REVIEW

of

FINANCE -

Feb. 2018

39

always the top priority.

Thirdly,

SBV controls credit growth through

the capital needs, capital supply capacity and risk-

taking ability of bank system in short, medium

and long term analysis.

Proposing but can not controlling credit growth

in typical period such as 2006-2008 period and

2010 have left unexpected consequences for bank

system and the economy. If Vietnam hope to have

credit growth towards macro-economic stability

(both ensuring enough capital for investment

and consumption demand and not causing

inflation, bad debt), SBV should determine and

manage credit growth speed for long term period

and annually give the target of credit growth

which is close medium and long term objectives,

combining with the adjustment consistence with

actual conditions.

The level of credit growth shouldbedetermined

appropriately and harmoniously in the

relationship of the overall resource allocation and

associated to the allocation of credit capital with

market signals and limited the intervention of the

Government. The proportion allocation through

market mechanisms must be raised gradually

matching the level of economic development;

determining an appropriate financial structure

has the effect of promoting the economy

sustainability. Therefore, credit capital resource

should also be defined in close and harmonious

relationship with other capital resource such

as State investment capital to development,

foreign investment capital, investment capital

from enterprise owners. In particular SBV should

collaborate tightly with the Ministry of Planning

and Investment, the Ministry of Finance to

determine the scale of credit capital in order to

meet the social-economic objective in the 5-year

plan of social-economic development.

References:

1. The State bank of Vietnam (2017), Directive No.01/CT-NHNN dated 10

Jan 2017;

2. The State bank of Vietnam (2017), Information about the management

of monetary police and banking operation in 2017;

3. The State bank of Vietnam (2017), Decision No.2730/QD-NHNN about

the announce of central interest rate of VND to USD, cross interest rate of

VND to other foreign currencies;

4. Websites: sbv.gov.vn, mof.gov.vn, tapchitaichinh.vn.

completion between commercial banks. Therefore,

the process of interest rate liberalization should

be based on the achieved results of the process

of restructuring commercial bank system as well

as SBV’s regulation capacity to the behaviors of

commercial bank.

Secondly,

the implementation process plays an

important role in deciding the success of interest

rate liberalization.

When the interest rate cap is intervened tightly

and commercial banks can adjust lending rate in

order to attract customer, they will have to: (i)

Implementing improvement operation measures

to minimize cost then reducing lending rate to be

more competitive, (ii) Valuating the loan to the

basis of risk and giving the appropriate offset for

risk; (iii) Developing other competitive factors

on service quality rather than focusing on price

(interest rate).

