction for the development

of corporate bond market

In order to create confidence for investors to

buy bonds, state management agencies should

continue to have regulations to improve the

quality of bonds as well as the transparency of

information, ensuring the assessment to the full

and accurate information for the investors who,

then can use to assess the true nature of the

business, forecast the company’s ability to pay

interest and repay principal. To do this, specific

provisions on the competent financial statement

audit organization, the early establishment of

enterprise credit rating agency are needed; the

provisions on the agents managing securities

assets for bonds, representatives of bondholders

should be instituted, the market makers for

corporate bonds should be formed.

repay insufficient maturities for three consecutive

years will not be entitled to issue bonds to foreign

investors, except for issuance to selected financial

institutions. This is stipulated in the Enterprise

Law but not regulated in Decree 90/2011/ND-CP,

causing concern for both issuers and investors.

Not to mention, there are no legal regulations on

financial institutions

In addition, bond issuers must meet the

condition that the financial statements are

audited. However, there are businesses being in

the process of investment, so business operation

in the previous year has not yet profitable.

These enterprises have investment and feasible

repayment plans and they also need to mobilize

capital to carry out investment activities. Many

large scale businesses that operate effectively,

but there are other payables, although very

small compared to the size of enterprises, for an

objective reasons having been not paid, leading

to the recognition of an outstanding debt; or

some companies operating under the parent-

subsidiary model, the the financial statements of

the parent company are fully accepted, but the

consolidated statements has the exception or

vice versa. Meanwhile, there are exceptions in

the audit reports that do not seriously affect the

nature of business as well as business operations

of the company.

Besides, the regulations on reporting results

of issuance of corporate bond market to the state

management agencies is not clear. According to

the regulations, after 15 days since the completion

of the issue of bonds, enterprises must report to

the Ministry of Finance and disclose information,

however, the time of completion of the issuance

is not clarified that it is when the investor has

transferred the money to buy bonds or the date

of the issuance of bonds.

