28

quality of budgeting in response to disaster risks.

Developing a quantitative tools for assessing the

disaster risks and developing a set of databases

on disaster risks (particularly on public assets)

will help to evaluate occurence frequency of

natural disasters and loss suffering in order to

have a financial and insurance plan in responding

to natural disaster risk.

- Secondly,

developing a strategy on natural

disaster risk financing and improving the legal

framework on natural disaster risk management

in order to enhance implementation of policies

regulating disaster risk financing. An effective

strategy on natural disaster risk financing and

insurance (including solutions for public asset

management) will provide better support for the

timely recovery and restruction after occurence

of natual disasters and make an important

contribution to the financial system stability in

the region.

- Thirdly,

diversifying the financial resources

in disaster risk management, including the state

budget, insurance, special financial funds and

other resources. In addition, it is important to set

priorities of the financial resources to be used for

each type of disaster risk.

- Fourthly,

developing the disaster risk insurance

market in order to create active financial sources

which helps to lessen burden on government

budget and transfer risks into markets. Along with

enhancing infrastructure of and supervising over the

insurance market, it requires a tight collaboration

between the state sector and private sector.

-

Fifthly,

strengthening cooperation on

information and experiences sharing among

APEC member economies and international

organizations (WB, OECD, etc.) in developing

the legal framework and strategies on financial

management for natual disaster risks as

well as developing database for disaster risk

management.

References:

1. Bao Viet Holdings (2016), Sustainable Development Report;

2. APEC Finance and Central Bank Deputies Meeting (2017), Documents of

seminar on Disaster risk financing and insurance policies;

3. Ministry of Finance (2017), The APEC Vietnam 2017 Joint Finance

Ministerial Statement;

4. Source from websites: mof.gov.vn, apec.mof.gov.vn, sbv.gov.vn...

mentioned above, we recognized the support

of international organizations, especially WB

and OECD. Accordingly, WB supported the

development of database on public assets and

disaster risk insurance and specific outputs

included: (i) A research report on methodology

for the development of database on public assets

and disaster risk insurance; (ii) A research report

on sound practices on the policy development of

disaster risk financing management for public

assets; and supports the development of a portal

providing knowledge on disaster risk financing.

Furthermore, WB and OECD supported to do

a research on contingent liability management

relevant to natural disasters in public finance

framework. These activities’ outcomesare also

presented at the APEC Finance Ministers Meeting

in October, 2017.

Recommendations

Based on the achievements and progress of

implementing the Disaster Risk Financing and

Insurance Initiative in 2017 and reviewing the

experiences of the APEC member economies, a

number of solutions for disaster risk financing

and insurance at the meetings, conferences and

the seminars in process of the APEC Finance

Ministers’ Meeting, solutions on disaster risk

financing and insurance are recommended to be

focused on the followings:

