32

Law on Securities in 2019. Together with the

Law on Enterprises 2015 and related laws, the

revised Law on Securities will create conditions

for enterprises to raise capital by issuing shares

and bonds, creating a legal framework for new

products on the market, improving quality and

efficiency of the inspection and supervision

over the securities market of the management

agencies, ensuring the market development in

a sustainable and transparent manner.

The new legal framework, together with a

new schyncronized system of technology in

two stock exchanges and the Vietnam Securities

Depository Center are expected to be applied

from 2019, along with recent innovation such as

the transfer of Government bond transactions

from commercial banks to the State Bank,

providing online transaction codes to foreign

investors, removing restrictions on ownership

of investors in the common business sector,

strengthening coporate governance according

to the Government Decree 71/2017/ND-CP

dated June 6th 2017 will create a more open

and transparent investment environment, and

more equitable to both domestic and foreign

investors.

Forthly,

the solutions to attract investment,

upgrade the stock market of Vietnam from

the marginal market class to emerging market

Paper Corporation, Mobifone, Vietnam Coffee

Corporation, Telecommunications Corporation,

Chemical Corporation, Coal and Mineral

Corporation and many other big companies

in the sectors of jewelry, real estate, electricity

generation... From now to the end of the year,

the equitization will be accelerated in some

enterprises such as PV Oil, PV Power, Vietnam

Tobacco Corporation, the sale of shares will

be strengthened in Sabeco and Vinamilk. Thus,

in the next 1-2 years, hundreds of SOEs will

be equitized and listed on the stock market.

The stock market will grow in size and create

great opportunities for domestic and foreign

investors.

Secondly,

many new products introducing

to the market will increase the investment

opportunities and attractiveness. The warranty

certificate is expected to be available at the end

of this year or in early 2018. In the derivative

market, in addition to the VN30 futures

contracts, future contracts of Government

bonds are expected to be traded in 2018. Other

derivative products are being researched to put

into place in 2019-2020 to meet the needs of

investment, preventing risks for investors.

Thirdly,

the legal framework for capital

market will be finalized in the coming time; the

Ministry of Finance will complete the revised

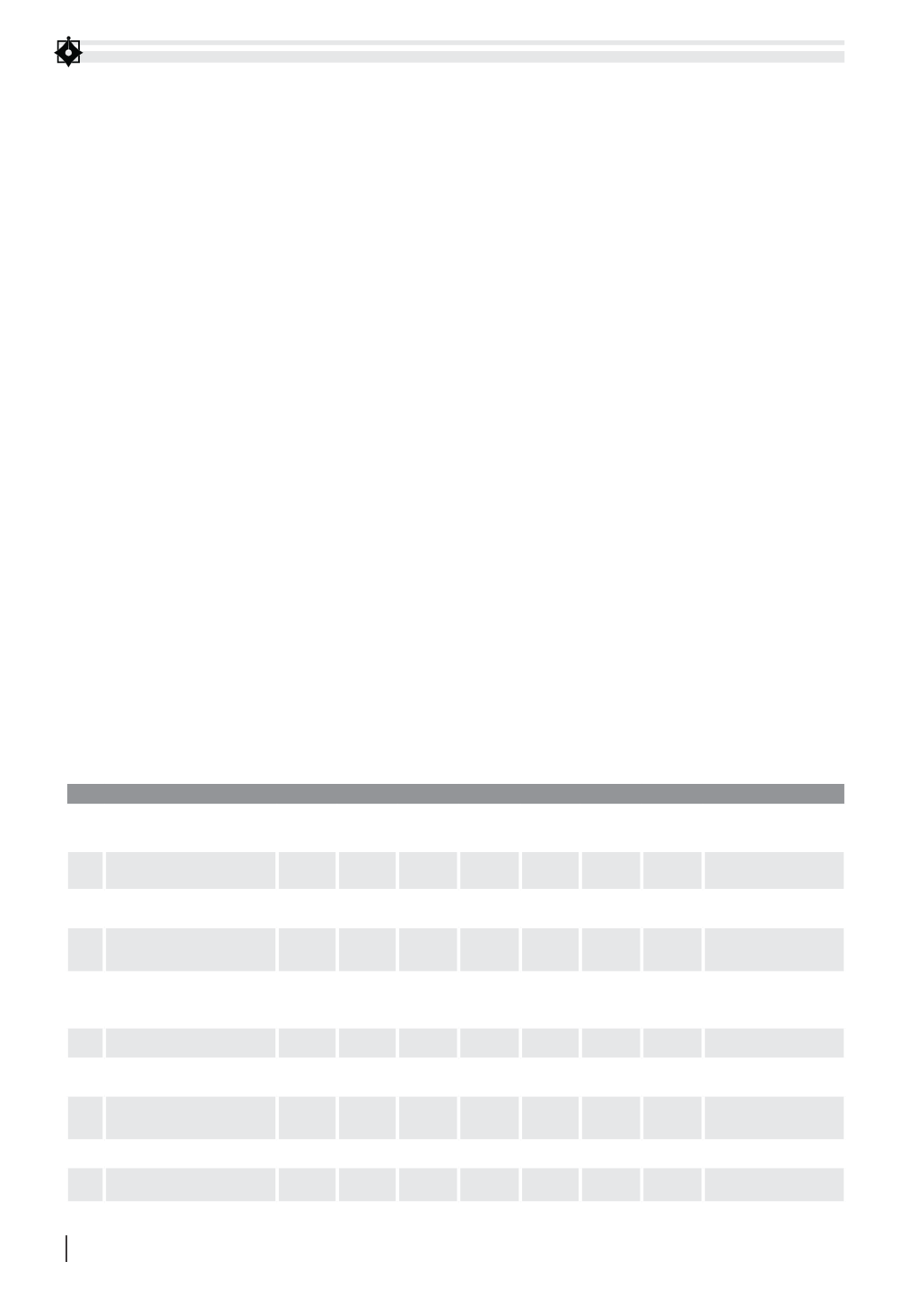

TABLE 3: VIETNAM’S BOND MARKET SIZE/SCALE IN THE PERIOD OF 2010-2017 (%)

No.

Items (% GDP)

2010 2011 2012 2013 2014 2015 2016 As of Nov. of 2017

(% GDP of 2016)

I

Issuance revenues

7,28 4,96 7,01

7,35 7,70 8,47

9,60

6,70

1

Government Bonds

3,45 3,17 4,36

4,90 6,24 6,11

6,69

4,42

2

Government

guaranteed Bonds

2,31 1,79 1,62

1,28 0,70 1,14

0,74

0,49

3 Local government bonds

0,00 0,00 0,15

0,23 2,42 0,20

0,08

0,00

4

Corporate bonds

1,51 0,28 0,88

0,93 0,58 1,02

2,09

1,79

II

Outstanding debt

20,60 17,96 16,59 19,00 21,73 24,14 36,9

36,49

1

Government Bonds

8,09 8,16 9,52 11,26 13,84 16,19 27,33

27,13

2

Government

guaranteed Bonds

5,57 5,45 4,85

4,63 4,30 3,85

3,68

3,25

3 Local government bonds

0,37 0,24 0,26

0,46 0,60 0,69

0,63

0,49

4

Corporate bonds

6,11 4,11 1,95

2,65 2,50 3,40

5,27

5,61

Source: Department of Finance for Banks and Financial Institutions, Ministry of Finance