34

depositary and listing of bonds and

establishment of a system for disclosure on

issuance and trading of corporate bonds.

In addition to these measures, renewed

coordination between fiscal and monetary

policies is needed to balance and link the

operations among the monetary, credit and

bond markets; surveillance and monitoring of

bond and capital markets will be enhanced to

ensure the safe, transparent operation of the

bond market to protect market stakeholders’

legitimate rights.

In the future, with the targets, orientations

and the implementation of concrete measures

in the Decision No. 1191/QĐ-TTg, Vietnam

bond market will develop strongly not only

in size, but also in liquidity and the level of

transparency and disclosure, presenting an

attractive profitable opportunity for domestic

and foreign investors.

References:

1. Goverment (2015), Decree No. 60/2015/ND-CP dated June 26th

2015 amending, supplementing several articles of the Government’s

Decree No. 58/2012/NĐ-CP dated July 20th 2012 on providing

specific provisions for the implementation of certain articles of the

law on securities and the law on amending and supplementing a

number of articles of The Law on Securities;

2. Ministry of Finance (2015), Circular No. 123/2015/TT-BTC dated

August 19th 2015 providing guidance on foreign investment

activities on Vietnam’s securities market;

3. The State Securities Committee (2017); The report of Vietnam’s

securities market;

4. Source fromwebsites: mof.gov.vn, ssc.gov.vn, tinnhanhchungkhoan.

vn, tapchitaichinh.vn...

balance of corporate bonds achieved 7% GDP in

2020 and about 20% GDP in 2030.

In order to realize the above-mentioned

targets, followingmeasureswill be implemented:

Firstly,

the issuance of bonds will continue to

be through open bidding with issuance schedule

made public with introduction of new bond

products in the market. The bond derivative

market will be established and operational and

the Government bond profile will be further

restructured to ensure sustainability. With

regards to corporate bond, new regulations

on corporate bond issuance will be issued to

facilitate fund raising by corporate sector while

ensure the transparency and public disclosure

of issuances to protect investors’ benefit.

Secondly,

establishment of market maker

system and secondary market for corporate

bonds; a centralized system of public disclosure

for corporate bond will be stabilized.

Thirdly,

the following structures will be

implemented, i.e.: (i) Establishment and

development of voluntary Pension funds;

(ii) Promotion of the professional investment

operations by the Social Security; (iii) Review

and revision of investment policies of major

investors (commercial banks, investment funds,

insurance companies); (iv) Revision and addition

to investment incentives such as fees and taxes,

investment processes and procedures to facilitate

investor participation in the bond market.