To limit the situation of unstable capital

mobilization when implementing the elimination

of mobilizing interest rate cap, SBV can prioritize

the implementation of interest rate liberalization

to the deposits of large customers, of SOEs before

applying for the deposit of individuals. Actual

interest rate liberalization in some countries

shows that interest rate liberalization usually

leads to an increase in excessive of credit, affecting

to macro-economic stability. With the context that

Vietnam’s economy is sill in adjustment period,

the good condition to ensure that the interest

rate liberalization does not lead to consequence

as the previous period is moderating economic

growth. However, SBV should perform the role of

monitoring mobilization and credit happenings

in the market and has intervention measures on

time to ensure that the macro stability objective is

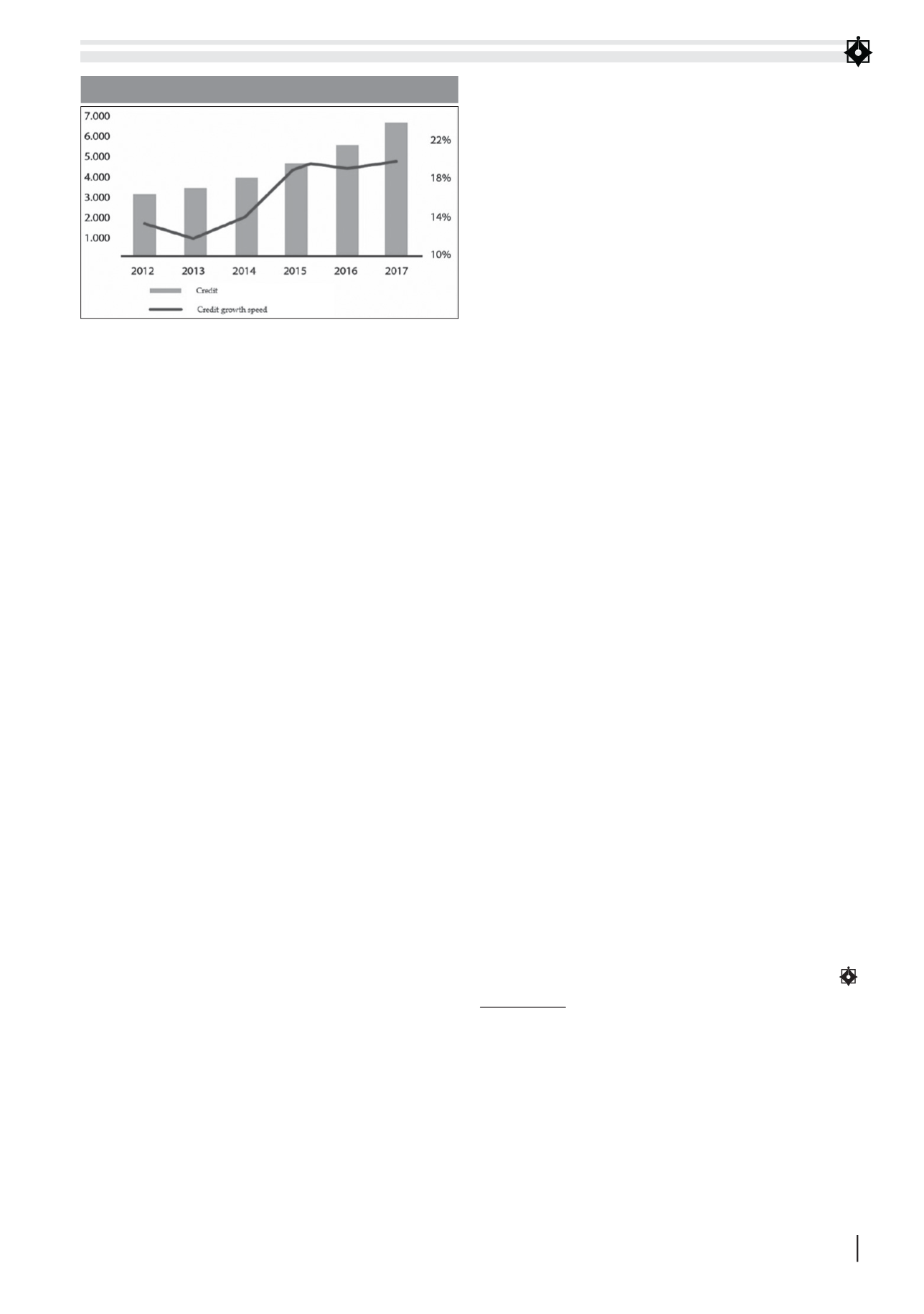

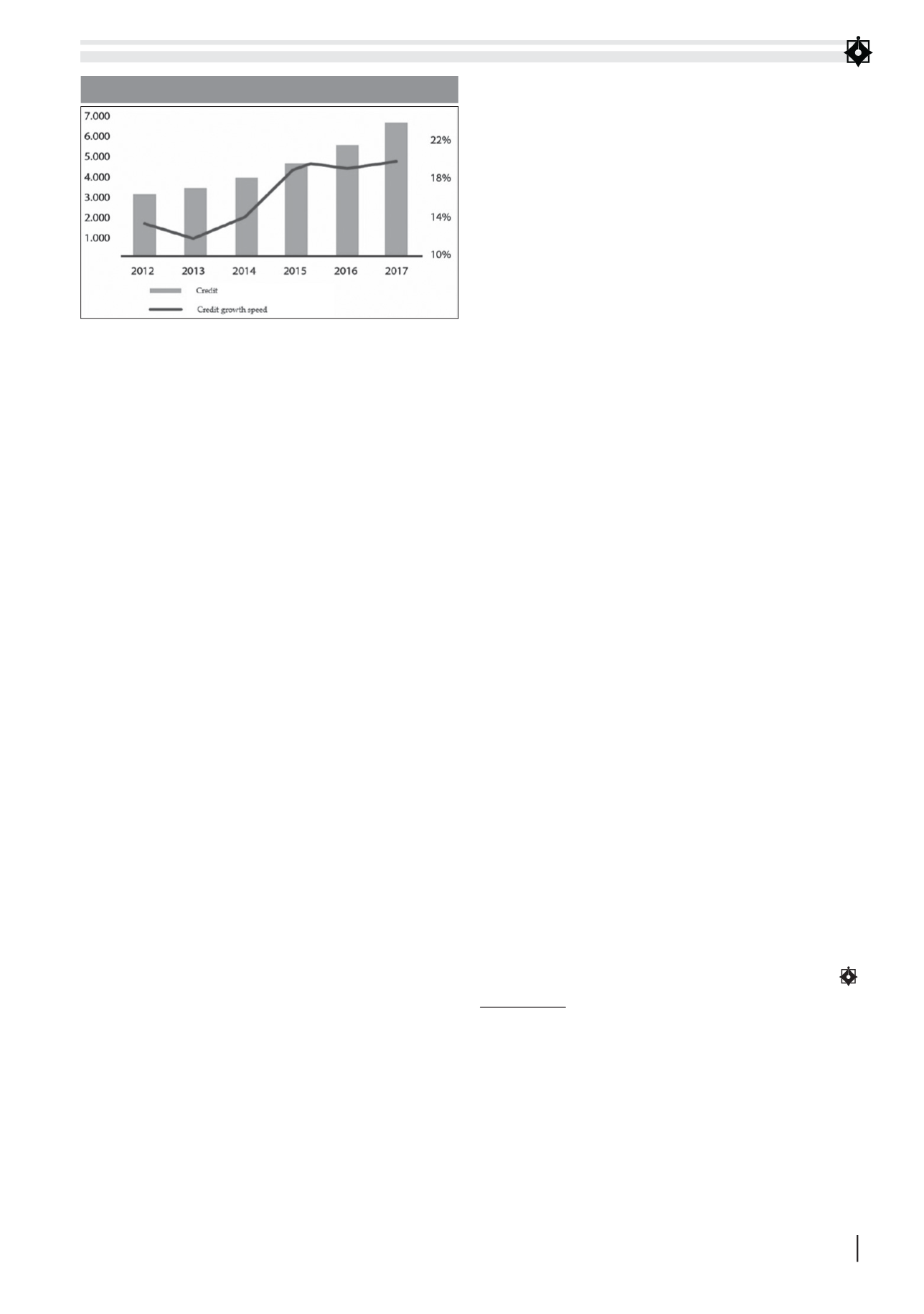

FIGURE 4: CREDIT GROWTH 2012 - 2017 (%)

Source: National Financial Supervision Comission