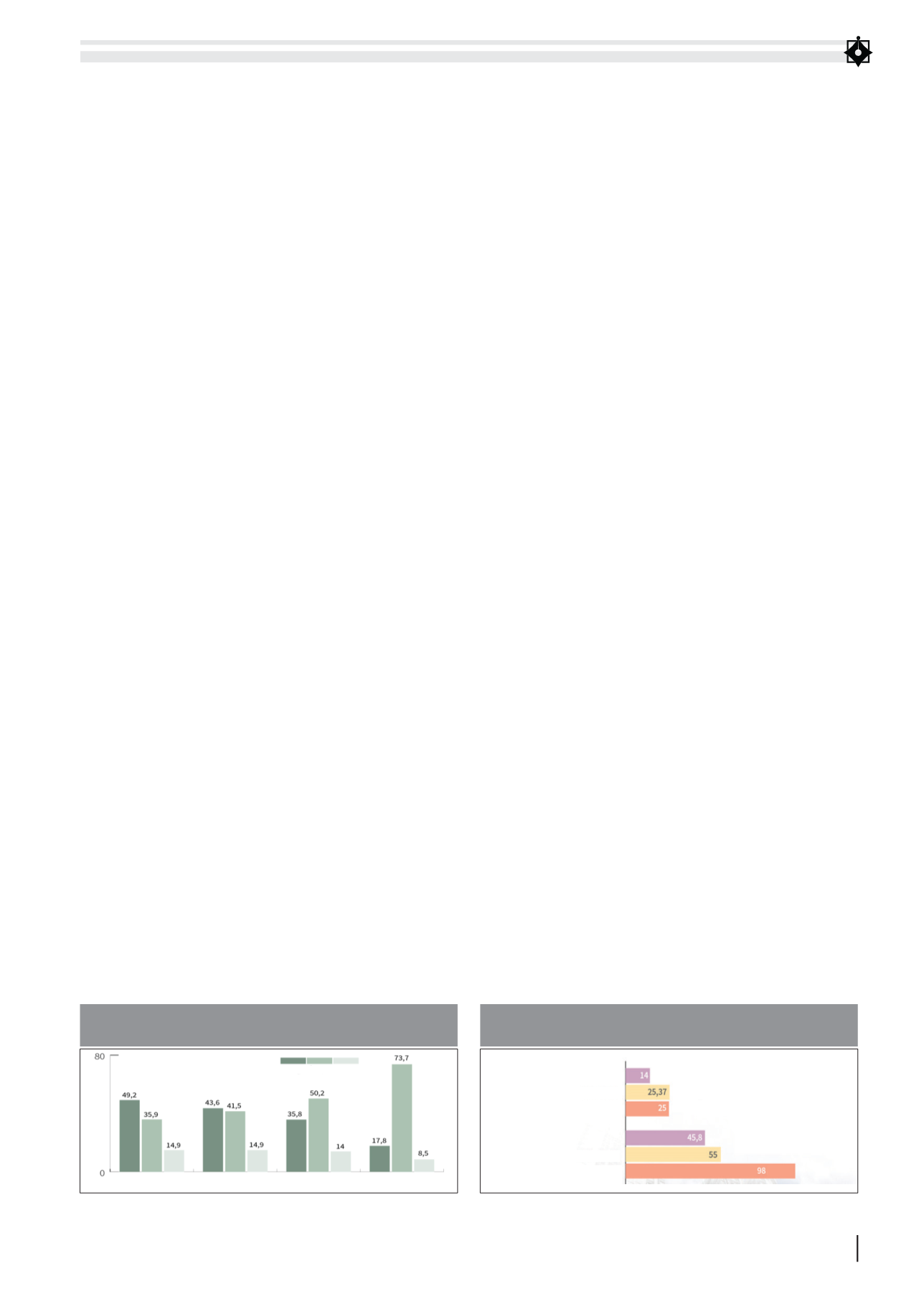

Increase Stable decrease

Productionvolume

Numberoforders

Numberof

exportorders

Numberofemployment

BUSINESS’ RATINGS OF THE EACH INDICATOR

OF Q1 2018 AND Q4 2017

Source: Review of Finance

2016

2017

Q4

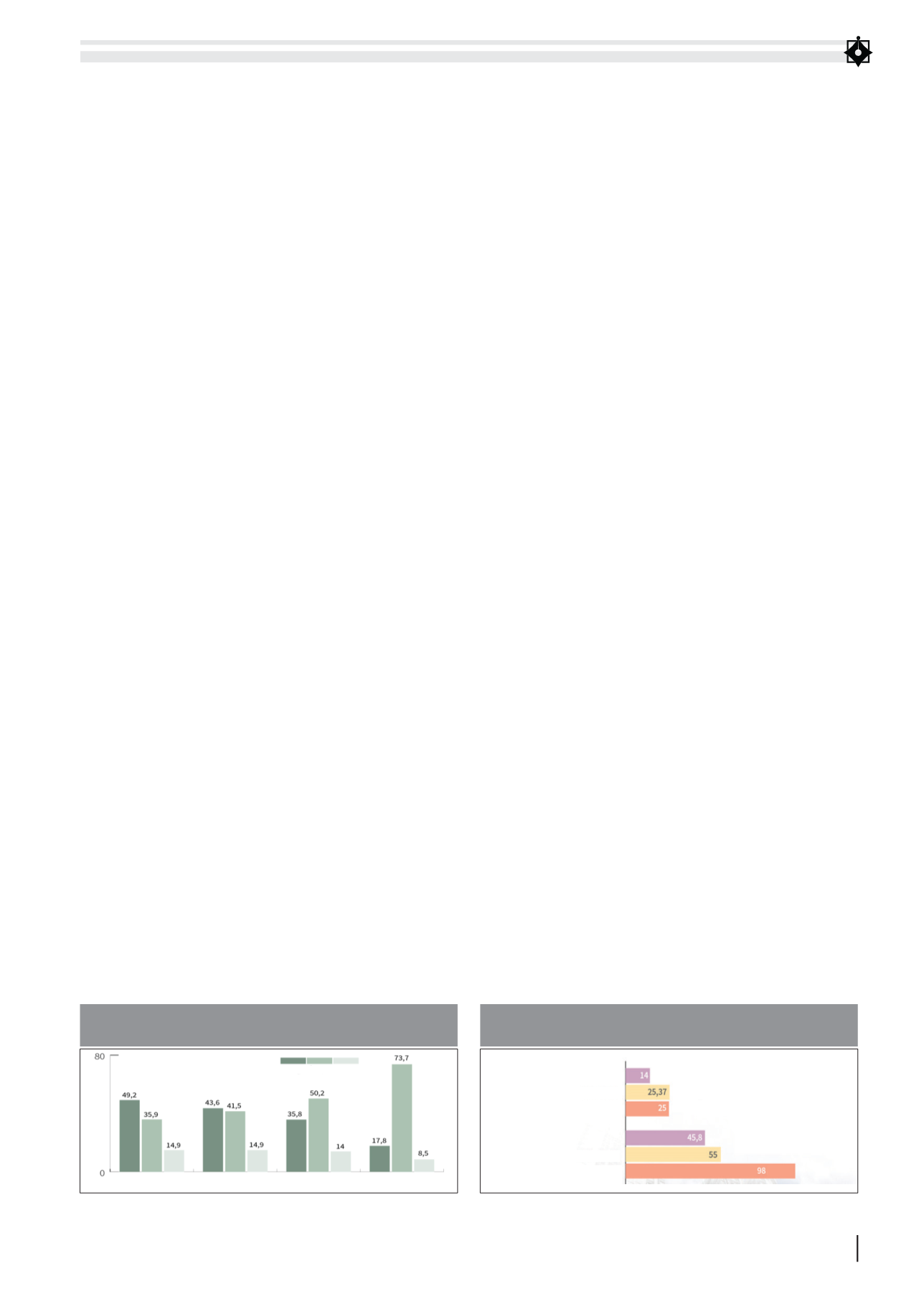

THE RATE OF BUSINESS ONLINE REGISTRATION IS INCREASING

RAPIDLY THANKS TO FAVORABLE POLICIES (%)

Source: Review of Finance