34

bonds, focusing on the issuance of long-term

Government bonds to meet the demand for

government bonds for insurance companies,

the social insurance fund and investment

funds.

- Performing the issue of additional bonds,

exchangeable bond to form the standard bond

codes, contributing to the sustainability of the

government bond portfolio.

References:

1. The Government (2017), Decision No. 1191/QD-TTg of August 14,

2017 approving the Bond Market Development Roadmap for the

2017-2020 period, vision to 2030

2. The Government (2017), Scheme on development of the bond market

for the 2017-2020 period, vision to 2020;

3. The National Financial Supervisory Commission, Report on

“Vietnam’s Financial Market Overview in 2017”;

4. Thematic Report on “Results of Capital Market Development in

2017 - Orientations and Solutions for Development in 2018” at the

Financial Sector Review Conference in 2017;

5. The Ministry of Finance, Bond market data from Department of

Finance - Banking.

of debt instruments.

Secondly, on product development:

- Diversifying term issue of government

bonds, issuing Government bonds regularly at

standard terms to form a benchmark interest

rate curve in the bond market as a reference for

the money market and financial system.

- Researching on the pilot issuance of floating-

rate government bonds when the market needs

to increase the ability to raise capital for the

budget.

Thirdly,

on market management:

- Organizing regular consultations with the

State bank of Vietnam and market participants

to manage the government bond market in terms

of volume, maturity, and interest rates suitably;

Announce issuance plans and detailed schedules

for market participants to participate actively

in the government bond market. Strengthen

policy dialogue with market participants to

catch up with difficulties and problems and take

measures to handle them.