- Firstly,

improving the capacity of natural

disaster forecasting as a basis for enhancing the

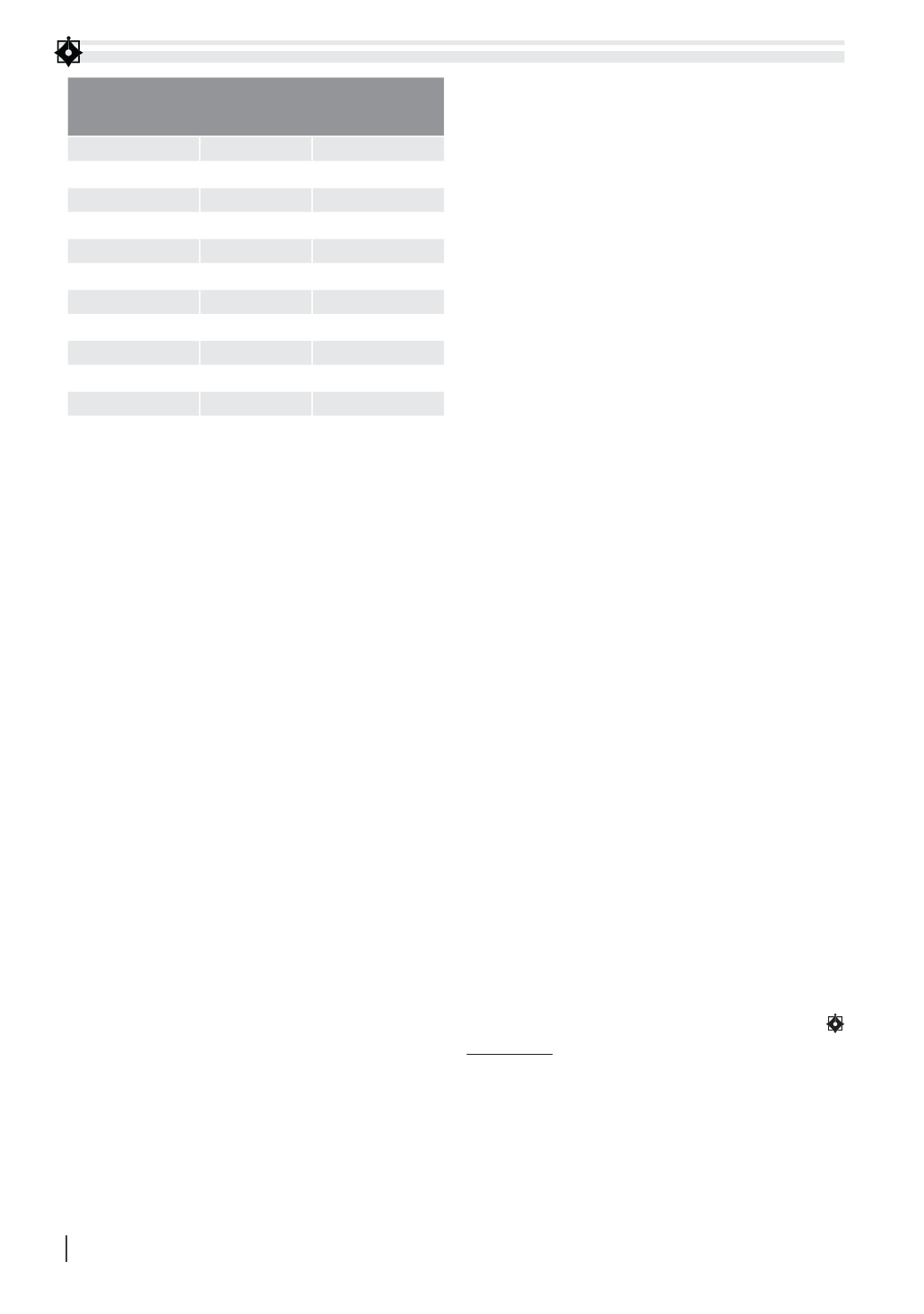

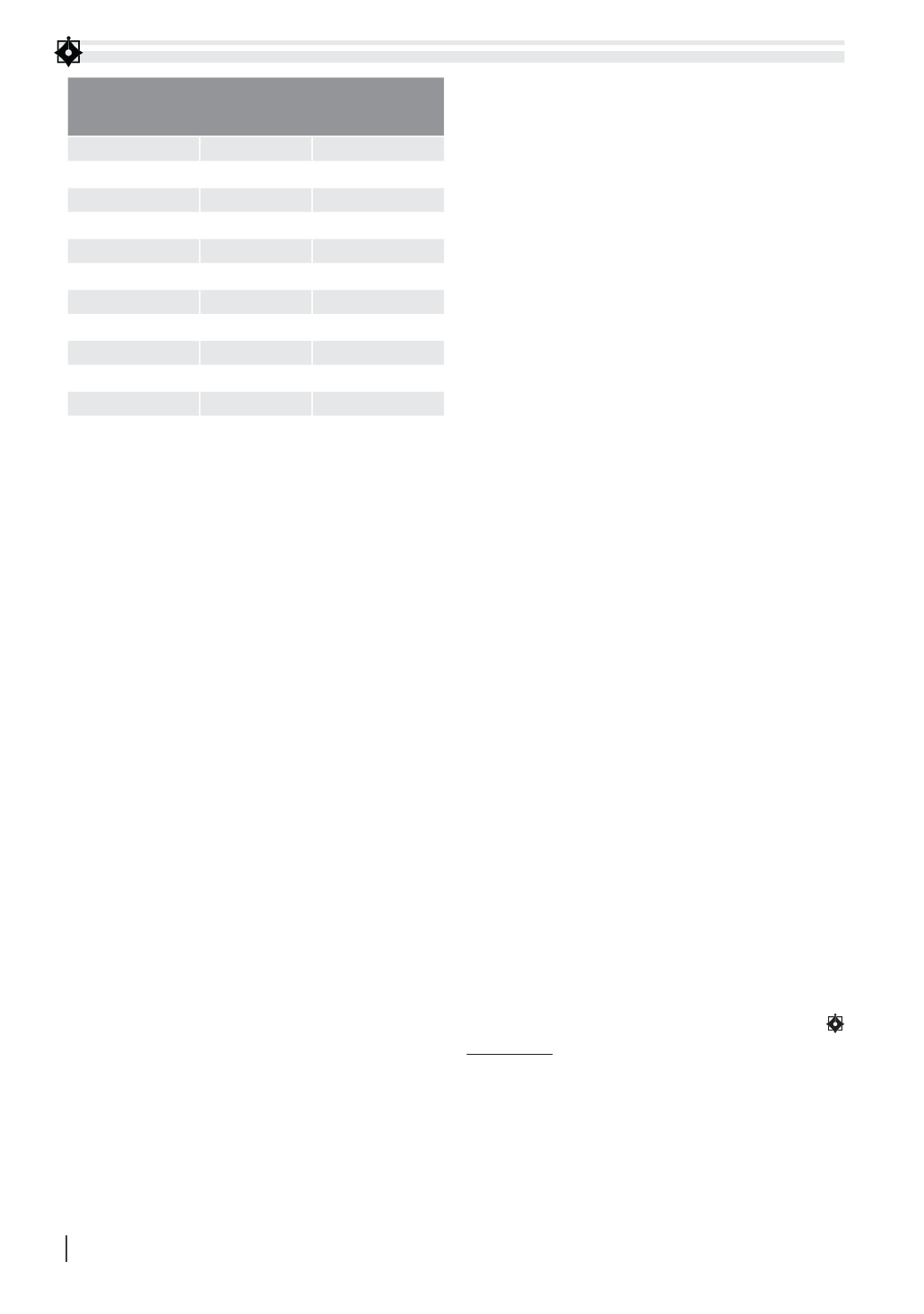

TABLE 2: TOP NATURAL DISASTERS IN VIETNAM FOR THE

PERIOD 1900 TO 2014 SORTED BY NUMBERS OF TOTAL

AFFECTED PEOPLE

Disaster

Date

No Total Affected

Storm

15/Sep/1980

9027174

Storm

23/Jul/1980

6624710

Flood

Jul-00

5000004

Storm

Oct-89

4635762

Flood

Aug-78

4079000

Flood

25/Oct/1999

3504412

Drought

Dec-97

3000000

Flood

7/Sep/1985

2800000

Storm

6/Sep/1986

2502502

Storm

28/Sep/2009

2477315

Source: