REVIEW

of

FINANCE -

Jan. 2018

39

UsingSource can improve thequalityof project

preparation by public sector and strengthen

their technical capacities and abilities to manage

risks. This makes infrastructure projects become

more attractive to the private sector.

Report on Risk mitigation and allocation

in infrastructure, including public private

partnerships in APEC economies is built by

coordination among GIH, ADB, OECD and

discussions held by the APEC members at the

APEC Seminar on long term investment in

infrastructure. This report provides an overview

of the type of risks in infrastructure projects

and the tools available to policymakers and

contracting authorities effectively manage and

allocate risks amongst the various stakeholders.

It includes four contents: (i) Analysis of risks

in infrastructure financing, (ii) Risk transfer by

contractual arrangements, (iii) Risk mitigation

instruments and blended finance approaches to

facilitate private investment, (iv) Selected good

practices and case studies.

It is an useful reference for APEC members,

particularly APEC members with lack of

experience in PPP transactions, to deeply

understand kinds of risk of infrastructure

projects in terms of politics and regulations,

macroceconomic and business, technical. It

describes how risk transfers among the project

companies and other subcontractors in PPP

contracts as well as project finance transactions.

A range of risk mitigation instruments in

infrastructure projects, such as guarantees,

insurance and some of the blended finance

approaches, for example loan syndiction

infrastructure projects, lower funding cost and

attract more capital.

Thirdly

, an optimise risk allocation align with

appropriate risk mitigation instruments is a key

to improve confidence from investor and success

of PPP transactions.

Fourthly

, institutional investors (such as

pension funds, insurances, sovereign wealth

funds, etc) are potential sources for long

term investment in infrastructure. In order to

attract institutional investors, infrastructures

needs to be structured as attractive investment

opportunities, providing revenue streams and

risk-return profiles that match investors’ return

expectations and liability structures.

Fifthly,

policy framework and regulations

play an important role to foster private to engage

in investment into infrastructure projects.

In terms of building capacity, Viet Nam,

Peru and China collaborated with Sustainable

Infrastructure Foundation (SIF) and ADB

organized training courses on using Source.

Source, initiated by Multilateral Development

Banks and ADB, provides the public sector with

an infrastructure project preparation tool, a

project selection tool, a project coordination tool,

a project funding tool, a project financing tool, a

project promotion tool and a project-monitoring

tool. Through a standardised template, it covers

the governance, technical, economic, legal,

financial, environmental and social dimensions

of the project definition. It encompasses the

whole project lifecycle; it is organised in

stages, including the preparation, procurement,

development and operating phases.

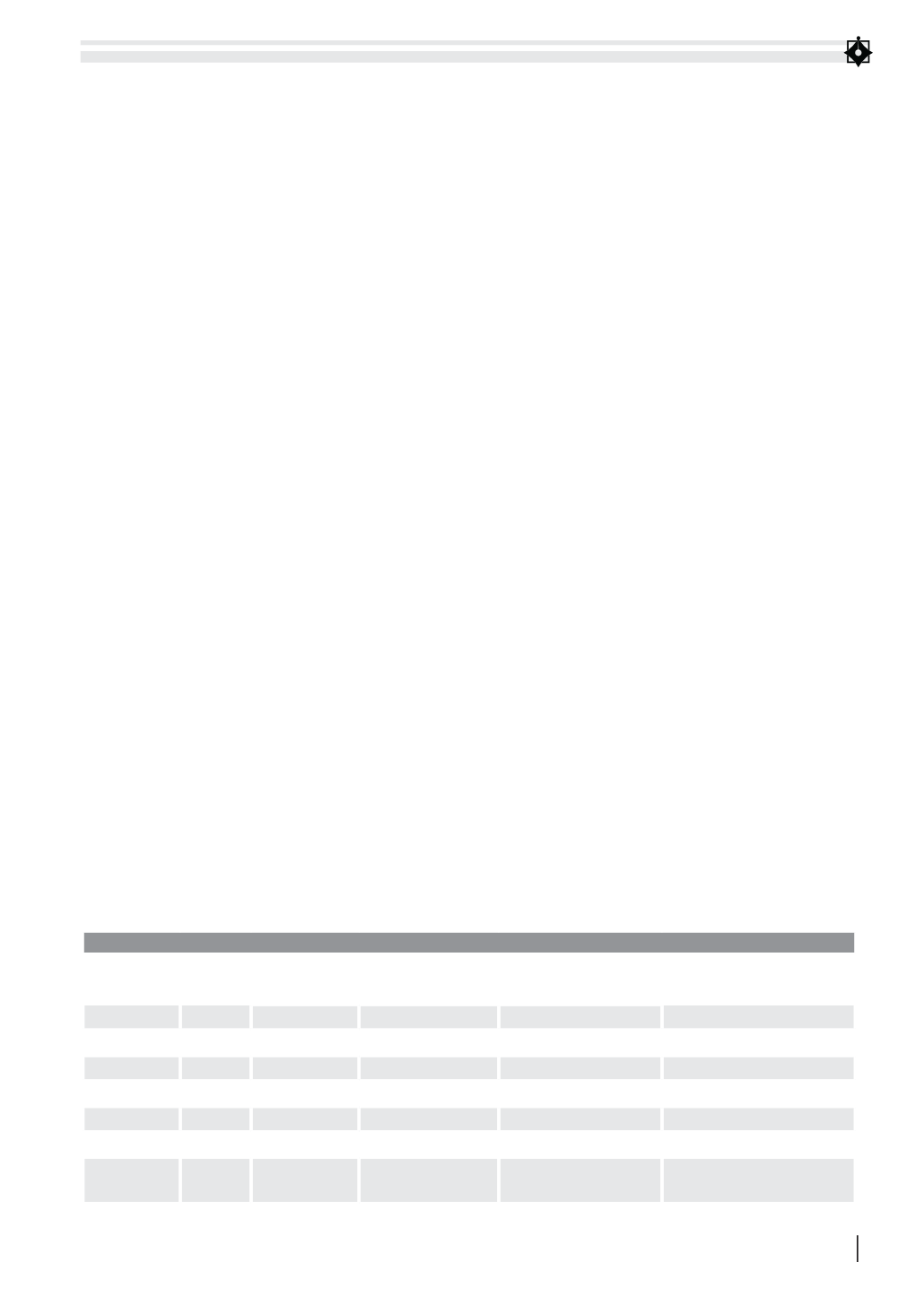

TABLE 2: DEVELOPMENT INVESTMENT CAPITAL AT CURRENT PRICE BY ECONOMIC COMPOSITION (VND TRILLION)

Year

Total

By

Investment capital/gross

domestic product

State Economy Non-State Economy Foreign invested sector

2011

924,5

341,6

356,0

226,9

33,3

2012

1010,1

406,5

385,0

218,6

31,1

2013

1094,5

441,9

412,5

240,1

30,5

2014

1220,7

486,8

468,5

265,4

31,0

2015

1367,2

519,5

529,6

318,1

32,6

2016

1.485,1

557,5

579,7

347,9

33,0

9 months

of 2017

1.128,7

401,8

450,4

276,5

33,9

Source: General Statistics Office of Vietnam