REVIEW

of

FINANCE -

Jan. 2018

33

2017-2020 and vision until 2030. In this same

vein, Decision No. 1191/QĐ-TTg cleared reflects

the policy on the development of the bond

market in depth and breath, proportionately

with the level of development of the economy

and other components of financial market the

market should be increased in size and quality

to become the proper medium and long-term

capital raising channel for the economy; with

diversified products and broadened investor

base. In addition, due process will be taken

to ensure the transparency and disclosure

requirement and investor protection and in

integration into international market.

The detail targets are clearlynoted in

Roadmap for the development of the Vietnamese

bond market in the period 2017-2020 and vision

2030 as follows:

- Striving for outstanding balance of bond

market to be 45% GDP in 2020 and 65% GDP by

2030, ofwhichoutstandingbalanceofGovernment

bond market, government guaranteed bonds

and municipal bondswill be expected to reach

38% GDP in 2020 and 45% in 2030; outstanding

rankings on the MSCI will enhance the prestige

and image of the stock market in particular

and the Vietnamese finanancial market in the

international arena, thereby attracting more

foreign capital into the Vietnam stock market.

In such macroeconomic outlook, along with

the equitisation process associated with the

listing/registration of large corporations who

are strongly encouraged by the Government

and solutions for developments, the stock

market in Vietnam is facing strong growth

opportunities and increasingly affirming its

role and position as the capital mobilization

and allocation channel for investment in socio-

economic development.