- Diversifying the term issue of Government

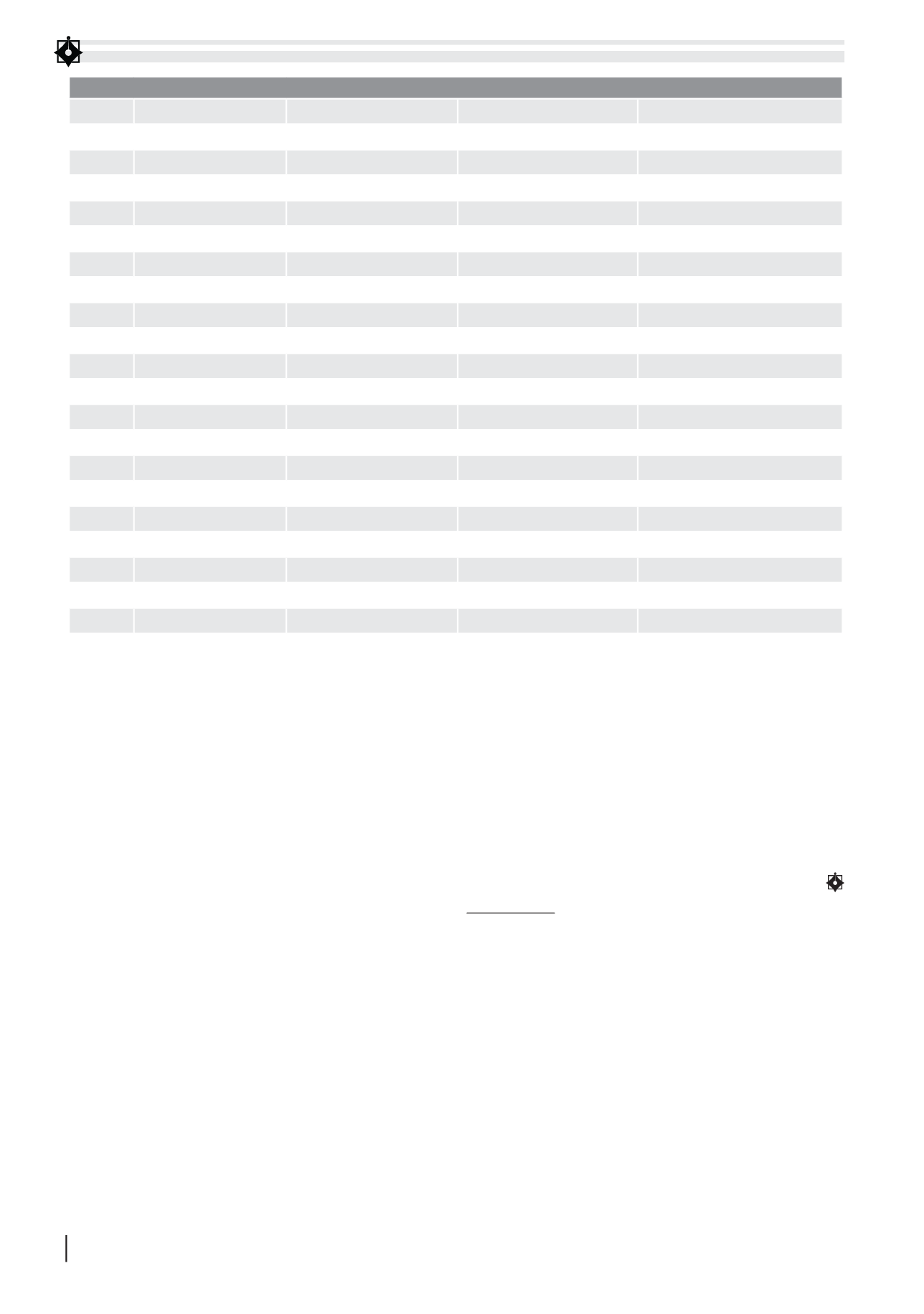

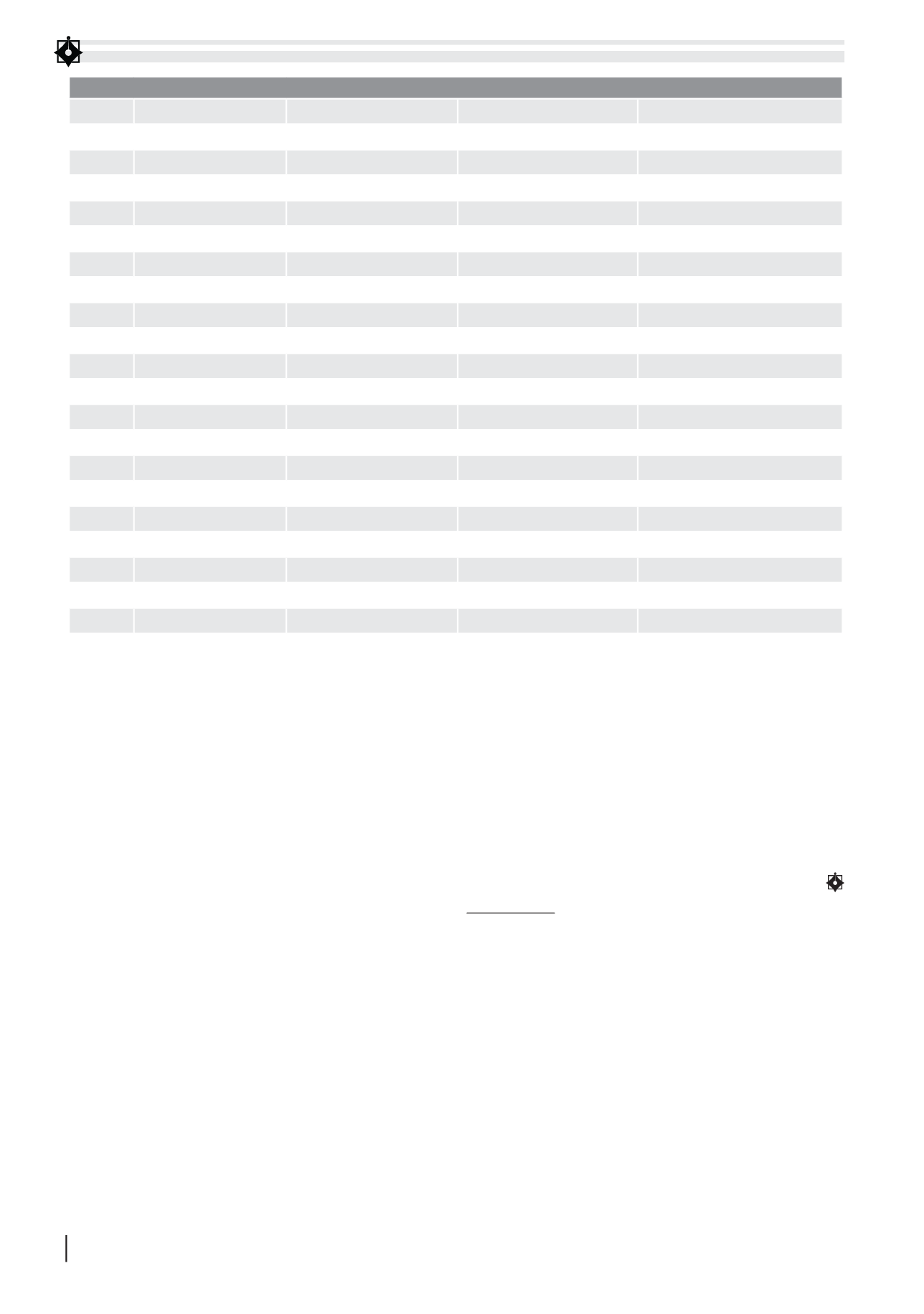

GOVERNMENT BOND MARKET IN THE SECONDDARY MARKET

Number

Remaining term Transaction volume

Transaction value

Yield zone

1

1 month

16.340.000

1.791.795.240.000

4,9025 – YTM* – 4,9025

2

2 months

9.900.000

1.045.877.800.000

1,9032 – YTM – 3,9979

3

6 months

7.200.000

778.517.400.000

4,3273 – YTM – 4,3273

4

9 months

34.900.000

3.648.424.000.000

3,4004 –YTM – 4,9567

5

12 months

683.927.694

73.176.682.841.845

3,0997 – YTM – 6,3391

6

2 years

1.459.274.878

154.450.538.839.294

3,3401 – YTM – 6,5252

7

3 years

1.477.444.258

162.057.177.666.504

3,5198 – YTM – 6,6693

8

3 - 5 years

1.871.376.050

202.157.038.308.500

3,7 – YTM –7,1285

9

5 years

929.822.500

96.598.506.035.000

4,2001 – YTM –6,138

10

5 - 7 years

303.010.921

33.735.866.062.137

4,3 – YTM – 8,4999

11

7 years

636.320.610

68.930.424.799.250

4,38 – YTM – 7,3077

12

7 - 10 years

147.462.152

15.761.447.610.762

4,9999 – YTM – 7,3256

13

10 years

538.865.962

47.807.607.243.845

5,05 – YTM – 6,8892

14

10 - 15 years

724.209.352

83.981.516.793.784

5,25 – YTM – 8,3095

15

15 years

556.180.000

59.593.277.360.000

5,5 – YTM – 9,5006

16

15 - 20 years

123.270.000

14.392.793.660.000

5,8165 – YTM – 7,8588

17

20 years

232.489.000

25.531.661.765.000

5,9 – YTM – 7,7524

18

25 - 30 years

205.052.200

24.392.215.532.400

6,27 – YTM – 8,0437

19

30 years

560.950.282

63.545.017.660.701

6,1 – YTM – 9,6231

Total

10.517.995.859

1.133.376.386.619.020

*YTM: Yield to maturity

Source: HNX