REVIEW

of

FINANCE -

Feb. 2018

33

system, the Ministry of Finance will concentrate

on synchronously implementing the solutions

and tasks assigned to it in the Bond Market

Development Roadmap for the 2017-2020

period, vision to 2030. Specifically:

Firstly,

on the policy framework:

It will continue to improve the policy

framework to develop a stable and sustainable

bond market in line with international trends

and practices, creating a link between the capital

market and the monetary and credit markets.

At the same time, to increase the public and

transparency in the market, to create favorable

conditions for the Government to raise capital;

to support the market development according to

international practices; It focuses on developing

a system of market makers with full obligations

and rights to increase liquidity in the market.

Diversifying the term issue of government

bonds, continuing to restructure investors to

develop the market and improve the ability to

mobilize capital for the state budget. Some main

solutions include:

- Building and submitting to the Government

for issuance of a Decree regulating the issuance,

registration, depository, listing, transaction of

the government’s debt instrument to improve the

government’s mobilization mechanism in both

the primary and secondary markets; Establish

a system of market makers in the bond market

with full obligations and powers in accordance

with international practices.

- Developing a circular guiding on issuance

and exchange of Government bonds on the

basis of the Government’s Decree on issuance,

registration, depository, listing and transaction

including the stock market and the money

market- bank credit in line with the guidelines

of the Party, the National Assembly and the

Government.

Secondly,

developing the bond market in both

breadth and depth, ensuring system security,

accessing international practices and standards,

making the market become an important

medium and long-term capital mobilization

channel for the economy.

Thirdly,

trying hard to increase the size and

volume of capital mobilization through the

market to meet the requirements for raising

funds for the state budget in 2018 and the

following years; expanding the system of

investors, especially institutional investors,

creating sustainable demand for the market.

On the basis of evaluating limitations and

shortcomings in the operation of the bond

market; difficulties and challenges in 2018, to

complete the plan to mobilize capital for the

state budget; As well as to develop the bond

market into the standard market of the financial

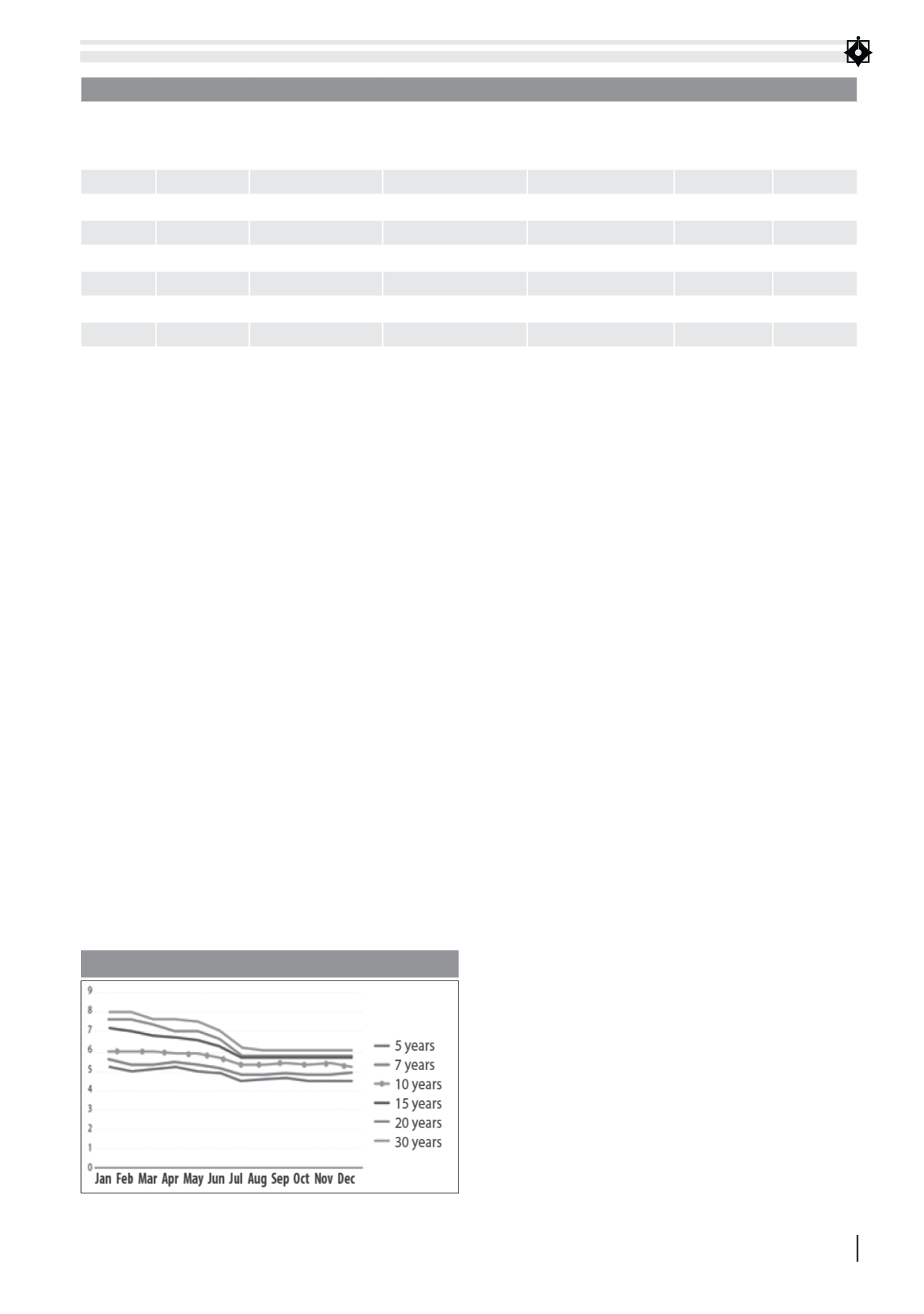

FIGURE 2: GOVERNMENT BONDS INTEREST RATES 2017 (%)

Source: Banking and Finance Department (Ministry of Finance)

Table 1: BIDDING FOR GOVERNMENT BONDS IN THE PRESIDENTIAL MARKET

Bond

term

Number

of auction

sessions

Value

Registered value

Winning bid

Bid interest

rate

(%/year)

Winning

yield

(%/year)

5 years

62

73.650.000.000.000 222.125.000.000.000 44.044.000.000.000

4,2-6,2

4,48-5,5

7 years

38

46.350.000.000.000 117.211.000.000.000 34.664.000.000.000

4,75-6,1

4,8-5,55

10 years

51

45.938.000.000.000 104.977.000.000.000 35.454.000.000.000

5,1-7,02

5,28-6,8

15 years

42

40.873.000.000.000 98.911.800.000.000 33.416.300.000.000

5,5-8,0

5,75-7,7

20 years

20

22.850.000.000.000 61.618.264.000.000 18.899.000.000.000

5,8-8,2

5,82-7,7

30 years

27

35.200.000.000.000 92.147.877.300.000 27.838.359.300.000

6,1-8,4

6,1-7,98

Total

240

264.861.000.000.000 696.990.941.300.000 194.315.659.3.000

Source: HNX