REVIEW

of

FINANCE -

Apr. 2018

9

now heavily dependent on the global economic

turmoil (the opening of the economy by the

size of foreign trade/GDP in recent years is up

to 150%). Vietnam’s growth depends heavily

on exports. When the world economy is still

difficult, Vietnam’s economy will be affected.

Secondly

, revenue was reduced due to tax

policy change, but the revenue estimate continued

to increase. Under the bilateral and multilateral

trade commitments that Vietnam participates in,

many import items will be cut tariffs, and have

a strong impact on revenue from import-export

activities. However, the budget revenue from

import-export activities in 2018 will not increase

as much as 2017, which is also a favorable factor

for completing the revenue estimate from this

sector. In contrast, the total estimated budget for

State budget revenue in 2018 increased by 13%

compared with the estimate for 2017 will be a big

challenge for the financial sector.

Thirdly

, the challenge of the implementation

of revenue estimates from domestic production.

In the state budget revenue projection in 2018,

the domestic revenue is estimated at VND 1,099.3

trillion VND, the crude oil revenue is estimated

at VND 35.9 trillion, the estimated revenue from

import and export is VND 179 trillion.

Domestic revenue will have to increase by 11%

compared to the estimated 2017 is a challenge

when the situation of domestic production is

difficult, inflation is still below 5% and domestic

revenue is secondary. Much of the revenues

from land (estimated to still account for 6.3% of

total state budget revenue). In 2017, the over-

collection of land use levy, revenue from foreign

direct investment (FDI) sector and the non-state

sector is relatively high compared to 2016 but still

not reached. Estimates are too high (estimates

are 23.4% and 23.8% respectively compared to

2016).

In the 2018 projection, it is expected that the

level of revenues for state-owned enterprises will

increase by 8% compared to the projection for

2017, because in recent years the average growth

of this sector is only around 4-5%; Similarly,

for non-state revenues, an increase of 15% is a

relatively high increase.

Fourthly

, implementing state budget with

savings and efficiency. The implementation of

state budget savings in 2018 is difficult due to:

- In term of state budget expenditures:

The

restructured expenditures shall be restructured

in the direction of increasing the proportion

of investment expenditures, reducing the

proportion of regular expenditures and

intensifying the application of market principles

in expenditure management such as package

expenditures, applying public car loans, step by

step and correctly calculating the cost of public

service delivery, on that basis, restructuring the

state budget in each branch and each domain.

However, of the restructuring of the state

budget being from the ministries, branches

and localities associated with the restructuring

of investment expenditures, recurrent

expenditures, restructuring of public service

delivery units, reorganizing the apparatus

and streamline the staffs according to the

Resolutions of the Central Committee and the

National Assembly.

- In terms of investment expenditure:

In 2017,

investment expenditures have not met the

budget and this is also a big challenge for the

State budget implementation with investment

expenditure when the state budget estimate 2018

reached the target of 12% increase compared to

the year. 2017 (although this increase is much

lower than the corresponding figures for 2016

and 2017, respectively up 30.7% and 40% over

the same period).

Fifthly

, the problem of borrowing and

restructuring of loans. Due to the deadline

for repayment, but the allocation of funds for

repayment of principal difficulties, Vietnam was

forced to issue government bonds to borrow

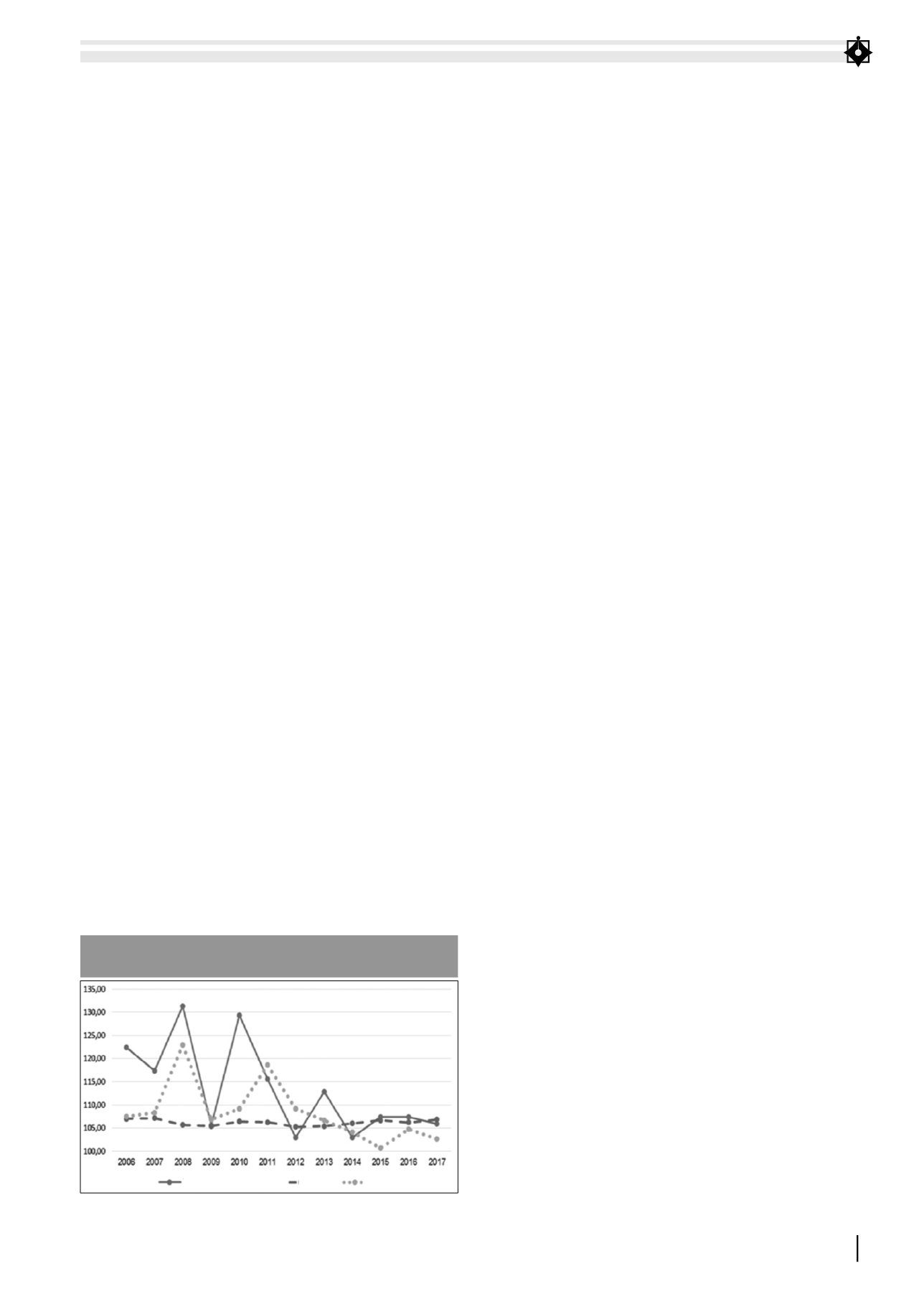

Total statebudget revenueandgrant

GDP

CPI

FIGURE 1. INCREASE RATE OF STATE BUDGET REVENUE, GDP

AND ANNUAL COMMODITY PRICES (2006-2017)

Source: Measured and calculated by the Author