A modern and well-rounded development of

Vietnam bond market

In order to sustain the development of the

bond market in structure, size and quality,

the Ministry of Finance has submitted to the

Government for the issuance of the Decision

No. 1191/QĐ-TTg dated August 14th 2017 on the

Vietnam bond market development roadmap

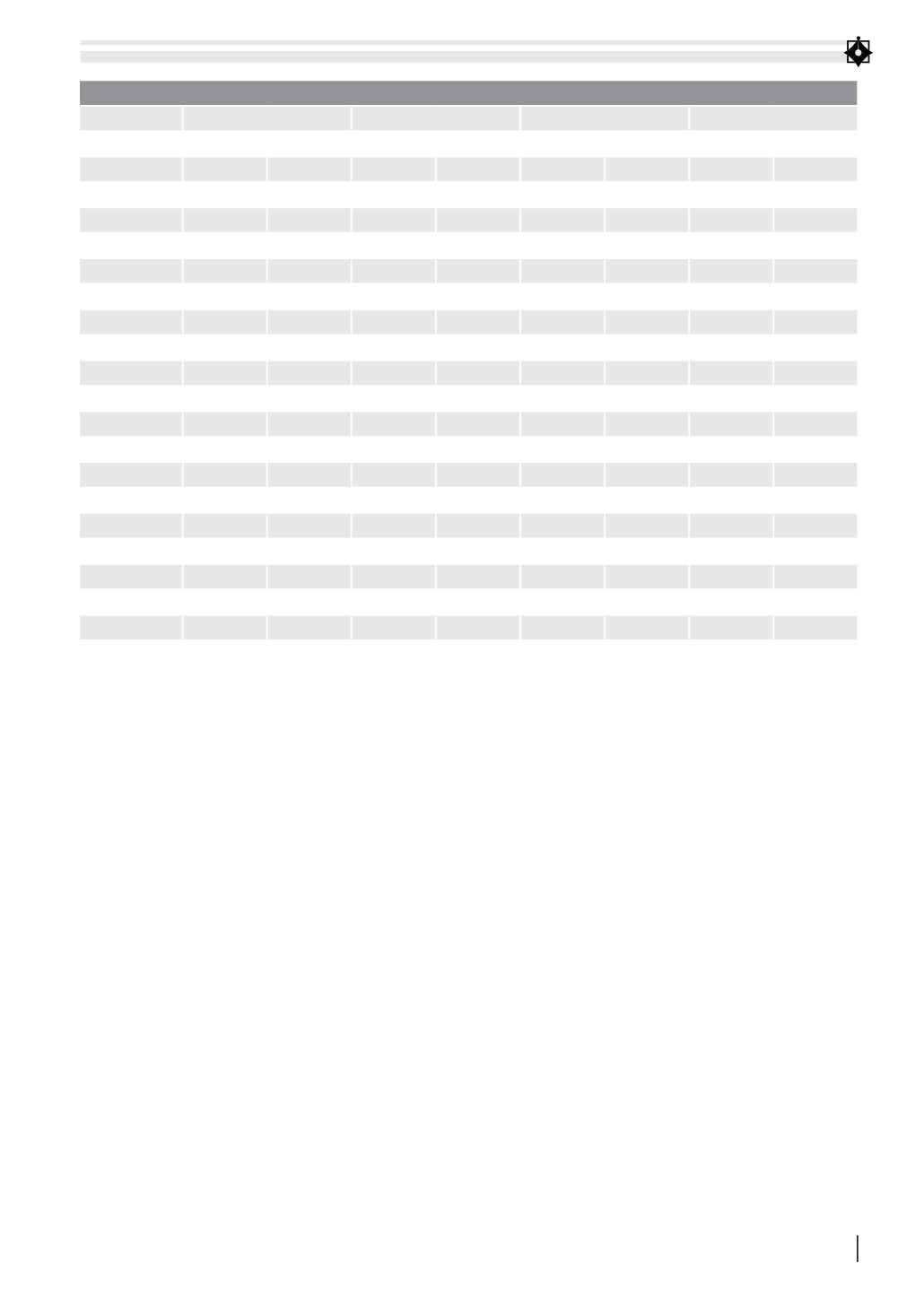

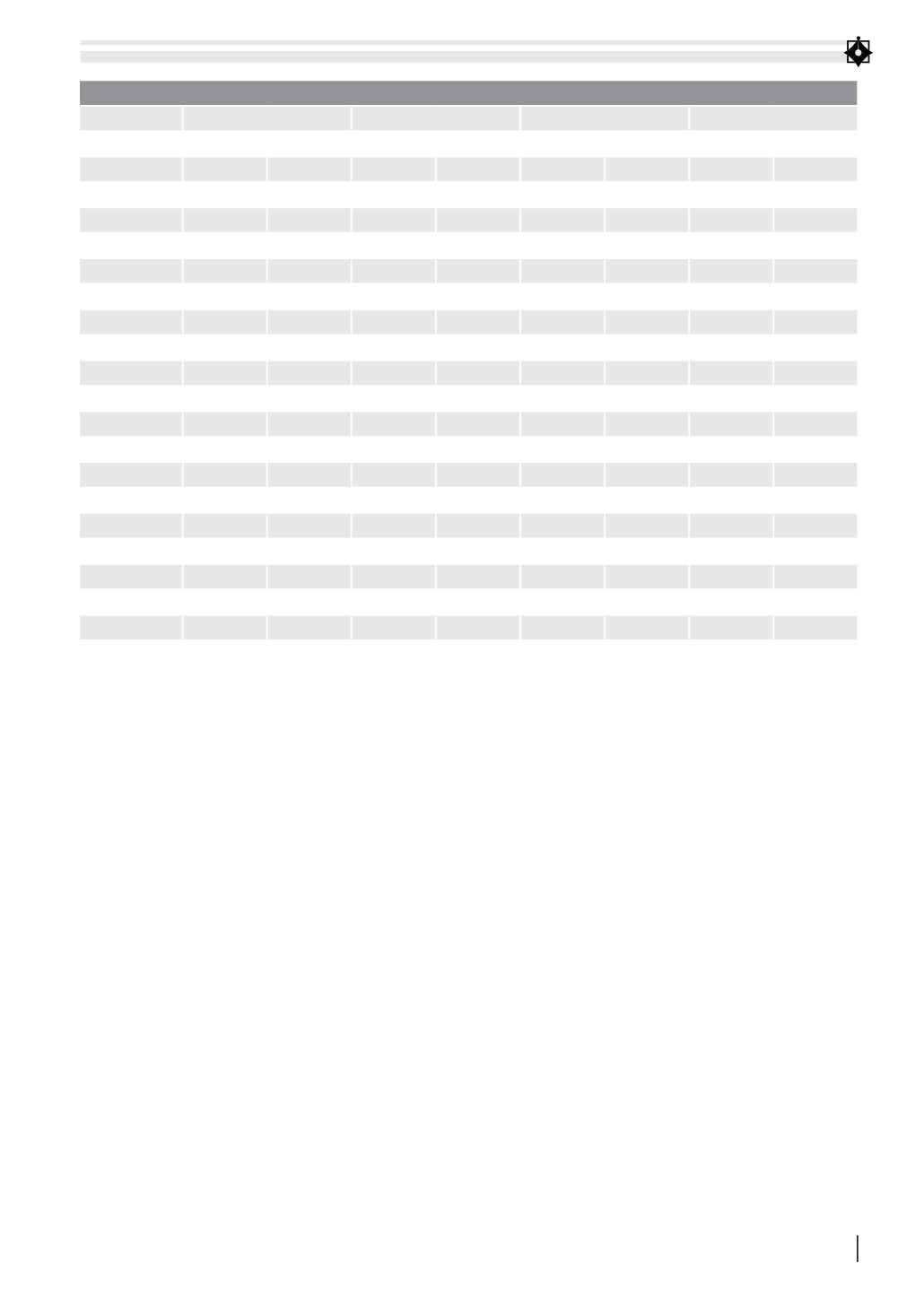

TABLE 4: TRADING VALUE OF FOREIGN INVESTORS AS OF DECEMBER 2017 (VND BILLIONS)

Time

Listed shares

Stock registered trading

Bond

Total

Buy

Sell

Buy

Sell

Buy

Sell

Buy

Sell

07/2016

7.889

6.800

50

7

16.060

11.506

23.999

18.313

08/2016

6.574

8.463

100

66

15.180

14.336

21.854

22.865

09/2016

12.850

15.613

18

10

21.450

21.668

34.318

37.291

10/2016

5.969

5.858

157

188

9.506

11.998

15.632

18.044

11/2016

6.823

8.404

208

154

3.419

10.947

10.450

19.505

12/2016

8.249

9.478

380

170

2.721

2.241

11.350

11.889

2016

95.252

102.164

1.299

684

74.328

61.539

170.879

164.387

01/2017

7.042

6.320

291

81

5.703

3.448

13.036

9.849

02/2017

7.985

7.342

405

231

7.588

5.864

15.978

13.437

03/2017

11.152

9.017

390

249

10.189

1.927

21.731

11.193

04/2017

12.566

10.342

294

185

5.067

4.385

17.927

14.912

05/2017

9.703

8.427

359

149

6.107

6.299

16.169

14.875

06/2017

10.303

8.260

551

357

8.200

4.391

19.055

13.008

07/2017

12.624

10.337

514

409

8.198

5.978

21.336

16.724

08/2017

9.405

6.838

239

76

6.204

6.099

15.848

13.013

09/2017

8.263

8.961

322

154

5.838

4.850

14.424

13.966

10/2017

14.035

14.554

569

140

4.546

5.227

19.150

19.921

11/2017

54.795

44.380

1.170

318

4.393

5.915

60.357

50.613

12/2007

17.879

16.725

627

262

6.576

5.044

25.082

22.031

Source: State Securities Committee