32

Despite the positive results mentioned

above, the overall size of the government bond

market is still small, the investor structure

needs to continue to improve; liquidity of the

secondary government bond market at some

time is limited; There is no system of market

makers with full rights and obligations under

international practice; Some new products have

been researched but not yet implemented.

Prospects of the government bond market

in 2018

Many forecasts have shown that the

macroeconomics in 2018 will be stable,

forecasting that the economy will continue

to grow. The positive impact of the global

economy and global trade will help promote

domestic exports; Vietnam’s position has been

improved following the success of APEC 2017,

domestic industrial production has grown, and

investment environment has been improved.

For thefinancialmarket, 2018 is anopportunity

to attract foreign investors to invest in the

capital market and bond market. In addition to

the advantages, the domestic financial market

also faces some difficulties and challenges from:

(i) Federal Reserve increases interest rates; (ii)

pressures from exchange rates and inflation.

In this context, in order to develop the

government bond market in 2018 and the

following years, it is necessary to implement the

following contents:

Firstly,

building and developing of the

government bond market is consistent with

the level of economic development, in sync

with other components of the financial market,

Thirdly,

in terms of government debt

portfolio management: The portfolio of

government bonds in 2017 was restructured in

terms of volume issue, term issue and interest

rate issue, contributing to the sustainability of

the government debt portfolio. The domestic

bond market was stable and could mobilize

long- term capital with lower cost. It made

advantageous conditions for the Government to

raise capital from the domestic market cheaper

than from the foreign market. Accordingly,

the Government’s domestic borrowing became

a major source of funds, accounting for 61%

of the total government debt, in line with

the Government’s borrowing and repayment

strategy up to 2020.

Fourthly,

investor structure continued to

improve positively, reflecting an increase

in the holding rate of government bonds of

insurance companies, the social security fund

and investment funds, reducing the holding rate

of commercial banks. The structure of investors

holding government bonds has changed

substantially, the proportion of government

bonds held by commercial banks down from

77% in the early 2016 to 53.7%, increasing the

proportion of long-term investors up from 23%

in the early 2016 to 46.3%.

Fifthly,

government bonds trading on the

secondary market: In 2017, bond trading volume

and Government-guaranteed bonds were VND

8.863 trillion/session, 42% higher than in 2016 in

average. Outright trades were 4,587 billion VND

/ session, 17% higher than 2016 in average. Repos

trading was 4,276 billion VND, 82% higher than

2016 in average.