Fourthly,

further restructuring of securities

companies to set up an appropriate system of

healthy financial intermediaries; modernization

of the IT system for bond auction, registration,

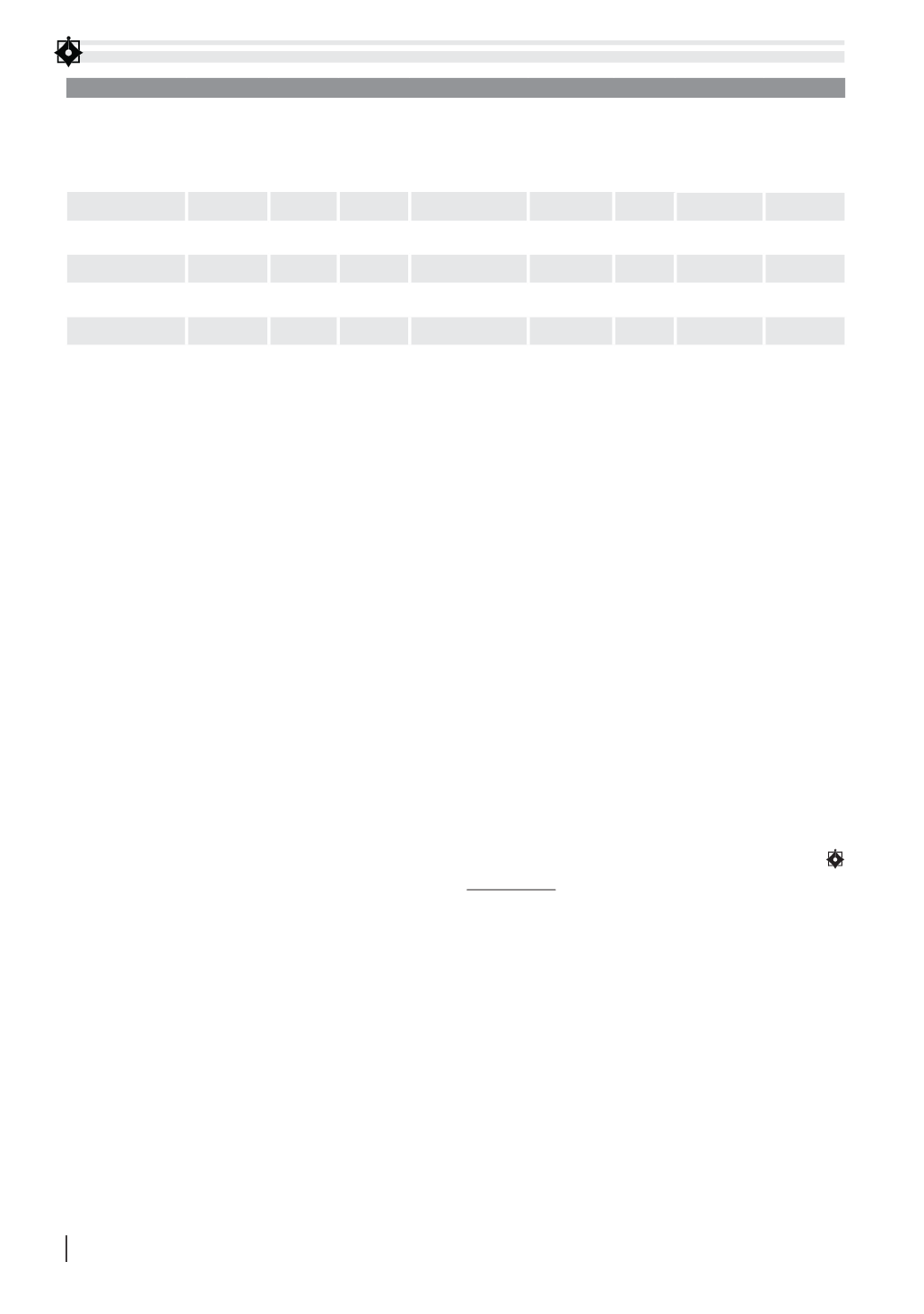

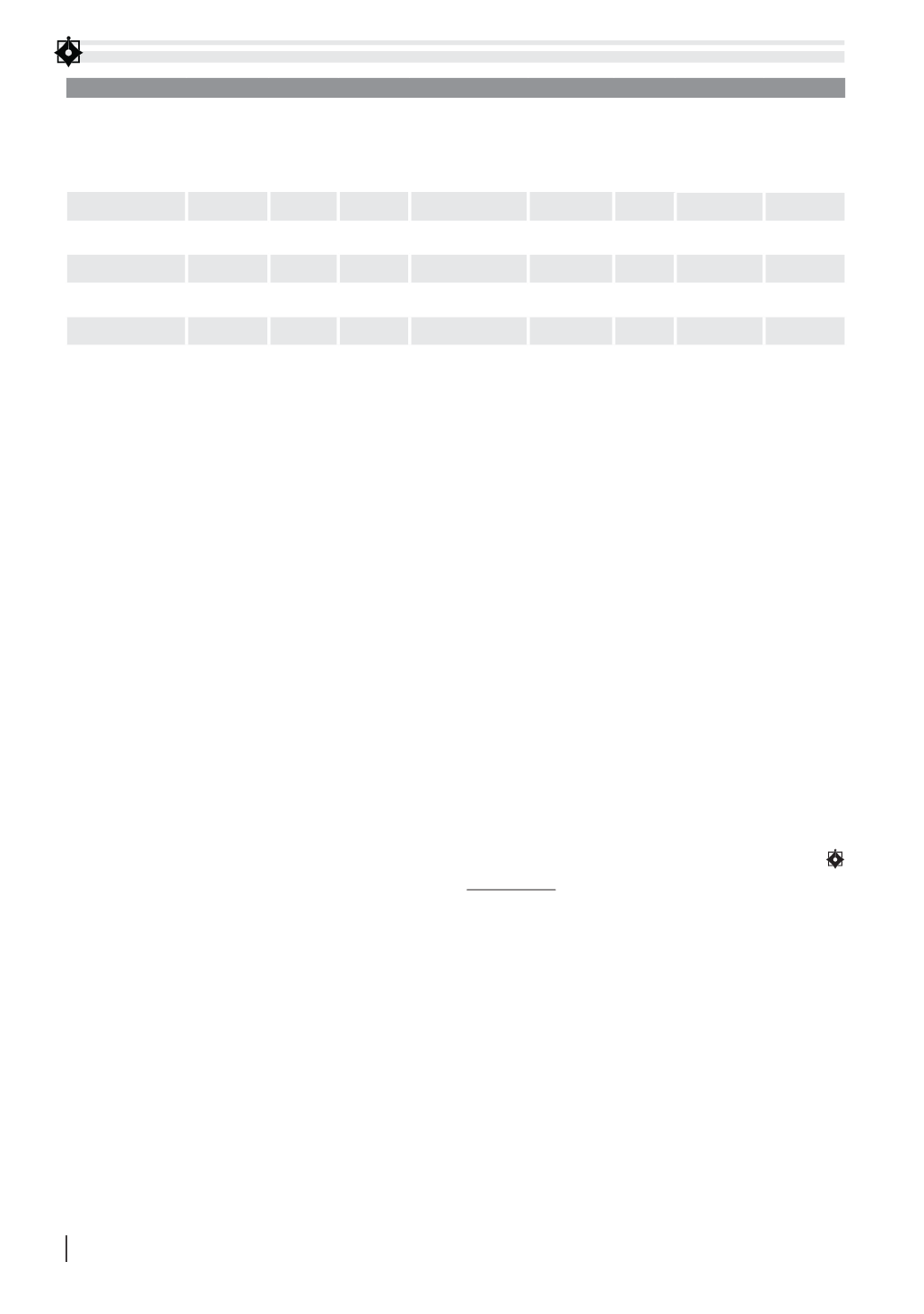

TABLE 5: CAPITALIZATION OF SECURITIES MARKET (AS OF SEPTEMBER 2017) (BILLION VND)

Market

Capitalization

HOSE

HNX

UPCoM

Government/

Corporate

bond market

Total

% GDP

(%)

Increase/Decrease

Compared

to the last

month

Compared

to the

last year

31/12/2015

1.146.925 212.641 61.033

753.451

2.174.050

30/09/2016

1.390.266 156.591 117.682

907.832

2.572.371 60,04

2,20

18,30

31/12/2016

1.491.778 150.521 306.629

931.340

2.880.268 68,7

6,80

32,50

30/06/2017

1.902.525 183.212 437.880

990.225

3.513.842 83,08

4,64

22,00

30/11/2017

2.520.482 221.323 588.312

1.003.815

4.333.932 96,25

11,93

50,47

Source: State Securities Committee