10

principal repayment. The majority of bonds are

mobilized from domestic sources. The challenge

is not to print money directly to offset budget

overspending, but the way commercial banks

now buying government bonds to refinance also

increases the money supply to the economy.

As a consequence, the economy may face high

inflation as the economic theories have shown

(Sargent and Wallace (1981). Thus, sustainable

restructuring of public debt and diversification

debt financing in the capital market should be

continued.

Positive hightlights for 2018

Although many issues need to be resolved, the

implementation of the State Budget estimation

for 2018 also has many positive signs:

Firstly

, the Government and the Ministry of

Finance have taken drastic measures to promote

economic growth and renovate the business

environment. According to the Business

Environment Report 2018, Vietnam ranks 68

th

,

with a score of 67.93 on a scale of 100. Thus,

compared to the rankings last year, Vietnam has

risen 14

th

ranks from the 82

nd

rank. In particular,

the index of tax payment is assessed to have the

highest increase in the index of Vietnam with

14.78 points. Specifically, in 2018, this index

reached 72.77/100 points, higher than the level

of 57.99 per 100 points in 2017.

Secondly,

economic growth in 2018 will

continue to improve on the basis of positive

changes in the economic situation in 2017. The

world economic situation in 2017 is also expected

to improve (IMF, 2017).

Thirdly,

the 2018 budget projections do not

increase too much compared to 2017. The forecast

of 2018 budget spending in estimating is usually

considered on the basis of the current state

budget implementation. In 2018, it is expected

that the state budget deficit will increase by

only 7.4% compared to the estimated figure for

2017, which will be favorable for completing

the expenditure estimate. The Government’s

determination to reform public spending will

also be a good opportunity to achieve the targets

set in the 2018 State Budget.

The overall assessment can be seen, the

implementation of fiscal policy in 2017 in the

context of increased revenue estimate is very

difficult task. Therefore, the perspective of

fiscal policy in 2017 was active, tight, thrifty;

strict discipline, financial discipline contributed

to the objective of economic growth; efforts

to increase revenues and save state budget

expenditure. These are timely solutions that

have contributed significantly to the fulfillment

of the state budget revenue and expenditure

tasks in 2017. The successful outcome of the

State budget collection and expenditure in

2017 is the great effort of the Government to

implement the fiscal policy for 2017.

With the state budget estimates in 2018, the

Government, the Ministry of Finance, other

ministries, sectors and localities need to be

determined to overcome many challenges in

order to successfully complete the fiscal year 2018.

Simultaneously, in order to well implement the

fiscal and budgetary tasks in 2018, it is necessary

to closely monitor the socio-economic situation,

timely and appropriate solutions of the Ministry

of Finance to advise the Government on the

direction of implementation.

References:

1. Ministry of Finance (in years), Estimation and Balance of State Budget;

2. Vu Sy Cuong (2012), “Relationship between estimation and

implementation of State budget in comparison to inflation”, Banking

Journal No.2/2012;

3. IMF (2017), Seeking Sustainable Growth: Short-Term Recovery, Long-

Term Challenges – World Economic Outlook Report, Dec. 2017;

4. Sargent, Thomas J. and Neil Wallace. 1981. “Some Unpleasant

Monetarist Arithmetic.” Quarterly Review of Federal Reserve Bank of

Minneapolis, pp. 28p;

5. Some website: mof.gov.vn, mpi.gov.vn, tapchitaichinh.vn...

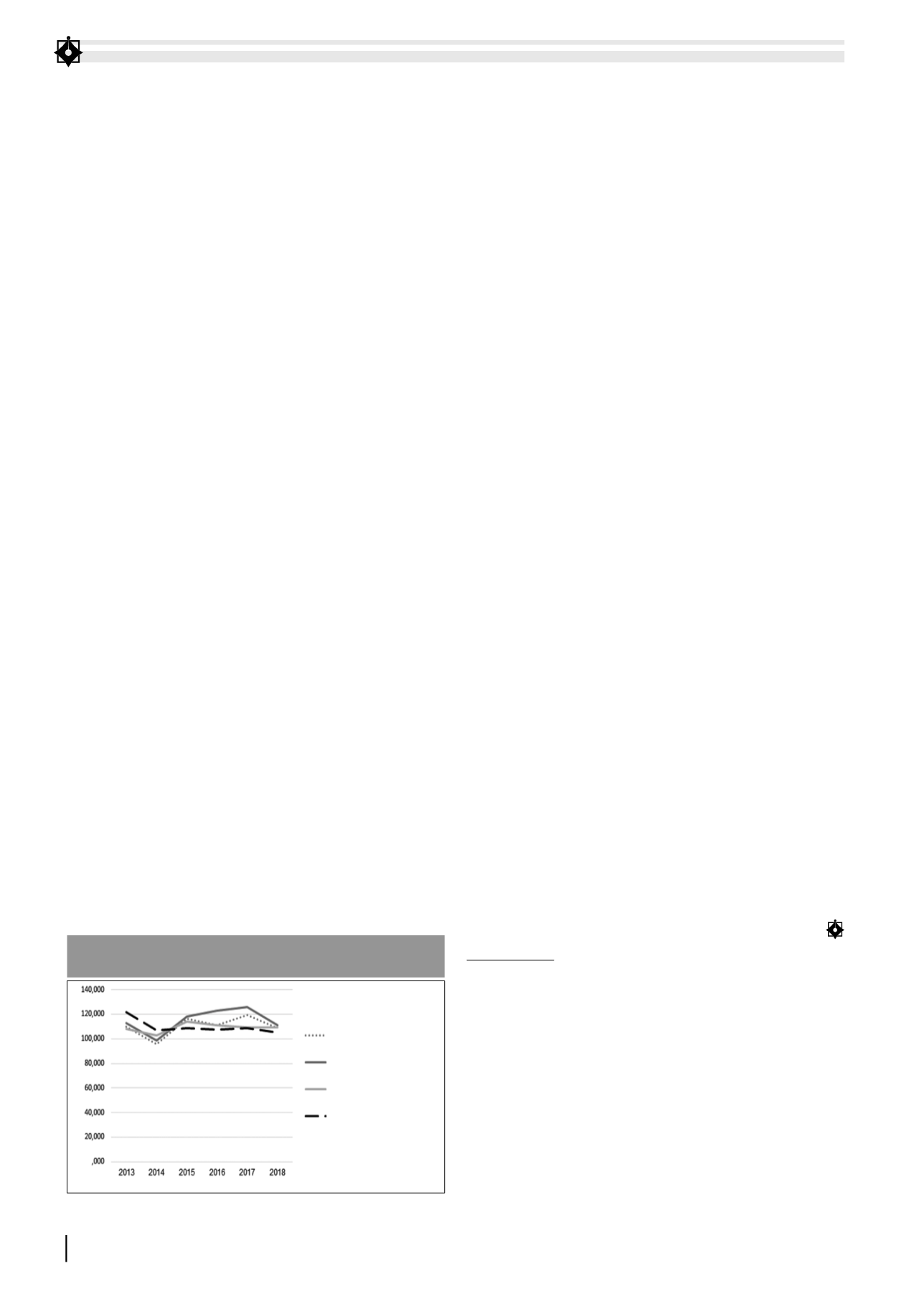

Annualgrowth rateofestimated

statebudget revenue

Annualgrowth rateofdomestic

estimated revenue

Thegrowth rateof the totalestimated

statebudgetexpenditure

Thegrowth rateofestimated

recurrentexpenditure

FIGURE 2. CHANGES IN ANNUAL STATE BUDGET PLAN FOR

2013-2018

Source: Calculated from figures of yearly - estimated state budget