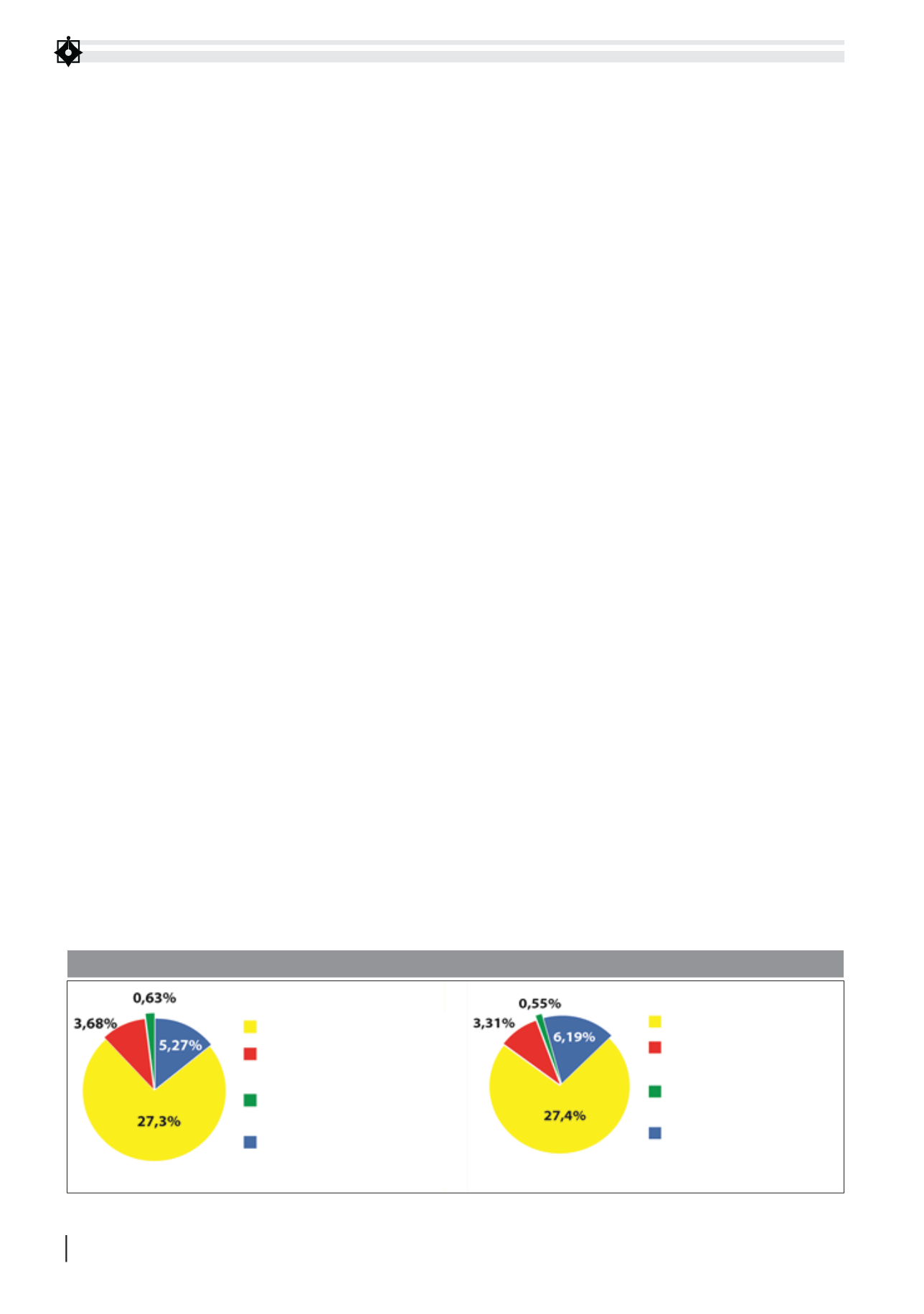

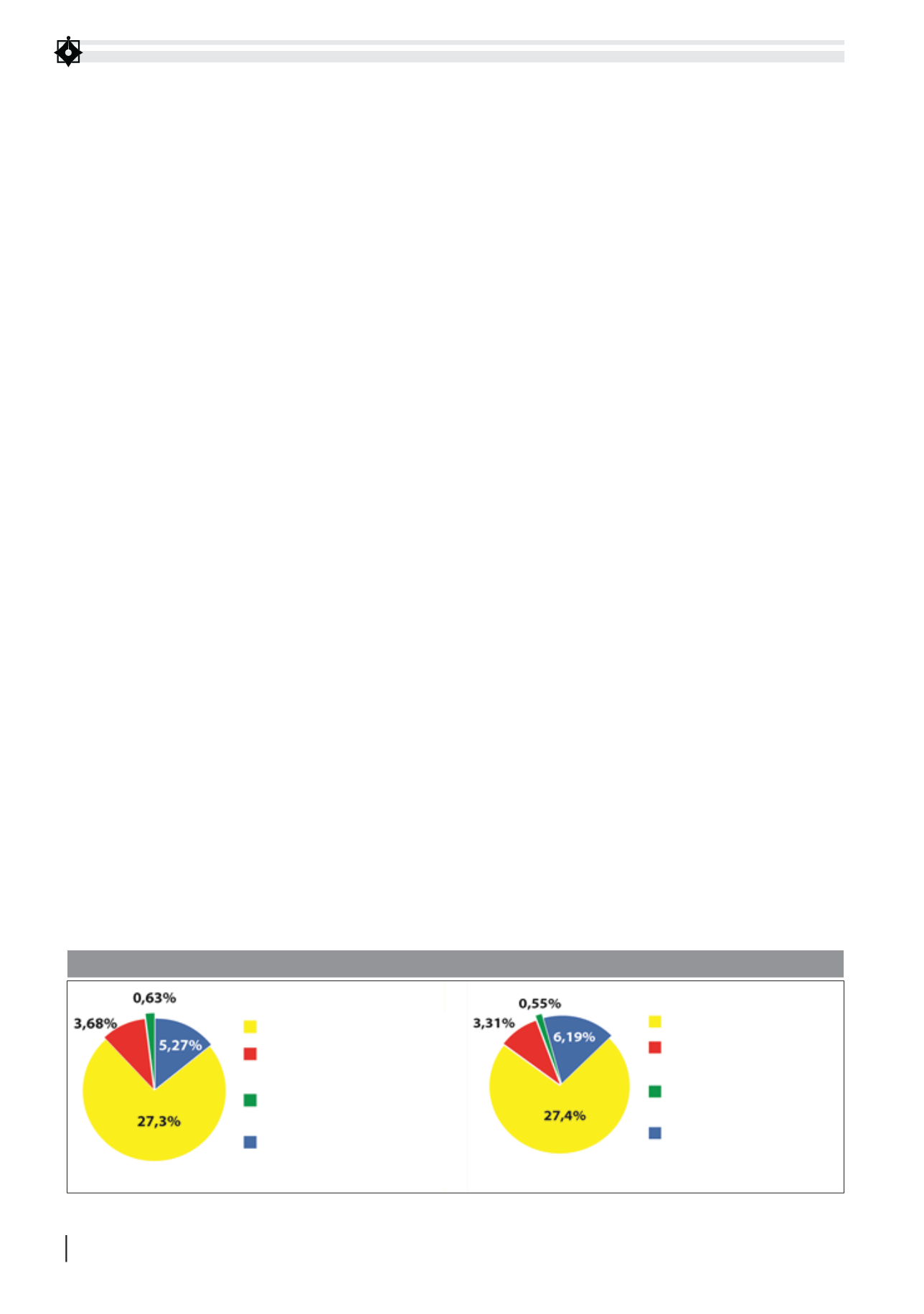

2016

2017

Corporate bonds

Total: 36.9%

Total: 37.45%

Government bonds

Government guaranteed bonds

Local government bonds

Corporate bonds

Government bonds

Government guaranteed

bonds

Local government bonds

FIGURE 1: BONDS MARKET SIZE 2016-2017 (%GDP)

Source: Banking and Finance Department (Ministry of Finance)