REVIEW

of

FINANCE -

November, 2018

33

social insurance contributions for FDI enterprises

reflects labor productivity, the efficiency of using

funds of the management apparatus and the

implementation results. The effectiveness of state

management over social insurance contributions

for foreign invested enterprises is assessed

in terms of: Achieving the collection of social

insurance with a certain level of cost of resources;

reach a certain target with minimal cost of

resources; Achieving goals in relation to the cost

of resources (finance, human resources ...). In

other words, the efficiency of state management

over social insurance is measured through the

following indicators:

(i) Level of increase of social insurance revenue

(ii) Minimize the collection of social insurance

(iii) Level of cost savings

The immediate objective of State management

onsocial insurance contribution to foreign invested

enterprises is fully collected (the amount must

be paid on the salary, Employees in accordance

with the law), timely collection (ensure the time

to participate in social insurance under the law).

Three long-term goals of state management of

social insurance for foreign invested enterprises is

to expand coverage; Ensure sustainable financing

of social insurance fund and ensure the satisfaction

of participants in social insurance.

Evaluating the efficiency of the state

management over the collection of social

insurance for FDI enterprises

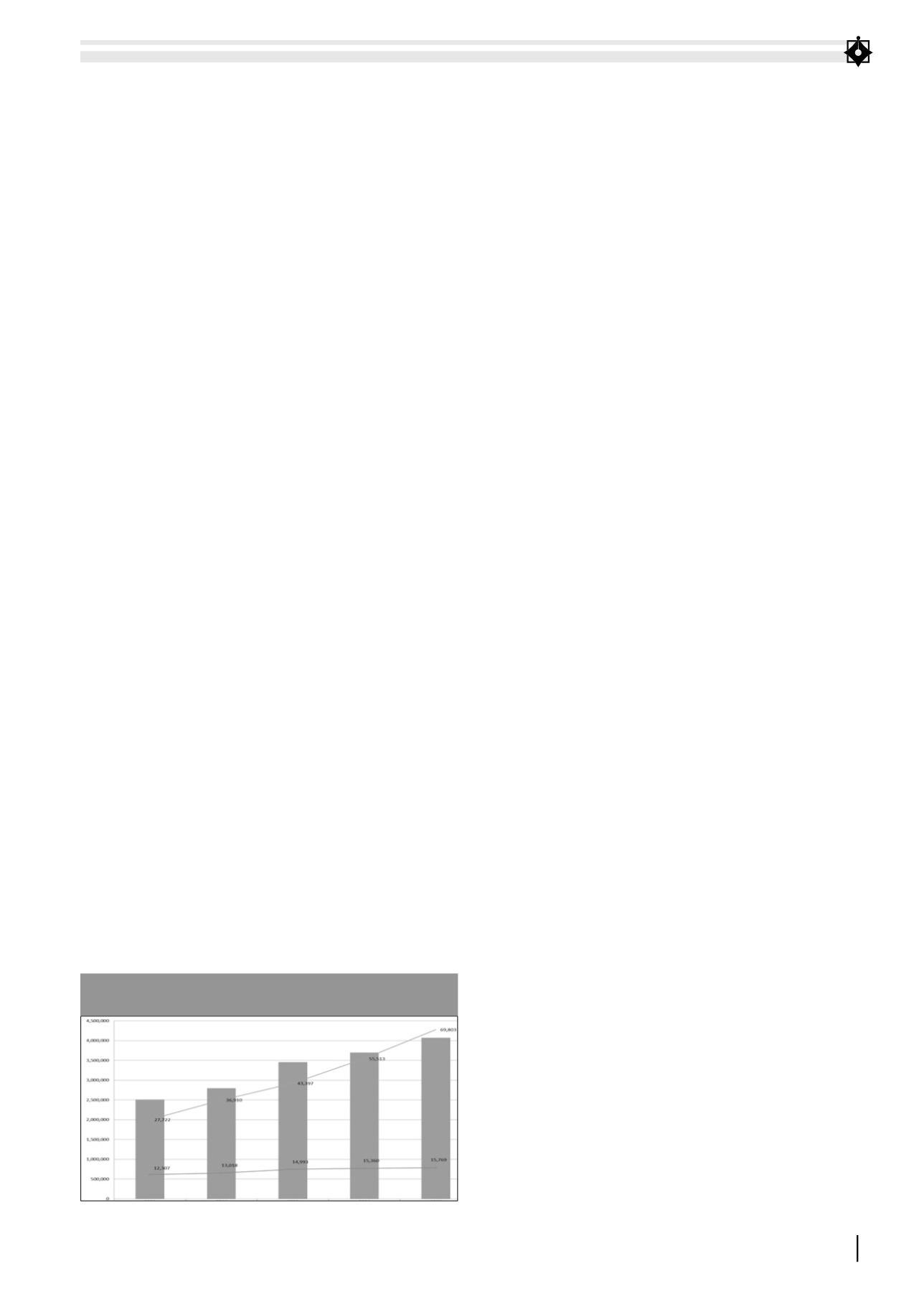

Increasing social insurance revenue of foreign

invested enterprises

The level of increase of social insurance revenue

of foreign invested enterprises is assessed on the

increase of enterprises, number of employees;

and annual revenues.

FDI often have a large capital base, employing

a large number of workers, on average 325

employees per enterprise (MOLISA, 2017).

Employees in the FDI sector increased in both

quantity and density, especially in the period

2012-2015. “If in the period 2007-2011, the

proportion of labor in the enterprise sector is

always about 23%, then by 2015 it has increased

to about 30.27%. The number of employees in

the FDI sector has increased rapidly as many

large corporations have and continue to invest in

Vietnam. By 2015, it is estimated that the share of

non-state employment in the non-state sector is

58.34%, followed by the FDI sector with 30.27%,

while the housing sector water only accounted for

11.39%. (VSS).

Minimizing the collection time of social insurance

payment

Evaluation on the process and procedures

of collecting social insurance, the outstanding

result is “the collection time of social insurance

payment is reduced”. The process from receipt of

documents to participate to record contributions

to each employee on a monthly basis is carried out

according to the closed process. VSS has reduced

administrativeprocedures.“In2015,administrative

procedures are reduced from 115 procedures to

33 procedures. A decrease of 56%, the number of

indicators on the declaration, the form reduced

by 82%, the process, the implementation also

reduced 78%. In 2016, Vietnam Social Insurance

has reduced 01 administrative procedures (from

33 to 32 procedures); reduced by 38%; reduced

42% of the criteria on declarations, forms; reduced

54% process, operation performed. Based on

the reduction of administrative procedures, the

combination with Vietnam Post Office and the

application of information technology, the social

insurance payment is expected to reach the

average goal of 49 hours a year.

The application of information technology in

the collection of social insurance, social insurance

now provides free software for employers.

Although the software has enough features, the

support and information processing speed is

slow so it is better suited to units with less than

50 employees. With an average labor force of 241

FIGURE 1: LEVEL OF INCREASE OF SOCIAL INSURANCE

REVENUE (billion VND)

Source: VSS